(Listen to audio version of me reading👆)

Viewer question from the YouTube channel…

Since the Sam Friedman fiasco what happens if they monitor bitcoin? Also isn't it better to have your assets in real estate and some gold rather than Bitcoin? I own a $2.3 million property which is safer than selling it and putting in to Bitcoin.

“Hey Jan! Food for thought...

Depends on what your definition of "safe" is and where property is located etc... I own a bunch of rentals and they are in different jurisdictions with different prop taxes that keep going up. I cant move them if I need to get out of dodge.

However, I can take bitcoin anywhere in the world. Also, anyone can monitor bitcoin but they can't do anything to yours if you hold in cold storage. They can't "eminent domain" your digital property like they can your physical property...

I do have a diversified portfolio in all asset classes. I do believe bitcoin is the hardest money humans have ever discovered but I can't predict the future for certain. I believe there is a great chance that bitcoin becomes world reserve asset then eventually the global currency in the next couple decades, but I still don't have 100% of my net worth in bitcoin.

Now if I was just starting out as a young kid with no prior assets then I might go all in on bitcoin.

What do I have to lose?

I know the entitlements are all insolvent in the next 10+ years.

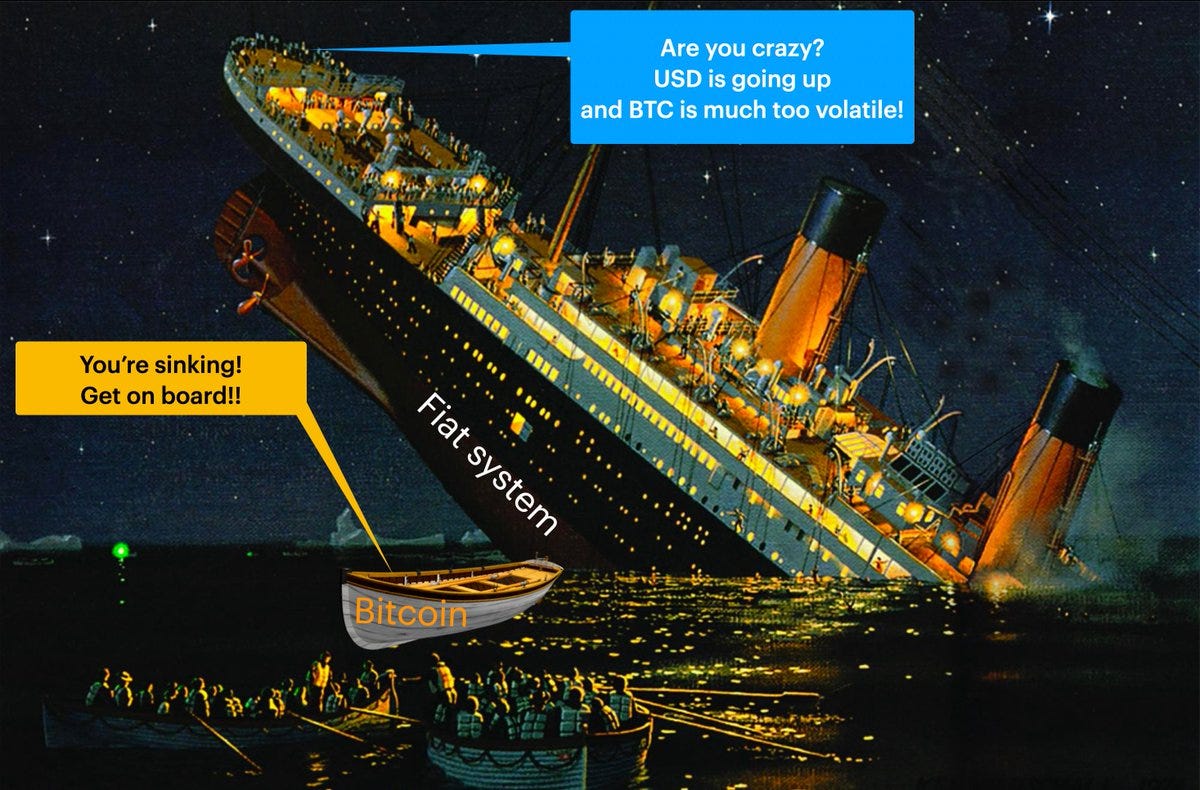

I know the currency is going to zero.

What other option do I have?

Plus, I have the ability to change the whole system politically.

Worth a shot, no?

As a reminder I share my monthly asset allocation breakdown here that you can check out where I talk about this very issue and what I am doing or how I am thinking about things, like my frameworks.

Should have January edition out this week or next week.”

Some of the reasons out why someone might hold their wealth in bitcoin instead of real estate.

Many of these arguments have made me start to look how I view all assets, including real estate, in relation to bitcoin.

Greater liquidity: Bitcoin is more easily tradable and transferable than real estate, which can be difficult and time-consuming to sell. This makes it easier to access and use bitcoin as a store of wealth.

Lower fees: Bitcoin transactions generally have lower fees than real estate transactions, which can involve significant costs such as closing costs, broker fees, and property taxes.

Greater accessibility: Bitcoin is more easily accessible to a wider range of people due to its digital nature, which makes it more convenient for those without access to traditional financial systems or the ability to own physical property.

Portability: Bitcoin can be easily stored and accessed from anywhere in the world, making it more portable than real estate, which is tied to a specific location.

Greater potential for growth: Bitcoin has the potential for significant growth in value due to its limited supply and increasing demand, which makes it an attractive investment for those looking to grow their wealth over time.

No rental issues or residents to deal with: Bitcoin obviously has no problems while you are holding and no evictions with bitcoin in cold storage.

Security: Bitcoin transactions are secured using advanced cryptography and are recorded on a decentralized, public ledger known as the blockchain. This provides increased security and transparency compared to traditional real estate transactions, which can be vulnerable to fraud and errors.

International compatibility: Bitcoin can be used and accepted globally, making it a useful option for individuals who need to transfer or access their wealth across borders. In contrast, real estate may be more difficult to transfer or access in certain countries or regions. Remittances are a big deal for developing countries who got pillaged by fees historically.

Why live in a system that we know is broken when we can actively be the change in the world we want to see and build the future we want?

Stay strong,