(Listen to audio version of me reading👆)

Government is destroying your currency, so there really isn’t a long term reason to save it.

Where do you turn?

Is bitcoin really an inflation hedge or a store of value?

Since March 2020 lows bitcoin is still up almost 500% (6x). I don’t know of any assets that have done that. That is only in 27 months.

What inflation has done to you if you held stimmies in dollars over the years.

The Fed printed 40% of all dollars in the past 27 months. So your currency lost that amount of purchasing power overall.

Some reasons why dollar is losing power:

Jay Powell said CBDC is coming and dollar is at risk.

Putin said dollar worthless, too. They will take gold and bitcoin for oil.

Saudi Arabia said they will take yuan for oil and not dollars.

Fed just keeps typing digits in to their computer.

The chart here shows the purchasing power of the dollar compared to bitcoin. The chart shows how many Satoshis (divisible units of bitcoin) can be bought by one US dollar. It has fallen through the floor in the past 10 years….

Teeka Tiwari notes:

“Despite its volatility, I believe that over time bitcoin is the best hedge against inflation. No other asset comes close.

In January 2013, $1 could buy nearly 10 million SATS.

Today, that same $1 can only buy about 4,000 SATS. That means the value of a single SAT (measured in USD) has increased by 189,900% in just under 10 years.

No other asset I know of has increased in value that much over the past decade. Not one.

Because of bitcoin’s pre-programed scarcity and Proof-of-Work security, I expect that trend to continue for many decades to come.

That’s why I say – despite its pullback – bitcoin is the best inflation hedge today.

And it’s only going to see its value increase. That’s because the government will continue printing and sending the dollar into oblivion.”

This is why people are struggling and don’t know why.

It was only masked by the fact that people thought they were getting wealthier because asset prices and 401k’s were going up in nominal price.

However the REAL value of their purchasing power was falling because the dollar was losing its value. Inflation makes each dollar worthless (worth-less) and buys you less good and services, making you poorer.

Remember compounding works both ways. Positive compounding is great, however inflation acts as a negative compounding anchor around your neck. Causing everything in life to get more expensive if you hold fiat dollars.

Teeka Tiwari again:

“Sound money goes up in value over time. It doesn’t go up in a straight line… But it will be worth more than it was in the past.

Yes, bitcoin is highly volatile. That’s because it’s still a relatively small asset class. At $450 billion, its market cap is 24 times less than gold.

But as adoption increases, bitcoin’s volatility will tamp down. The crashes will be fewer and farther between… and they’ll be less severe than they are now.

….

Ask anyone that has developed massive wealth… and they’ll tell you they created that wealth by having a vastly different opinion from everyone else.

They then backed that opinion with sweat equity and money.

Fortunes don’t come from following the crowd. They come from going against conventional wisdom.

They come from letting go of the fear of feeling foolish and backing your judgement over the judgement of others.”

