(Listen to audio version of me reading👆)

Could it all be changed with one simple move?

I have been doing a lot of thinking lately about my goals for last 15 years to consistently turn your earned income into portfolio or passive income. We have a job to get our money (time and energy) to work intelligently for us so that way we can gain freedom in our lives.

This explains the very reason why I work in the financial literacy space now, with Bitcoin Trading Cards and have been making my own content.

Jim Rohn said, “you must work harder on yourself then you do on your job.” Simply put, you must work on your skills, your awareness, your attributes more than your your paycheck. Otherwise you will be a slave to a paycheck for the rest of your life at the mercy of other people.

Money buys you freedom for what you want to do and the choices you want to make in your life. People don’t really care about money. They just want what money buys them and this case money is freedom.

Money is time. Time is money. Money is a container for your time and energy.

We hope to be investing back in to our community through apartment complexes, or triple NET leases (NNN), or storage facilities that provide beautiful living and services for people. We will be doing it at a time where hopefully we are able to earn more bitcoin from the people we are servicing.

In the future people will only be parting with their bitcoin if they get real service and dependable products. Think about how we say, “they just don’t build them like they used to.” That is because of course they don’t. Why is that? Is it corporate greed? Or is it the dollar collapsing in value and people need to find more dollars to buy the same thing?

The fiat debt based legacy monetary system now is cracking every single day and the whole dam is about to come down. It could be in days, months and years. Better to be a year early then one day late.

The government is guaranteed to continue printing more currency which will devalue your savings and all the other assets will continue to hedge the inflation at best.

Bitcoin is the reason I moved my entire life into the space after looking at all the different asset classes for 15 years. It is the control in the experiment that we call “investing.”

Bitcoin is the unchanging guide. 21 million. They never will be more, and there will never be less. You can measure everything in the world against it.

Now real valuation and price discovery can float to the surface, and life can begin to make sense again. I invite you to deeply ponder that thought. The importance of that cannot be understated.

Here is my allocation last 4 months:

Bitcoin (NOT “crypto”)

Bitcoin ETFs were approved right after the last investment letter we published, last month.

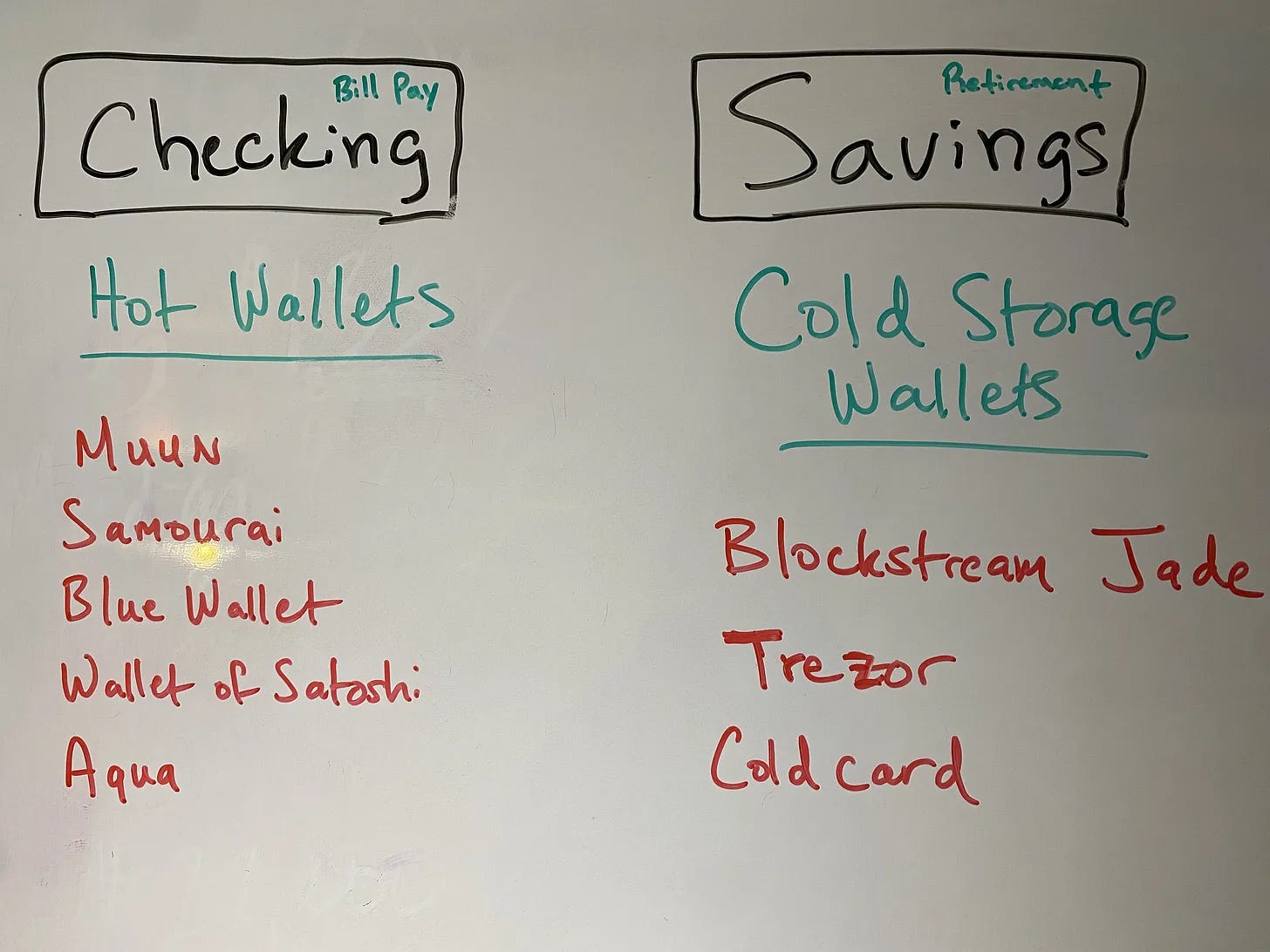

Remember, ETFs are paper bitcoin, and the real bitcoin that gives you sovereignty is the bitcoin that you store in your cold storage wallet.

