(Listen to audio version of me reading👆)

Saving Social Security?

Currently there is we will say $3,000,000,000,000 ($3T) in the social security fund, rounding up.

We know that it is slated to go insolvent in the next decade…

WTF is goin on?

This poses two main questions:

How is that the people who contributed to the fund now don’t have enough to be paid out and retire?

How are we going to fix this problem?

Show me the money!

For starters most people believe (like they do about their bank) that the dollars they put in have been sitting there waiting for them, in a little black box, decades later for when they retire.

Just like a bank, the social security fund’s cash gets lent out or spent on other projects and investments over and over. Namely to buy votes.

They take away from you and they hand the cash out to other people to buy those votes for the lack of a better explanation. I know this is upsetting for people to hear however the truth is the only way we can prepare ourselves for a better and brighter future.

The simple answer as to why the bank or the security fund is insolvent or is susceptible to bank runs; They don’t have your cash. They spent it.

This should make you incredibly angry that the people you entrusted with your retirement.

Your economic time and energy have been frivolously spent and stolen it from you.

Banks do the same thing as in the moment you give them a deposit it is legally no longer yours and the banks are free to do with it pretty much whatever they wish. We go into that more in depth as to why that is in other blogs.

How do we fix the looting?

How do we give ourselves an unfair advantage?

My proposal while trying to uproot corruption and fix our system in the meantime (which we have explained in other blogs how bitcoin helps accomplish this) is to invest 1% of the SS fund’s assets into bitcoin.

At current state that would be $3 trillion X 1% = ~$30 billion.

Worst case scenario you lose $30 billion which government can just print up in currency anyway (and create more inflation raising the prices of everything, but “hey at least you still get Social Security you were planned!”)

This is their plan to do anyway once it actually goes bankrupt, so let’s roll with it.

Just like we have written about on the individual level, if you take 1-10% of your individual wealth and put it into bitcoin you stand to hedge your self and potentially double, triple, or quadruple your portfolio in a matter of 10 to 20 years without having to take much risk.

$30 billion divided by $25,000 per bitcoin would be approximately 1.2 million bitcoin. (I’m rounding these numbers just a little bit for the sake of easy math.)

