(Listen to audio version of me reading👆)

A couple months ago I told you we were in a recession.

Then the data came out and confirmed that the next month.

I have a sneaky feeling we are going to see another negative GDP number come out soon. Third quarter in a row.

The economy is really on the brink.

If you need any confirmation of that, I would point you to the bond market swinging violently, the dozens of dire warnings from all the big banks, or over to Europe to see the literal disaster scenario playing out there.

That will cascade and come here.

Have you heard of ANY of this in the local news or national news?????

My job isn’t to tell you what you want to hear, we have the media for that.

I am here to forecast what I think is truly happening and show what I am doing to combat it and grow my family’s wealth.

I want as many people independent as possible as its the ONLY way we will get through the chaotic and turbulent times ahead.

More on the disaster in Europe coming soon….

I am always a student. I am no expert. This is never financial advice, but only what I’m doing and what I see.

Real estate (positive cash flowing rental real estate)

Sold the home in Sterling Heights that we bought last month. Made a little chunk of cash using OPM (other people’s money.)

Used half our HELOC to pay off private money lender (PML) on one of our other properties that we couldn't refinance. We had the refi fall apart and had to go find some other lenders to work with so hopefully we can get that cash out and recoup some of that cash to go invest somewhere else.

***Special tip: watch the credit market (bonds) especially the 10 year to see where the markets are going to go. That tells us where the stock and rest of markets will go.

Still building our back end for our commercial real estate plans. We should have that up and running in next month or so and getting deals on the table that will be suitable for investors to come on board for. Excited for this next phase as we scale up!