Bitcoin sits at about half of our portfolio still.

This will only continue to grow over time as we stated, guaranteed. The fiat legacy debt-based monetary system has to continue printing and destroying itself.

We have about ~50% in bitcoin.

**I expect bitcoin to become majority of my portfolio again in the next few years as fiat decreases in value.**

Real estate (positive cash flowing rental real estate)

Rental real estate has been decent and starting to come around for us. We finally got our third rental property occupied and seems like a good resident is in there now.

We paid our winter taxes last week and they were astronomical on one of the properties. Another property in the same city has very low taxes so I may have a fight on my hand.

This is another frustrating aspect of real estate where you don’t exactly control all of your issues hence why you need to make sure you’re buying great areas and start to know the leadership in the locale.

We have about ~17% in rental real estate.

**Remember that the dollar is debt. Real estate like bonds over last 40 years has become more expensive and produces less yield if you don’t buy properly.**

Commodities (gold, silver, oil wells, uranium, copper, wheat, corn, etc..)

I have been meeting with some different pawnshop owners and gold & silver dealers and developing relationships with brokers in the area. We must build our community locally in order to truly thrive in this world going forward.

Community is the number one resource in any survival situation.

We have not added any metals or other commodities to our positions.

We have about ~14% in commodities and physical gold/silver.

Paper (stocks/bonds/IRA/etc.)

We did make some changes in our paper portfolio with our existing IRA.

We ended up selling the GBTC that we had in there and bought three different Bitcoin ETFs.

GBTC (Grayscale Bitcoin Trust) has performed very well for us over 3X multiple over the past couple years. The fee was just way too much, and we moved where the fee was much less. From about 2%/year on average to about 0.25%/year.

These should closely track the spot price of bitcoin in theory because they are supposed to take delivery of the asset and that is auditable, unlike physical metals which are much tougher to audit and price suppression is very rampant.

I am adhering to the "invest in what you know" principle and have deliberately not touched this at all as you have seen in recent quarters.

We have about ~3% in paper.

***Special tip: watch the credit market (bonds) especially the 10 year treasury, to see where the markets are going to go. That tells us where the stock and rest of markets will go.

Cash/Businesses

We still are keeping some cash on hand, and dollar cost averaging bitcoin and buying dips.

We will probably be investing more in Bitcoin Trading Cards as well like I mentioned previously. This is the company that I lead marketing for and has a massive future with some incredible partnerships already in the works with companies you might know.

Cash on hand is also good in case our long term view of inflation is wrong. If we experience massive deflation, and the dollar increasing in strength (DXY), then we will be able to use the dry powder (cash) to buy many more assets as well.

We have about ~15% in cash.

Remember

There are some people don’t pay attention to the federal reserve which is commendable. I watch and listen to them or experts I trust at a minimum effective dose. Just enough so I have what I need to know. Way less than I used to.

I cannot stand being a part of a system where a few people get to a podium and tell us what the price of my work will be or the cost of the currency (we are forced to use) will be. This is the system that I am actively, day and day out, trying to change so that my children and 8 billion people on the planet can secure their wealth and freedoms.

I’m sick and tired of the fiat debt based legacy monetary system that has destroyed so many lives. I can only operate in the system where we get to use a money that is fair just and equitable.

The new system is here, but it’s not evenly distributed yet and most people don’t have the education. That’s part of what I am looking to do each and every day.

The fiat legacy system is collapsing more by the day as you look around at headlines and politicians that make no sense and seem to get loopier every time you see them.

It’s time to defund the chaos and the cronies.

The more independent and resilient we become the less these people affect your life and I couldn’t support it more.

Stay strong,

Brandon

I am always a student. I am no expert. Freedom advice, not financial advice.

Afterword

My newsletter is based off of 20+ years of historical, political, and monetary study plus my experiences in investing.

I spent the first 10 years studying politics and history.

The last 10 years I have studied monetary, fiscal history and policy, along with investing through what I call our “family office.”

In that time I have 15’xed our net worth through contrarian views and watching what people do, not what they say.

I believe you must know the financial and money games for ANY of the political side to make any sense.

If you like freedom and can’t stand politics and bridges to nowhere, racial polarization, division, hate, looting, and all the moral decay in society than you might just be a bitcoiner.

To fix all these problems we have a solution where you cannot be racketeered by governments anymore through inflation.

“Bitcoin fixes this.”

You don’t need a lot, just a couple percent is a vote for freedom and could change the world forever.

Study bitcoin. Invest in what you know.

I ONLY want to trade my finite time for finite assets, NOT trade my finite time for infinite pieces of paper/digits on a computer.

MAKE A FAIR TRADE FOR YOURSELF.