Bitcoin’s potential

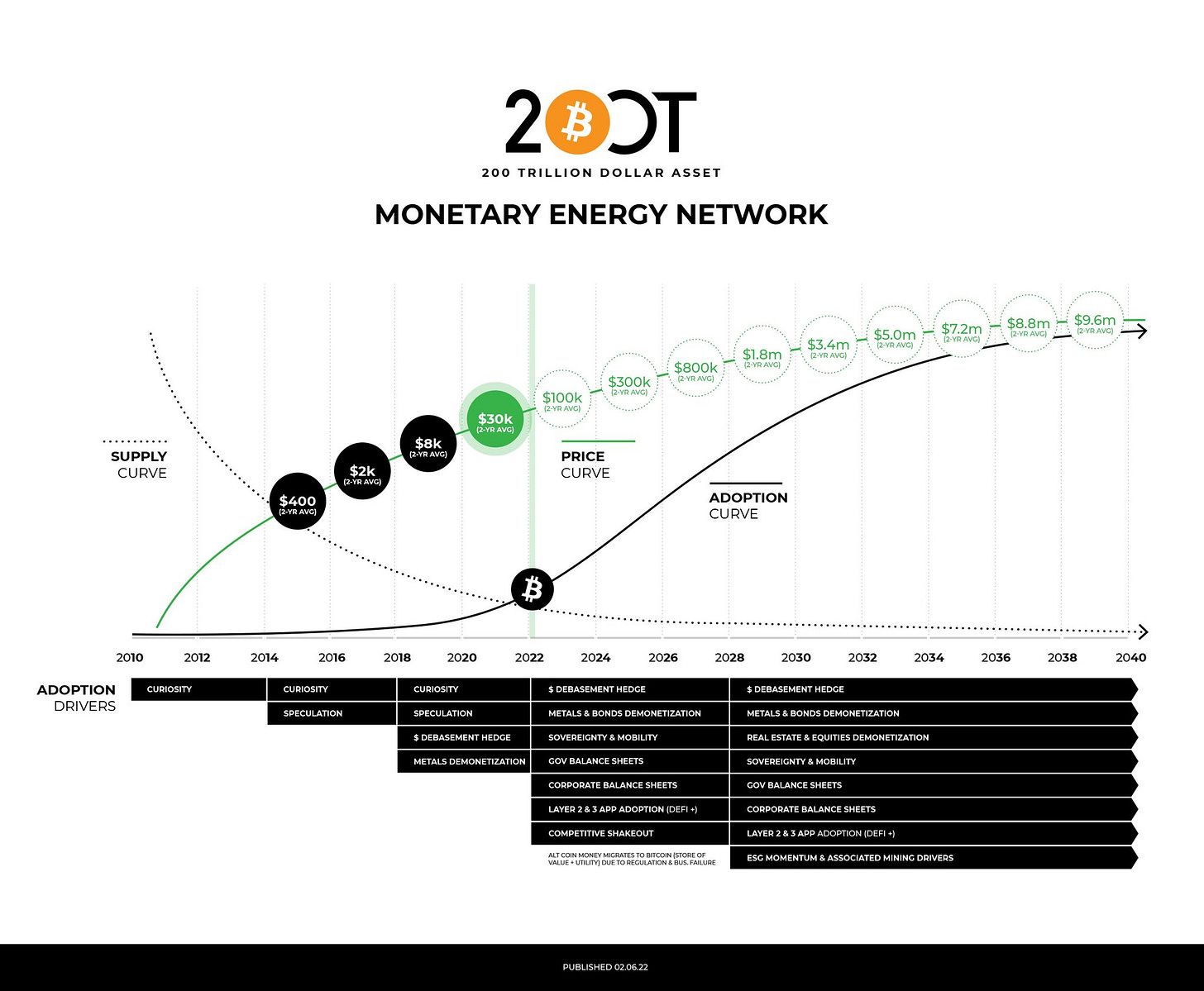

Here’s the chart of where bitcoin could be in the coming years through looking at network effects and adoption.

Say bitcoin went back to the all time high of $70,000.

You are looking at $84 billion.

Tripling your investment based off of a ONE percent allocation from the fund!

The averages of many different publications say Social Security will be bankrupt in 10 years.

If we look 10 years from now on the chart above, the average is about $3.5-5 million per coin.

Even if you cut that and half and be extra conservative and say only $2 million per coin.

At that rate $2 million/coin X 1.2 million bitcoin would be $2.4 trillion!

So you almost doubled the entire Social Security fund at the very time it is said to go insolvent on the current trajectory, mind you this is with a 1% allocation initially into bitcoin at today’s price!

What if we hadn’t cut the 10 year projection per coin in half?

OR…

Say you put a 10% allocation initially into bitcoin, now?

What do you have to lose, we already know it’s trending towards insolvency?

Yet the senators who we just wrote about the other day shaming Fidelity about offering bitcoin to its retirees should ironically be doing the very thing they are grandstanding against.

In order to ensure the retirement of Americans and actually lead and serve people they should be doing everything that can to think outside the box and help with people‘s retirement in the situation we find ourselves in.

A 10% initial investment would be $24 trillion ten years from now! Literally 8x what the current fund is at.

Again that’s only with a minimal upfront investment when we know the current thing we are doing will lead to insolvency and bail outs, which will only lead to more inflation lowering the living standards of all people.

Sometimes easy answer is the simplest answer.

Not to mention the freedom technology that the bitcoin network will give the country and the first mover advantage accruing the wealth before other countries.

Remember that bitcoin first movers will benefit the most.

Those that are last into the economic game theory will buy at the highest prices and benefit least.

It pays to be decisive and take action!

Stay strong,