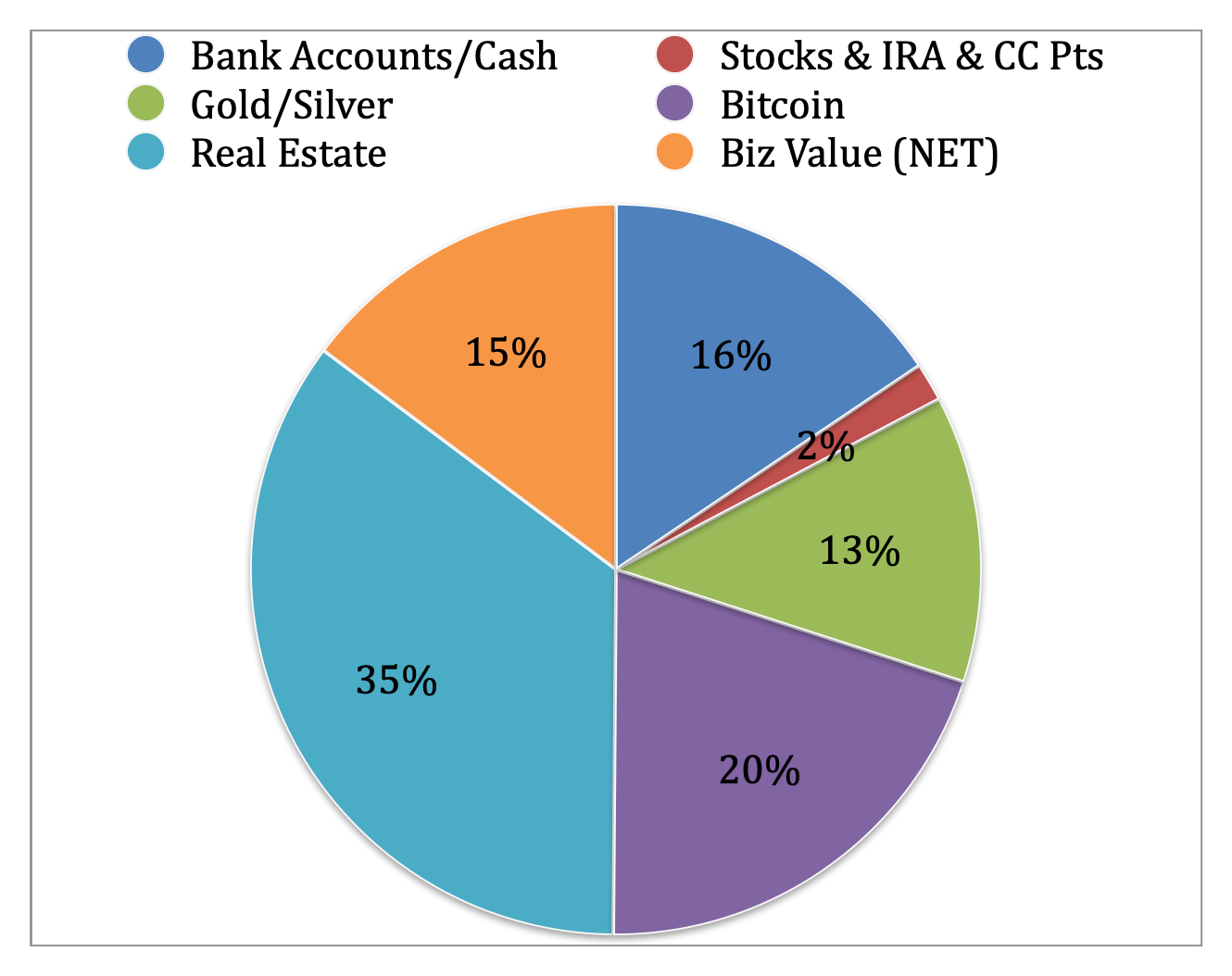

We have about ~35% in rental real estate.

**Remember that the dollar is debt. There’s nothing backing it so the further you can get into good debt and buy appreciating assets you will win long-term as government continues devaluing the dollar. (ie. Refinancing real estate and pulling cash out tax-free to invest in other assets will be the people who win long-term. Savers get crushed by inflation and minuscule interest savings rates.)**

Bitcoin (digital assets)

Again, Bitcoin has been steady over the past month which is awesome. I have continued putting big chunks of our cash in beyond my weekly DCA (dollar cost averaging) as it has dipped below $20,000.

The REAL power lies in the fact that when you own and custody bitcoin in your own cold storage hardware wallet, you have become your own sovereign bank. No one can freeze you out of the system or steal or dilute your wealth.

PLEASE READ: There is Bitcoin, then there is everything else. Here is Fidelity’s executive summary and full report on this very topic or you can listen to me read through it here: https://www.fidelitydigitalassets.com/research-and-insights/bitcoin-first

About ~20% in bitcoin.

**I expect bitcoin to become majority of my portfolio again in the next few years as it increases in value.**

Gold and Silver (commodities; oil wells, uranium, copper, wheat, corn, etc..)

Silver is the main thing for me here. It has monetary value historically and it has utility galore in the ever increasing digital world we live in.

This will slowly get overtaken by bitcoin in the next few years. But I still want some analog in case we get hit by a meteor….

Again, I would rather store my savings/retirement in appreciating hard assets like gold/silver/bitcoin rather than depreciating dollars.

We have ~13% in gold/silver to diversify in the analog world spread around different vaults and geographic locations that we can access in emergency.

Paper (stocks and bonds)

I have a couple percent in gold stocks, my company’s stock, Jessica’s small IRA from a job 10 years ago, and credit card points.

Still not keen on things I cannot control. Been thinking about stocks a little bit but I do think you could see another leg down still on blue chip dividend paying stocks.

Again, there will be a time for stocks in “phase 2” once the defensive positions and hedges (insurance) pay out.

We will then sell those assets or lend against them and use that cash to buy businesses, cash flowing apartments/storage/mobile home parks, and dividend paying stocks (dividend aristocrats.)

We have ~1% in stocks

Cash/Businesses

I still believe there will be more investments to buy on the cheap in the next 12-24 months.

This could also be cash or equity you have in businesses you own, private placements, limited or general partnerships.

Cash on hand is also good in case our long term view of inflation is wrong. If we experience massive deflation and the dollar increasing in strength, then we will be able to use the dry powder (cash) to buy many more assets.

I also have life insurance as well that I may roll in to whole life cash value at some point. Going to be talking to Ron Sneller about that at some point in the future and the pros and cons of that move.

We used up some cash to buy bitcoin this month and refi lender out of properties etc.. I expect this to go up again in the next month or so once we refinance one of these rental properties.

~31% is in cash.

Conclusion

Soon as we get this refinance done and have cash back in the hopper we may just sit tight for a quarter or two. We need to run business and investments in bitcoin, private placements, and potentially commodities could get much cheaper in the near future if we have big economic shocks.

We will deploy cash once there is real carnage in the markets, so I have changed my outlook for the time being to be a bit more patient.

The apartments and self storage may get some of our cash in the coming months but we have tons of cash on the sidelines with investors that need a place to go, so I may keep our powder dry for now.

Trying to stay very liquid but I don’t want a ton of cash on the balance sheet for more than 12 to 24 months because you are paying an option premium of real inflation which is around to 15-20% each year.

Any investment you make has to be beating 20-24% each year Warren Buffett says.

Keep that in ming when making an investment!

Why I love bitcoin because it grows CAGR (compound annual growth rate) at 100-150%/year.

Stay strong,

Brandon

My newsletter is based off of 20+ years of historical, political, and monetary study plus my experiences in investing.

I spent the first 10 years studying politics and history.

The last 10 years I have studied monetary, fiscal history and policy, along with investing through what I call our “family office.”

I always mention to anyone that will listen: you must know the financial and money games for ANY of the political side to make any sense.