(Listen to audio version of me reading👆)

We are going to call this; pictures are worth thousands of words.

I am not going to do much talking here.

There is no need to as we have written about these things for months and years.

Be prepared and get your mind, body, and soul right.

The piper is getting closer and louder, and he wants to be paid.

Here is my allocation which hasn’t changed much from the past month, slow and steady.

Investing is a plan more than it is crazy high flying fun moves.

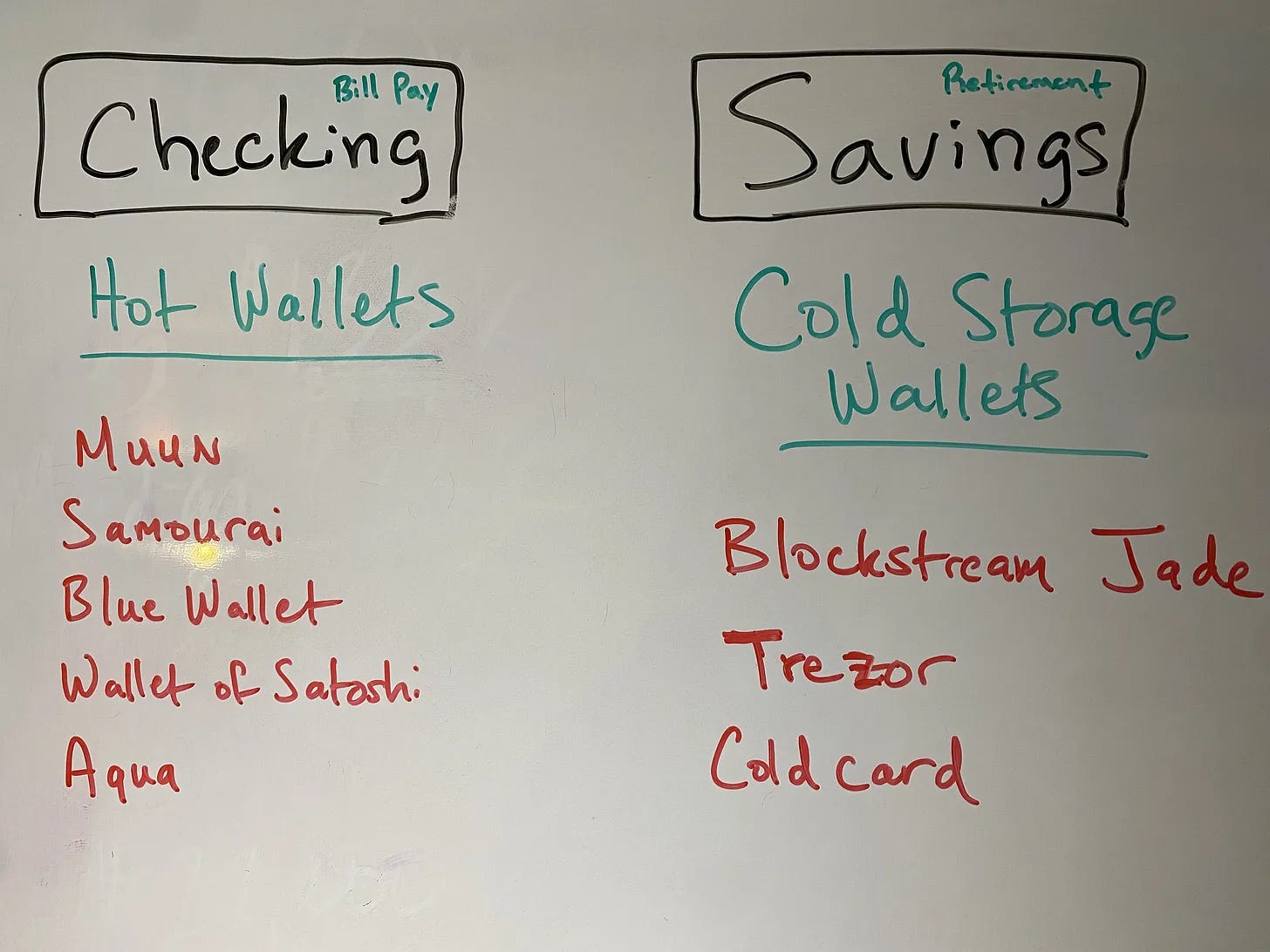

Bitcoin, NOT “crypto”

I made a couple extra buys these past couple weeks above and beyond my dollar-cost averaging into Bitcoin.

