(Listen to audio version of me reading👆)

The prevailing narrative suggests that the economy remains robust, despite the significant job losses we've witnessed and increased steady inflation.

That narrative is fed to you by none other than the Federal government and Treasury Secretary Janet Yellen.

However, interest rates are surging, reaching a 15-year high in 10-year treasury rates, with no clear indication of slowing rate hikes.

Prepare for potential turbulence ahead: more business closures, increased unrest, growing chaos, and growing tent cities.

From many metrics we are worse off than we were in the depression. Yes, you read that right. I will write a separate article on this.

It's a situation we've partly brought upon ourselves, having elected our governments and allowed ineffective leadership.

It's time for a reality check and a fresh start.

One of the most enlightening discoveries I've made in recent years is redefining money in a way that makes sense for everyone. I've been working on transforming this insight into a business venture here through my newsletter and YouTube etc..

My goal is to empower people worldwide with financial knowledge and freedom, as Jeff Booth aptly describes it as “the greatest game.” Understanding that money is a tool and deeply psychological can help us bring order to the current chaos.

I feel a calling to help all 8 billion people on this planet, not just a select few. The path I was on the past 10 years only helped a few dozen people around me. When we establish a fair and honest monetary system, everyone benefits, irrespective of their profession.

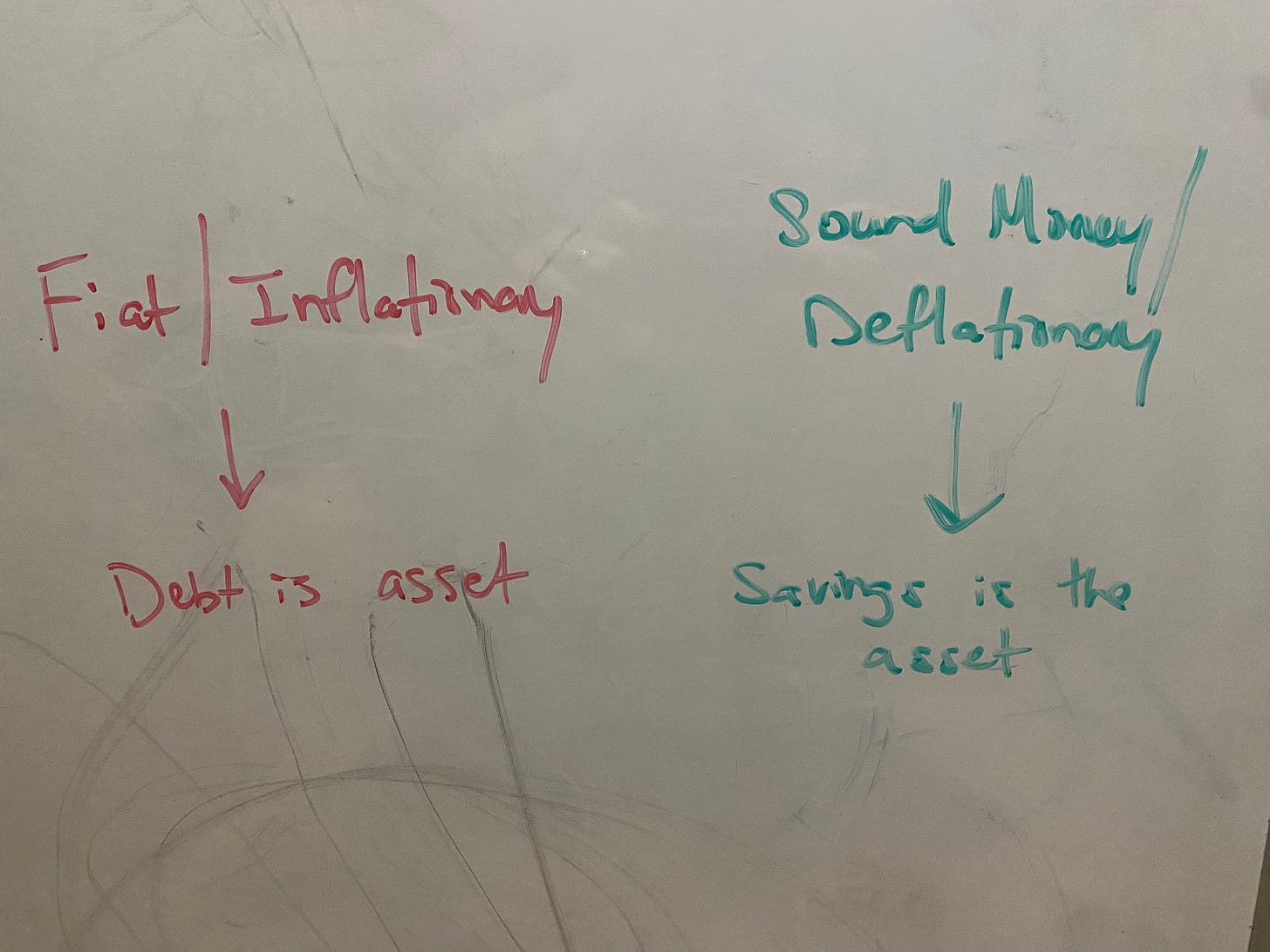

Fiat currencies are inherently political. As long as we have fiat currencies, politics will persist.

