How to measure assets against each other to see when to buy or sell.

How you can tell what’s undervalued and when you should be buying or selling?

These are key evaluation tools you can quickly use to see where a market sits without having to dive in to hours of research. (Even though I do recommend studying up on your investing as much as possible.)

These ratios can also tell you how assets have performed against each other and the true validity of an asset class compared to others.

If you do this at the very least you can get a great idea of a market situation and cutting through the clutter of the media and advertisements.

Gold to Dow

Bitcoin to QQQ

Gold to Silver

S&P to Brent Crude Oil

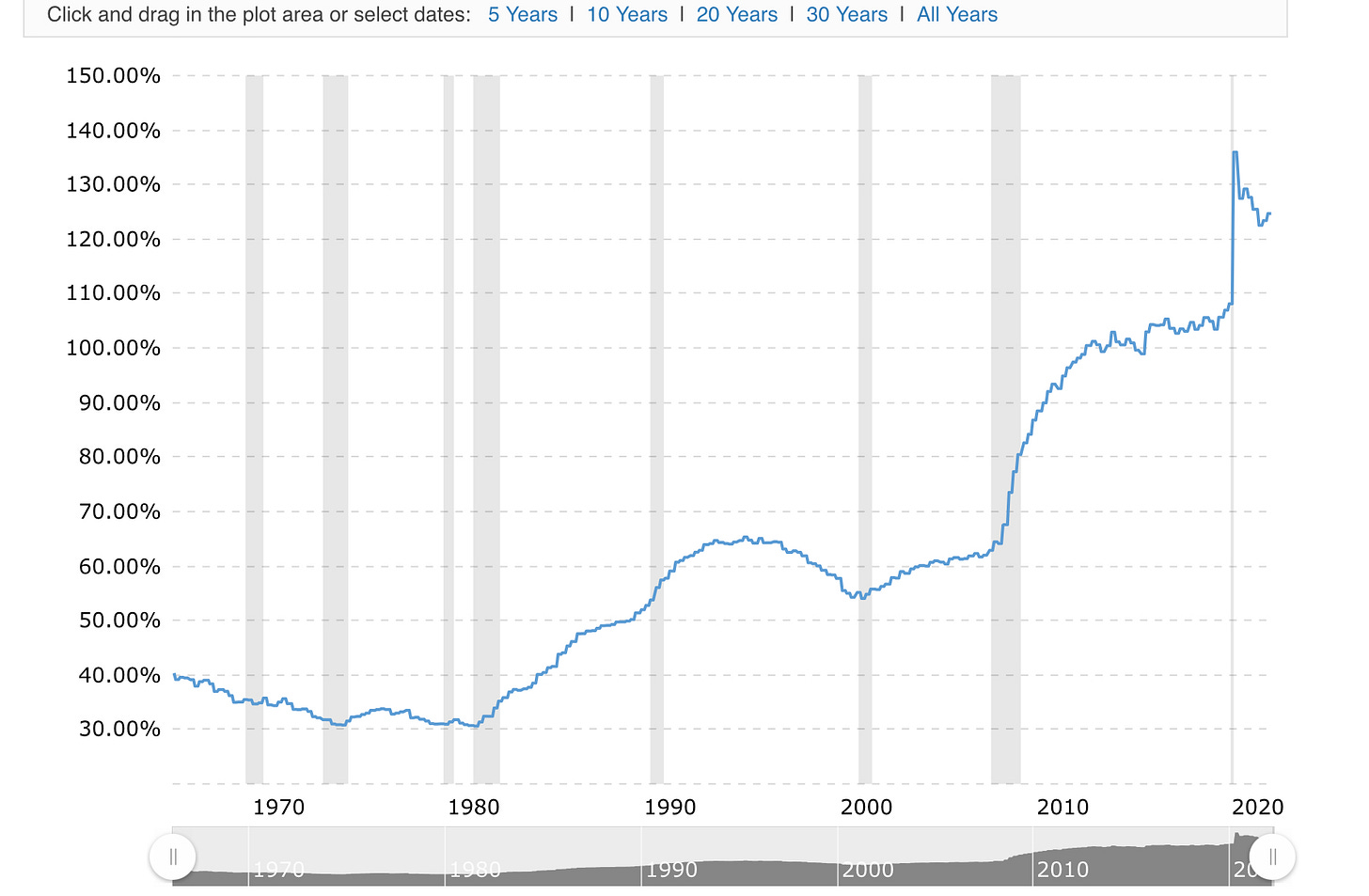

US Debt to US GDP

Another tactic to use when actually selling or buying in and out of the market: tranches.

Buying and selling in tranches is super important.

I do mine about 20% at a time. This way you are never totally in or out of a position either.

I learned this from Mike Maloney years ago.

Tranche on the way in, and tranche on the way out.

This way you can get an average of the bottom or top, hopefully.

No one ever catches the exact bottom or top.

If someone does it’s really only through luck.

This is why it is important to consistently measure assets against each other over time and take position sizes through tranches in and on the way out as a form of diversification or dollar cost averaging.

This way you can hopefully catch everything around the top or the bottom.

We could go into massive detail on all the subjects.

I hope that these little primers for a few minutes shed light on how I think and what I have learned from many of the greatest mentors I study from.

All of these tools and strategies have been very fruitful for me over the years and I hope they are for you as well moving forward.

Stay strong,

Brandon

Ps. Please let me know what you would like to see expanded on?

Tomorrow we will be talking about what is the price of an asset versus actual value. It is said that, “Americans know the price of everything and the value of nothing.”