The best savings tool we have, Bitcoin, is up ~65%+ this year.

Inflation will continue to rise long term as we just hit $33T #33.5T in debt this week.

If you are holding dollars, you will have to continually find more and more dollars to pay for normal every day things.

Bitcoin will continue going up in value forever because fiat will continue to lose value forever.

We have about ~37% in bitcoin.

**I expect bitcoin to become majority of my portfolio again in the next few years as fiat decreases in value.**

Real estate (positive cash flowing rental real estate)

Getting the property from last month cleaned up currently as the resident left the place a mess.

Such situations highlight the importance of financial preparedness for unexpected changes.

Again, I look to the diversification in assets to weather the storm and why this letter is focused on highlighting that on a monthly basis.

We have about ~20% in rental real estate.

**Remember that the dollar is debt. Real estate like bonds over last 40 years has become more expensive and produces less yield if you don’t buy properly.**

Commodities (gold, silver, oil wells, uranium, copper, wheat, corn, etc..)

Commodity investments remain unchanged, but I'm still contemplating selling some assets to diversify further, but I haven’t pulled the trigger yet.

Still nothing on the private placement front.

I will be buying some more art (bitcoin trading cards) though in the meantime to diversify more and sell my fiat.

We have about ~16% in commodities and physical gold/silver.

Paper (stocks/bonds/IRA/etc.)

Still vetting this strategy and not much has changed here yet, as I was in LA two weeks ago for Pacific Bitcoin and it stalled out some of my due diligence.

From September letter:

May be adding to this bucket here soon for dividends to pay for liability instead of just paying cash for liability and losing that cash forever.

Might buy a bunch of puts so I can gain some cashflow off the premiums and that way I can buy at a lower cost basis.

We have about ~2% in paper.

***Special tip: watch the credit market (bonds) especially the 10 year treasury, to see where the markets are going to go. That tells us where the stock and rest of markets will go.

Cash/Businesses

Huge win this week as the taxes I was going to have to pay were cut by a third when they actually came back in!

Going to be using that cash to deploy a bit in to bitcoin and some of the new bitcoin trading cards lines that we have coming out.

Art for your dirty fiat that just so happens to educate the masses.

Cash on hand is also good in case our long term view of inflation is wrong. If we experience massive deflation, and the dollar increasing in strength (DXY), then we will be able to use the dry powder (cash) to buy many more assets as well.

We have about ~25% in cash.

Remember…

The case for chaos and recession has been laid out above.

I have heard this song and dance before, though.

My advice as to what has helped me sleep well at night is to prepare.

The number one survival skill of any person is building a network.

Build community locally; ranchers, farmers, sheriffs, neighbors, etc..

Get some food and water, some guns and security, and some energy sources.

Be prepared for man made or natural disasters.

You will NOT regret it.

If you never have to use it then great, but if you do then you will be able to assist others instead of being a part of the chaos.

We can all sense bad things are coming down the pike.

Use your iniution as your guide. Your gut instinct in there for reason, don’t ignore it.

Our thoughts are prayers are with those in Israel who were brutally attacked last week and those innocent people on both sides being thrust in to another senseless war.

Stay strong,

Brandon

I am always a student. I am no expert. Freedom advice, not financial advice.

Afterword

My newsletter is based off of 20+ years of historical, political, and monetary study plus my experiences in investing.

I spent the first 10 years studying politics and history.

The last 10 years I have studied monetary, fiscal history and policy, along with investing through what I call our “family office.”

In that time I have 15’xed our net worth through contrarian views and watching what people do, not what they say.

I believe you must know the financial and money games for ANY of the political side to make any sense.

If you like freedom and can’t stand politics and bridges to nowhere, racial polarization, division, hate, looting, and all the moral decay in society than you might just be a bitcoiner.

To fix all these problems we have a solution where you cannot be racketeered by governments anymore through inflation.

“Bitcoin fixes this.”

You don’t need a lot, just a couple percent is a vote for freedom and could change the world forever.

I ONLY want to trade my finite time for finite assets, NOT trade my finite time for infinite pieces of paper/digits on a computer.

MAKE A FAIR TRADE FOR YOURSELF.