Bitcoin offers a historic opportunity to introduce real money into human nature for the first time, and dismantle cronyism and politics.

Bitcoin, NOT “crypto”

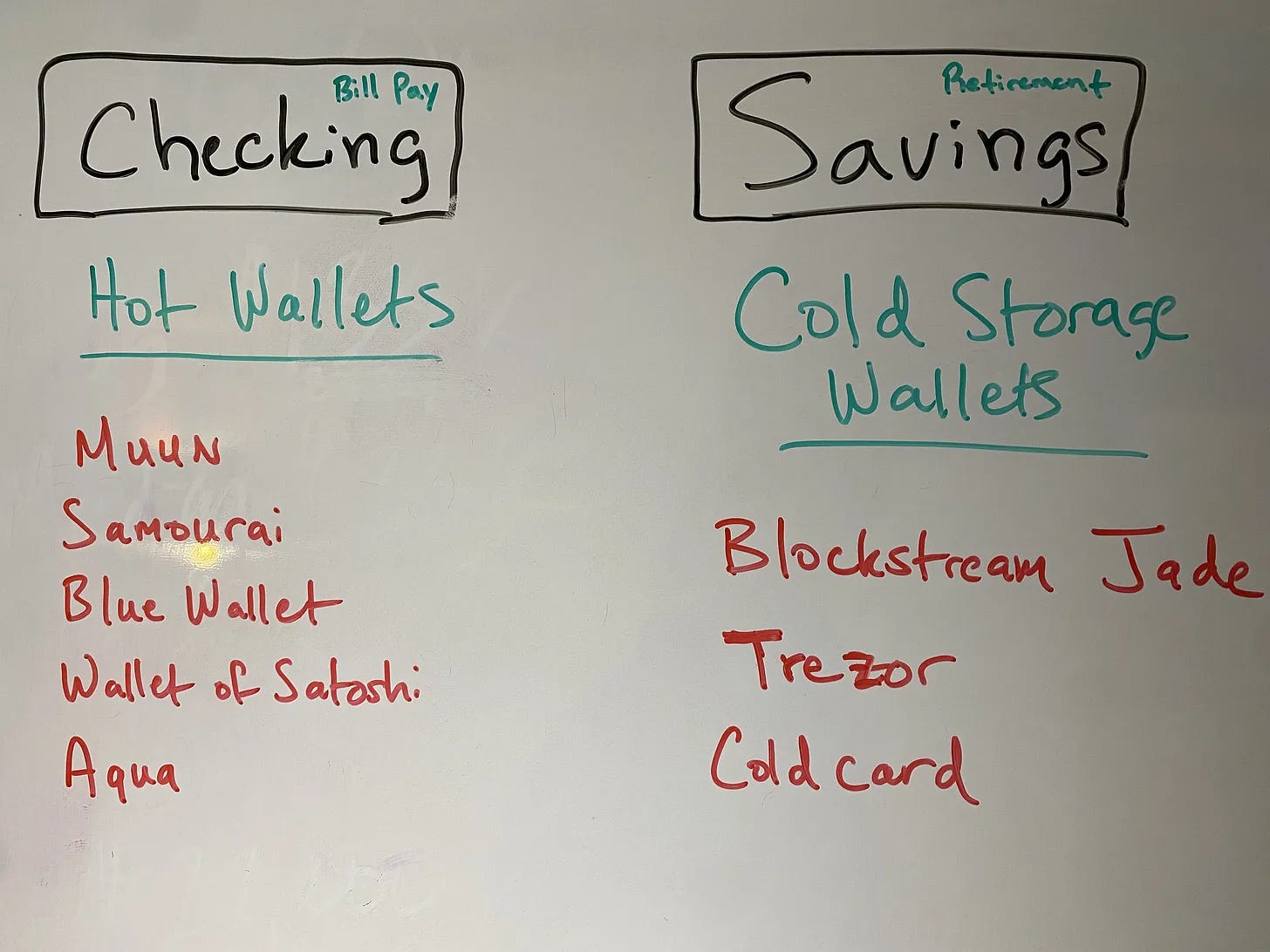

I continue to engage in dollar-cost averaging into Bitcoin as a means of saving.

The best savings tool we have, Bitcoin, is up ~65%+ this year.

Inflation will continue to rise long term as we just hit $33T in debt this week.

If you are holding dollars, you will have to continually find more and more dollars to pay for normal every day things.

The ONLY finite asset to trade for your finite time is bitcoin.