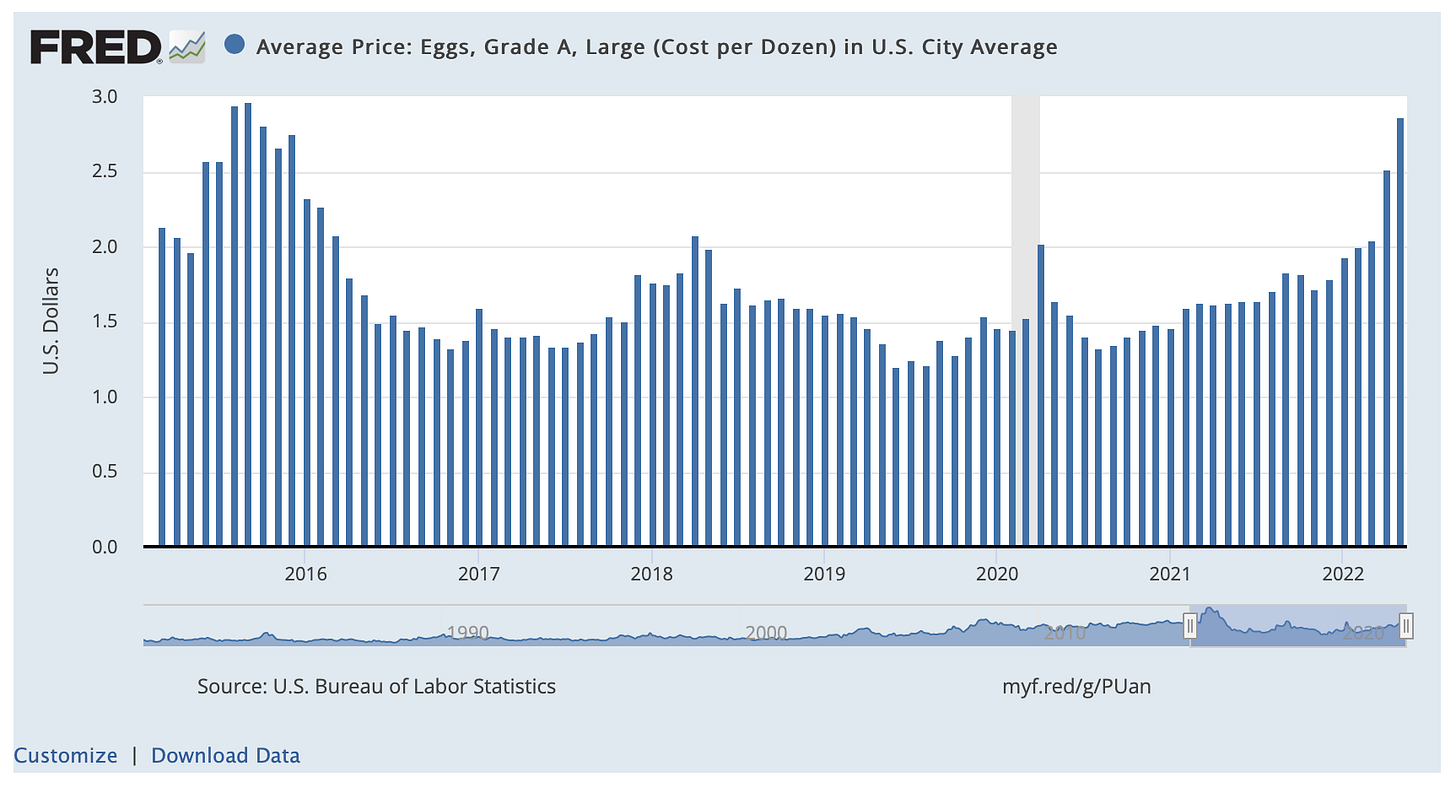

Eggs priced in bitcoin in the past year, can fool you as Fed tries to do: (ZOOM OUT!)

When you zoom out….Eggs prices in bitcoin 2015-2022. You can buy a lot more eggs…

