Patience. Patience. Patience.

Trump wins election = lower rates and prices of assets going up plus more cover to build on bitcoin and scale long term.

Harris wins election = more people will lose civil liberties, so faster adoption and prices of all assets going up because they will be rushing for cover outside the government system.

The point is that no one knows what’s going on or can predict what will happen.

In my opinion, the polls are made to look close to make it seem like the election could go either way and things are real and don’t need to be “looked in to” any further.

The biggest reason according to Warren Buffett that the average person doesn’t meet their wealth goals is because they don’t possess the necessary patience.

Emotions rule the day. Fear and greed are why humans make the decisions they do. When fear goes up, intelligence goes down.

Vote for someone or not. Invest in that or not. Start or leave that relationship or not. Take that job or leave it.

Those that can make an investment and sit there for as long as they possibly can generally do the best, seeing that they made the right choice. Seeing that they saved their finite time and energy in an equally finite asset.

My portfolio hasn’t change much over the last quarter because I have spent nearly a third of my life studying money, history, finance, and investing. I found the money/investment that is finite like my time, has the most upside and most adoption to go, is built on network effects, and fits the properties of what people have been searching over 100+ years for.

Our investments have been eaten up slowly but surely by bitcoin.

Bitcoin will continue to eat the whole portfolio every 4 years. The volatility (price going up and down) is the fiat price moving and the public’s education of the asset. Bitcoin doesn't change.

Making an investment in to another asset and selling cash to buy an investment IS a decision.

Saving dollars by selling assets and buying dollars that are programmatically designed to be inflated away and worth less and less IS a decision.

Even when you think you are not doing anything and being safe, you are still making a very dire decision.

Admittedly, the investment letter each month seems stale because its only a practice in patience each month.

Here is the allocation over time:

Bitcoin (NOT “crypto”)

There will only be 21 million bitcoin EVER and there are 42 million millionaires in the world. They all have to fight over that small amount with all their worthless fiat dollars….