Bitcoin will continue going up in value forever because fiat will continue to lose value forever.

We have about ~36% in bitcoin.

**I expect bitcoin to become majority of my portfolio again in the next few years as fiat decreases in value.**

Real estate (positive cash flowing rental real estate)

While real estate remains stable, we're facing the departure of a long-term tenant, resulting in some lost rent through turnover and cleaning.

Such situations highlight the importance of financial preparedness for unexpected changes.

Again, I look to the diversification in assets to weather the storm and why this letter is focused on highlighting that on a monthly basis.

We have about ~20% in rental real estate.

**Remember that the dollar is debt. Real estate like bonds over last 40 years has become more expensive and produces less yield if you don’t buy properly.**

Commodities (gold, silver, oil wells, uranium, copper, wheat, corn, etc..)

Commodity investments remain unchanged, but I'm contemplating selling some assets to diversify further.

Silver, in particular, has performed well for me over the last decade and done its job as savings and beating inflation for me.

This is because we bought low and stayed patient.

Because of life situations arising I may put some assets together in to a private placement for one of my friends who handles apartments or possibly some dividend paying stocks so my asset can pay for my liability.

We have about ~16% in commodities and physical gold/silver.

Paper (stocks/bonds/IRA/etc.)

May be adding to this bucket here soon for dividends to pay for liability instead of just paying cash for liability and losing that cash forever.

Might buy a bunch of puts so I can gain some cashflow off the premiums and that way I can buy at a lower cost basis.

Will be vetting this strategy and where I might go over next 30 days.

We have about ~3% in paper.

***Special tip: watch the credit market (bonds) especially the 10 year treasury, to see where the markets are going to go. That tells us where the stock and rest of markets will go.

Cash/Businesses

We're dealing with a tax bill due to last year's sales in properties and a new car coming up. Hence why I am looking at some ways to convert income to throw off some more cashflow.

It's frustrating that we're taxed twice on our hard-earned income, first as income and then again when investing through capital gains.

Robinhood pays almost 5% on cash sitting in your account. Point being that there are many ways you can be earning interest on your cash that is sitting around.

But any time you are “earning yield,” know that there is risk involved. The person holding your cash is lending your cash to someone else for an even bigger yield.

Weigh your risk tolerances and figure out what makes the most sense for you whether it is banks, credit unions, or brokerage accounts.

This is again why I love bitcoin, but we are all still living in two separate systems.

Cash on hand is also good in case our long term view of inflation is wrong. If we experience massive deflation, and the dollar increasing in strength (DXY), then we will be able to use the dry powder (cash) to buy many more assets as well.

We have about ~25% in cash.

Remember…

Over the past month or two, I've scaled back my attention to the macroeconomic landscape.

After over a decade of studying the existing system, I've grown disillusioned with its moral shortcomings.

Why give power and energy to a bankrupt system?

It's clear that significant changes are on the horizon, with Bitcoin and new financial paradigms set to reshape the world.

I've always been ahead of the curve in my predictions so it may not happen overnight, but I choose to channel my energy into educating people about the emerging world that promises fairness, prosperity, and freedom for all.

Bitcoin is a neutral money that captures deflation and spreads the higher standard of living and lower costs back to all people inside that system.

When you align incentives the world starts to heal.

Fiat currencies are the disease and these broken currencies permeate all areas of life.

Simply put, the dollar is backed by nothing, making it currency, and making it easy to inflate away and slowly steal all your wealth (time and energy.)

The stealth tax that governments and bankers use to siphon away your wealth without having to tell you.

This allows people in positions of power to control the masses with endless fear campaigns and propaganda while keeping most poor so they are helpless and subjected to this endless torture.

Fiat currencies are designed to lower standards of living and raise costs for the 99% while sucking the gains up to the few at the top.

This doesn’t have to continue, you can easily change this with a one second choice of choosing a money that doesn’t steal from us every second of every day.

Stay strong,

Brandon

I am always a student. I am no expert. Freedom advice, not financial advice.

Afterword

My newsletter is based off of 20+ years of historical, political, and monetary study plus my experiences in investing.

I spent the first 10 years studying politics and history.

The last 10 years I have studied monetary, fiscal history and policy, along with investing through what I call our “family office.”

In that time I have 15’xed our net worth through contrarian views and watching what people do, not what they say.

I believe you must know the financial and money games for ANY of the political side to make any sense.

If you like freedom and can’t stand politics and bridges to nowhere, racial polarization, division, hate, looting, and all the moral decay in society than you might just be a bitcoiner.

To fix all these problems we have a solution where you cannot be racketeered by governments anymore through inflation.

“Bitcoin fixes this.”

You don’t need a lot, just a couple percent is a vote for freedom and could change the world forever.

I ONLY want to trade my finite time for finite assets, NOT trade my finite time for infinite pieces of paper/digits on a computer.

MAKE A FAIR TRADE FOR YOURSELF.