And here is eggs priced in dollars 2015-2022

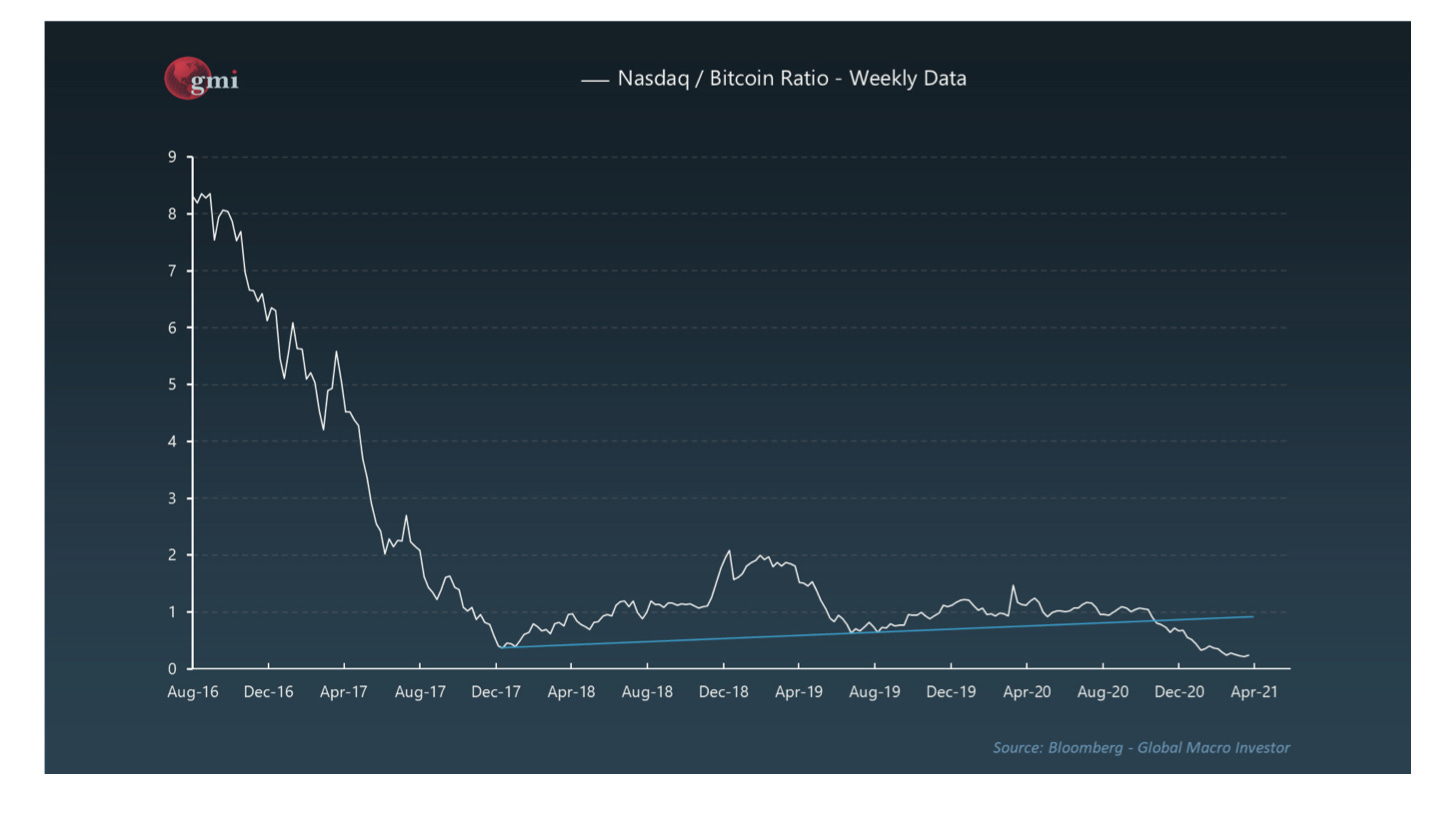

Dollars are getting rocked by bitcoin as we pointed out at the beginning of article and it is not even close.

The loss of our purchasing power before your eyes.

But it doesn't stop there…

Bitcoin compared to QQQ

Bitcoin compared to NASDAQ

Bitcoin compared to emerging markets

Bitcoin compared to gold

Bitcoin compared to median price home

Why is bitcoin correlated to stocks or tech?

Short term correlations tell you nothing about long term returns or value.

Look at Pets.com and Amazon. Both on same trajectory and correlated. Now, one runs the world and the other quickly went out of business.

In crashes or in shorter timeframes correlations generally all go to 1, and cash floods in to the dollar.

When in doubt, zoom out.

If you are looking in 6, 12, or 18 month spans you will miss many investments.

You might as well go to Wall Street and try to become a hedge fund if you are thinking in that short of span.

We don’t look at other traditional stores of value and judge them in one year…

Bitcoin is the apex predator asset. Bitcoin’s properties lend it to being the hardest asset and currency to ever exist.

Would a bubble or something that had no value continue taking down all asset classes? Would it crash and die and then rise again, over and over, while continuing to break new higher highs and set lower lows?

Stay strong,