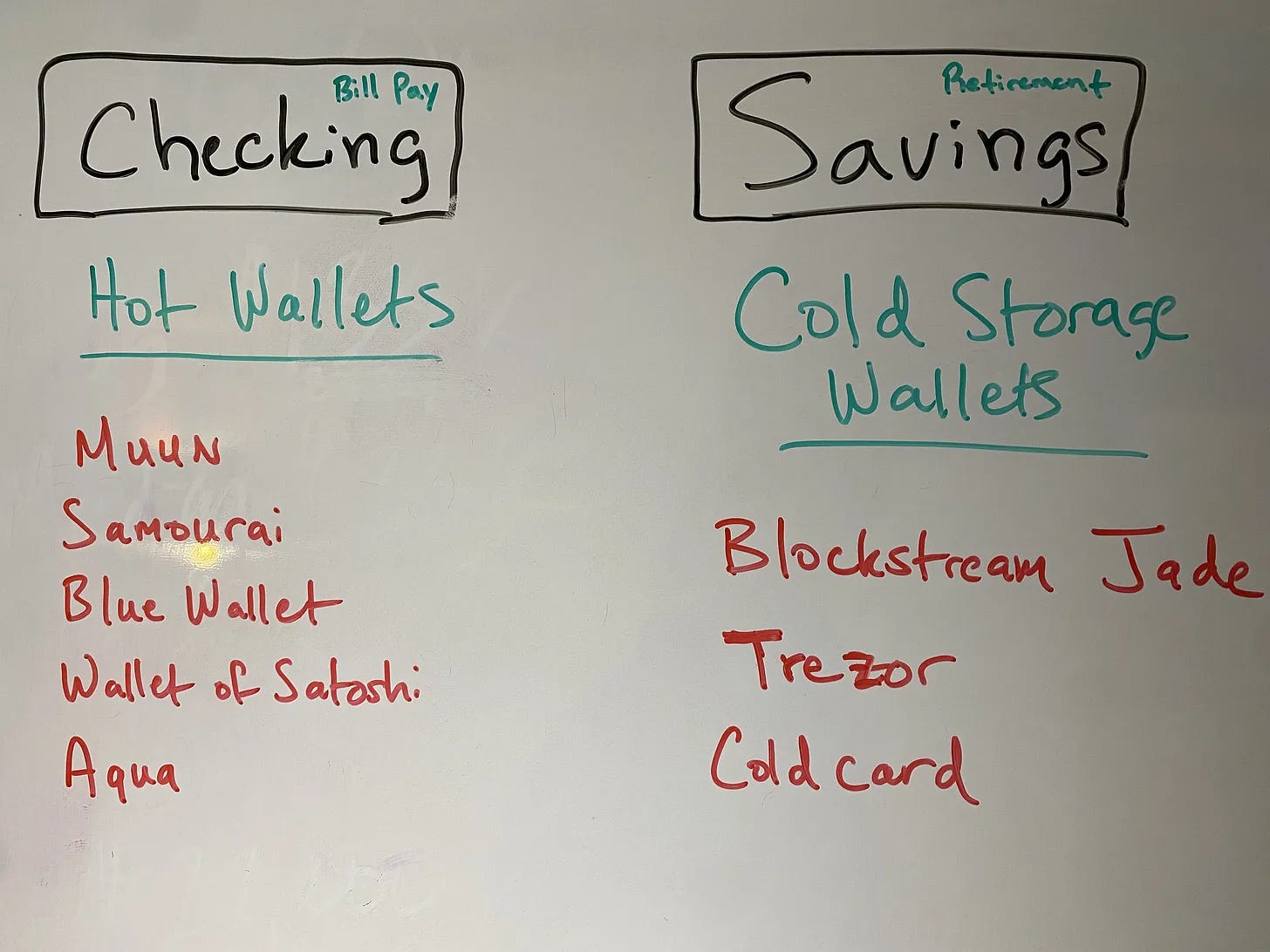

Bitcoin has network effects and the Log chart helped me realized why bitcoin continues to go up and to the right over time. Fundamentals like wallet creation, coins in long term storage, and hash rate all keep getting stronger in each market.

Bitcoin will continue to eat all assets just like you see it doing to my portfolio over 4-year spans and life will continue to get cheaper for those who hold bitcoin and more expensive for this who hold fiat and fiat assets.

We have about ~60% in bitcoin.

**I expect bitcoin to become majority of my portfolio again in the next few years as fiat decreases in value.**

Real estate (positive cash flowing rental real estate)

Still trying fixing up a property all summer. Hope to have this done soon and then a resident in before end of fall. What a mess. You have to have time and energy to put in to real estate and I am in a life cycle where I can’t commit what is needed. This is why we are on the sidelines in the hardest money ever discovered waiting for nature to heal.

We have about ~14% in rental real estate.

**Remember that the dollar is debt. Real estate like bonds over last 40 years has become more expensive and produces less yield if you don’t buy properly.**

Commodities (gold, silver, oil wells, uranium, copper, wheat, corn, etc..)

Metals have been flying higher, namely gold. The wars are really starting to ramp up and the Fed is lowering rates now. Watch metals and bitcoin to start to take off even more in coming months.

Save your finite time in hard assets, not worthless pieces of paper that will be taken from you when the ruling class wants it. (See: BAIL IN)

We have about ~15% in commodities and physical gold/silver.

Paper (stocks/bonds/IRA/etc.)

I am looking at getting in to some Microstrategy as a levered play on Bitcoin. Since we cannot pull this money out I might as well move some from these ETFs in the Saylor strategy. He is implementing something that most companies in my opinion will follow in the future. Studying him would be a great move for anyone looking to build wealth.

Reminder here of the 3 bitcoin spot ETFs we invested in.

I am adhering to the "invest in what you know" principle and have deliberately not touched this at all as you have seen in recent quarters.

We have about ~3% in paper.

***Special tip: watch the credit market (bonds) especially the 10 year treasury, to see where the markets are going to go. That tells us where the stock and rest of markets will go.

Cash/Businesses

Bitcoin Trading Cards is about launch Series 3 “Warriors vs. Villains” which is our flagship product that is scarce and sells very quickly. We are very excited about this and I cannot WAIT to show you the surprise in this series.

Playable Characters is my Youtube channel where we interview people in the bitcoin and macro space as a medium to draw attention and energy toward the trading cards. I am blessed to be able to do all of these things that I love.

Slowly moving more and more in to bitcoin and DCA each week.

We have about ~9% in cash.

Some cash on hand is also good in case our long term view of inflation is wrong. If we experience massive deflation, and the dollar increasing in strength (DXY), then we will be able to use the dry powder (cash) to buy many more assets as well. (Not likely that this plays out, so we don’t keep much, just enough to live and pay bills for a few months.)

PHASE 2 on the horizon?

In saying all of this I do believe “Phase 2” is on the horizon. I told Jessica the other day that I “see the light coming now at the end of the tunnel. Not sure when that is exactly however I am very confident that this decade will bring MASSIVE fireworks for those who are prepared and moored their boats in the safe harbor of assets and NOT saving their wealth in the US dollar.

Phase 2 is where we begin deploying our bitcoin in to assets that can pay us back in fiat (which we will then turn in to more bitcoin) OR we will know the business cycle and world has healed when we are getting paid back by our customers or residents in bitcoin itself.

At some point bitcoin won’t be returning 50-150% CAGR per year. Eventually as Michael Saylor points out it will be somewhere down to 10-15%. So you still must find productive ways in society to give back and produce a return.

Speaking of Michael Saylor I believe what he is doing with his company MicroStrategy is what many will look to do over the next decade. People at a sovereign, business, and personal level will all try to replicate this plan.

To break it down quickly we will look at it as the BRRRR strategy that has become a very popular term for real estate investors over the past 10 years.

How can you take debt, buy a productive asset (one that goes up in value either by itself or through forced appreciation) and then can be refinanced, to pull the equity out, to then buy even more bitcoin with that debt and/or cash flow.

Stay strong,

Brandon

I am always a student. I am no expert. Freedom advice, not financial advice.

Afterword

My newsletter is based off of 20+ years of historical, political, and monetary study plus my experiences in investing.

I spent the first 10 years studying politics and history.

The last 10 years I have studied monetary, fiscal history and policy, along with investing through what I call our “family office.”

In that time I have 15’xed our net worth through contrarian views and watching what people do, not what they say.

I believe you must know the financial and money games for ANY of the political side to make any sense.