One of the biggest reasons people think we need inflation is that “the money supply is needed to grow because population is growing and so is production. Therefore we need our currency to expand with it.”

However, this I believe is a false equivalency and we are thinking about this all wrong.

Why would I take what I worked for (currency) and purposely dilute the value of it by creating more of it (printing more?)

Its like walking around with your SOLO cup and not only spilling your economic energy out the top of your cup but punching a hole or two in the sides as inflation grows.

My economic energy (wealth) is spilling all over.

Wouldn’t I have to work harder now just to keep up?

“In deflation, people wouldn’t loan it out and they would keep it to themselves if they just earned value by holding it. So a deflationary money can't work because there would be no growth and the world would grind to halt…”

I don’t believe this is not the right way to look at it. Our mind has such a hard time wrapping itself around deflation because webare all just very used to an inflationary system. It is hard to imagine a system in reverse. We aren’t thinking fourth dimensionally. Inflation stokes a hoarding mentality.

When you have cheaper or almost free energy and resources and capital are abundant, your money is continually accruing wealth, it won’t even be a thought in your mind to not spend it our lend it.

I believe that as life progresses even the little money you do have will be worth so much in contrast to the cost of goods and services that you will willingly give to charity more or lend to projects to further create more abundance and drive down cost.

People will want to invest in more and more technologies because they know that their money they earn back will continue going and up and the more capital invested the more these technologies exponentially grow on top of each other.

So, you very well may have more even more velocity because it would be a virtuous upward spiral of prosperity instead a race to debase at the bottom…

Well where would I allocate my deflationary money?

If people had a deflationary money they would be very careful how they used it, where they distributed their capital, and who they gave it to.

We all love to spend money so its foolish to think that people would just sit on their wealth and do nothing…forever.

Once good money was abundant in society you would have the reverse of Gresham’s Law and good money would start circulating back in to society.

You would still have loans with interest due however you would be very careful with who you gave it to and how you were paid back because you know that in general over time that money would be worth more.

Whatever you gained from the loan interest would have to increase faster than the value of money naturally did or the risk of lending it out.

Or maybe it doesn’t…People loan things out or buy things that negatively cashflow all the time for inexplicable reasons; they either don’t know any better or they want a “tax write off,” etc..

Bank’s Problem

The problem may lie in the banking sector. If you had money that just continued increasing in value you would most likely lend out yourself instead of giving it to a bank to pay third party fees and have them lend it out.

This plays right into where the world wants to go anyway getting rid of the commercial banks and only having central bank digital currencies run the central banking system.

That means “big brother” is spying on you every step of the way however we would have no middleman anymore and bitcoin would be much more prominent.

So it’s a double edge sword.

If you custody yourself and you have the capital you could lend it out and make cash flow from it.

Be your own bank and not deal with all of that red tape and bureaucracy.

Inflation

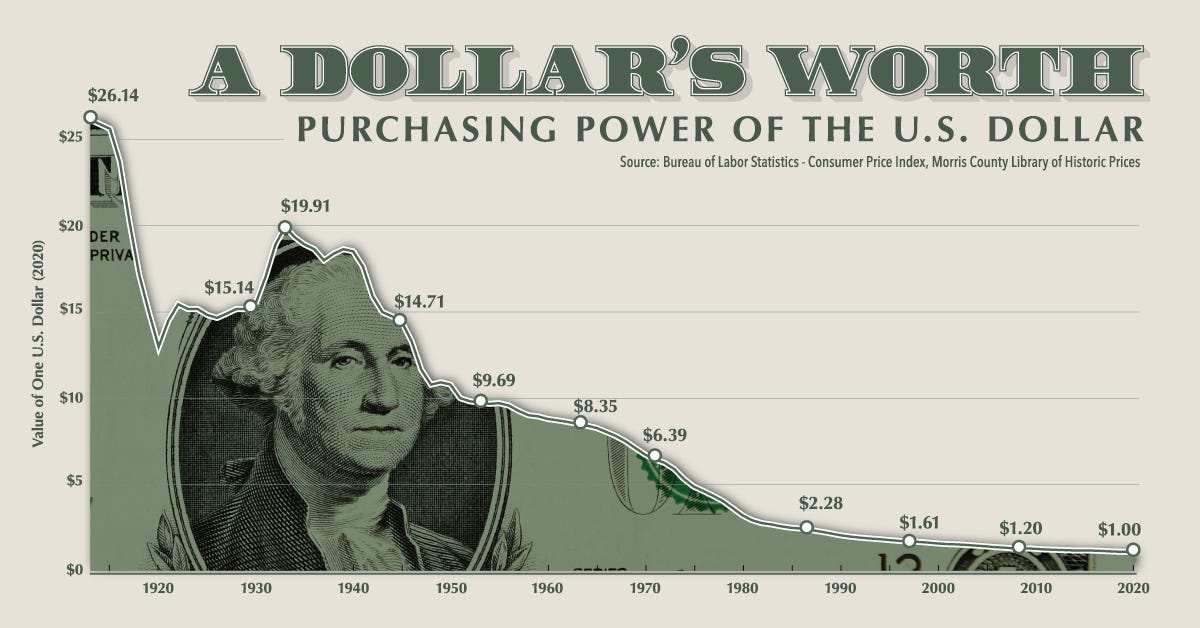

Inflationary environments destroy the poor and middle class because they have little to no assets. They usually are unaware that “saving” their inflationary dollars just loses them value as it sits there in the bank rotting away.

Deflation is the key to prosperity and lifting the MOST people out of poverty whether it is through the value of money increasing, new tech, or cheaper goods and services.

If banks still exist, they have to give out loans to stay in business during inflation or deflation in order to pay off their customers receiving interest on their deposits.

In a deflationary environment the bank would owe a ton of interest to entice people to stick their money with them.

They would need to lend it out and this would actually bring more stability because they would have to make sure they were lending on projects that were “worth it” and could produce more in return for their depositors.

This would beget less “casino games” (looking at you derivatives, Glass-Steagall, Basel II, “Net Capital Rule” for brokers and dealers, Swaps regulation, etc.) being played with your deposits and more capital being allocated to real projects of value.

No more payoffs to “the big guy” that produce zero in return or the banks quickly go under.

The Solution

This dovetails in to bitcoin being an incentive for worldwide peace, prosperity, and abundance creating a higher standard of living for all human beings.

Stay strong,

Brandon

PS. This was actually hard to write and wrap my own head around. Please leave your comments or thoughts on this as I cannot edit it anymore. I was trying to work my brain through thought experiments while writing and editing afterward. This was admittedly not easy to write.