(Listen to audio version of me reading👆)

A comment I received on a recent YouTube video about central bank digital currencies…

“The Bank for International Settlements (the central bank for central banks) OWNS all the transaction platforms, the hardware and software, for ALL the "crypto" assets. The only decentralized money is good and silver.”

I came in to sound money through gold and silver 12 years ago.

After studying bitcoin, once I found it 4-5 years ago, it changed everything and I saw that bitcoin was the only answer to cross the chasm and take power back for the people.

Bitcoin is the only discovery humans have made of digital scarcity that can cross space and time.

Bitcoin is not "crypto" and "crypto" is not Bitcoin.

Bitcoin IS the solution and the only thing that can't be captured by someone unless you give up your keys.

Even gold and silver have historically shown to be captured. Generally because it is hard to move over space easily.

So, it doesn’t matter what track record the horse had, it was still getting replaced by the car.

Despite its short history compared to gold, there are several reasons why bitcoin's age shouldn't be a problem:

Rapid technological advancement: The world has changed significantly in the past few decades due to rapid technological advancement. As a result, newer technologies, such as bitcoin, may be more relevant and useful in today's world than older technologies, like gold.

Limited supply: There is a limited supply of bitcoin, with only 21 million bitcoins set to be created. This limited supply, combined with increasing demand, can drive up the value of bitcoin over time. In contrast, gold has an almost unlimited supply, as it can be mined from the earth or from asteroids or other planets.

Greater accessibility: Bitcoin is more easily accessible to a wider range of people due to its digital nature. It can be bought, sold, and stored online, making it more convenient for people without access to traditional financial systems. In contrast, gold requires storage and transportation, which can be difficult and expensive. Space and time are no problem for bitcoin.

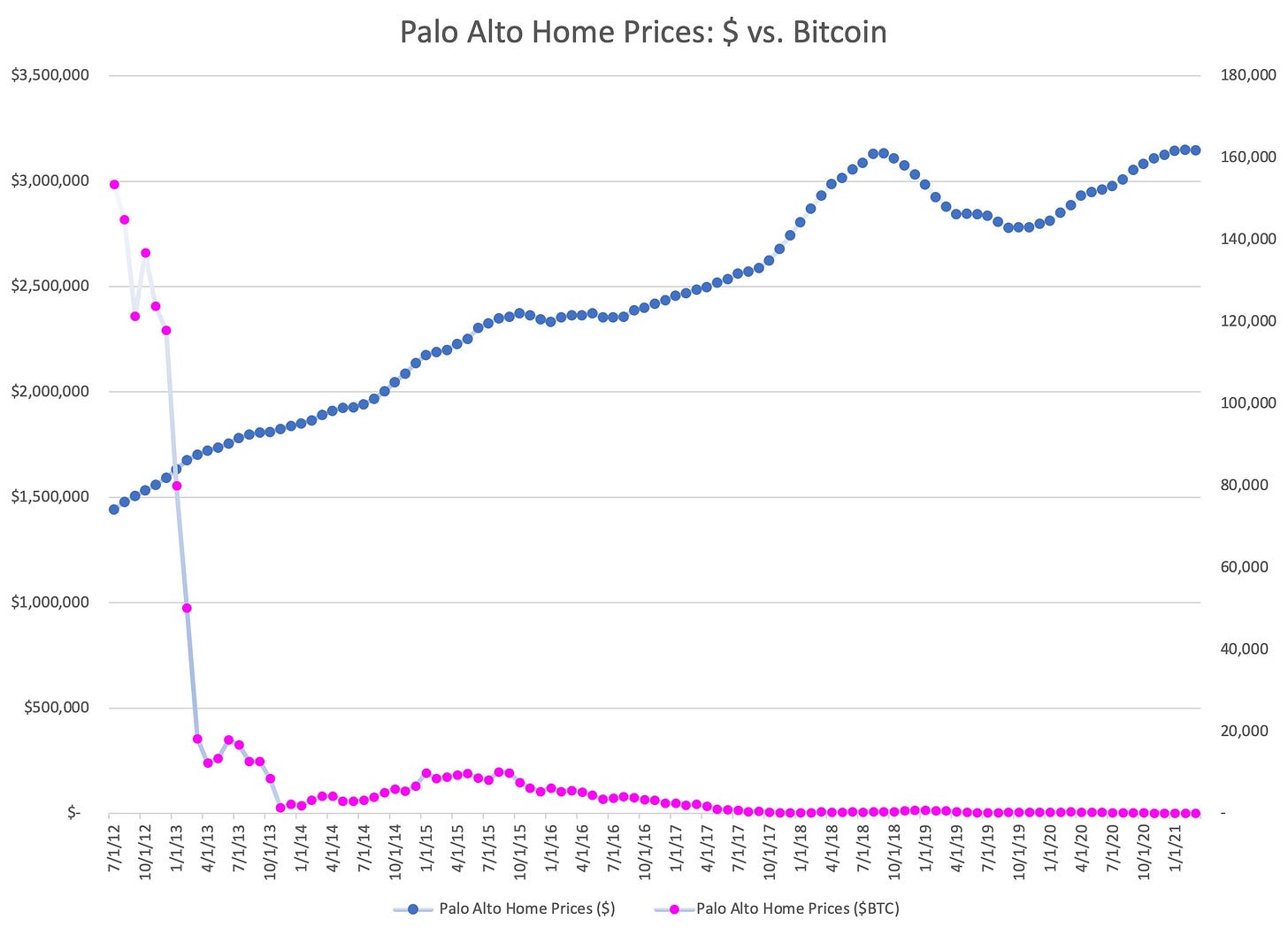

Greater potential for growth: Due to its limited supply and increasing demand, bitcoin has the potential for significant growth in value. The price at the margins comes from the people willing to sell. That will take a large price for most bitcoiners, meaning more and more fiat needed. Gold investors are usually thinking in terms of fiat, and not pricing life in ounces.

Social layer: Bitcoin’s social layer is one of the strongest anyone has ever seen. A community built and building itself which changes you once you become involved.

It is a constant: You can measure anything from bitcoin. Like a kid in science class, you were taught to only use one variable so you could figure out what works and what doesn’t. Too many variables and you get poor results. Bitcoin is the first money that is finite and auditable so you can verifiably measure everything in the universe from this monetary base and the goal posts never move. Bitcoin: Everything divided by 21 million.

Demographics: The younger generations favor bitcoin over gold 2:1 currently. Do we think that trend will reverse?

Ultimately, the properties that bitcoin contains make it a far superior investment in my eyes.

When you layer in these other trends, demographics, and properties things start to become very obvious and clear.

I changed my mind and am always open to being wrong and having my mind changed.

Bitcoin did that to me and opened my eyes.

Separation of money and state.

Stay strong,

Brandon

PS. Freedom advice, not financial advice.