(Listen to audio version of me reading👆)

The real political party

I saw the 2008 crash live from my apartment on the campus of MSU and thought to myself, “hmm that’s weird both sides are in on the charade.”

One party started it and the other finished it.

The uni-party was revealed to me at that time.

Then I went down the rabbit hole of learning monetary history and what money was.

The game was revealed and I spent 10 years trying to learn the game and invest in real estate that would hedge the chaos and produce cashflow.

I am not an expert at real estate but I am pretty damn good at it.

Who in the world has the time and ability to do what I did for the past decade or more?

That is what led me to realize the becoming an “expert real estate guru,” stock picker like Buffett, or hoping politicians and the “right guy” were going to get in just wouldn't cut it.

Fortunately, during that very crash where I was awoken to the masses being fleeced by the unproductive class and rent-seekers at the top, someone, in fact, many people had been working on the very solution humanity needed.

Some of those people were; Satoshi Nakamoto, Hal Finney, Nick Szabo, Adam Back, and more.

They had already correctly diagnosed the problem that the money was broken and there needed to be a solution outside the halls of government and in the hands of the people.

The diagnosis

These pioneers realized that the fiat currencies of the Earth have ALL gone to zero.

Yes, ALL OF THEM in history.

So what do we expect to happen with the dollar?

The government steals your time and energy through inflation (currency printing.)

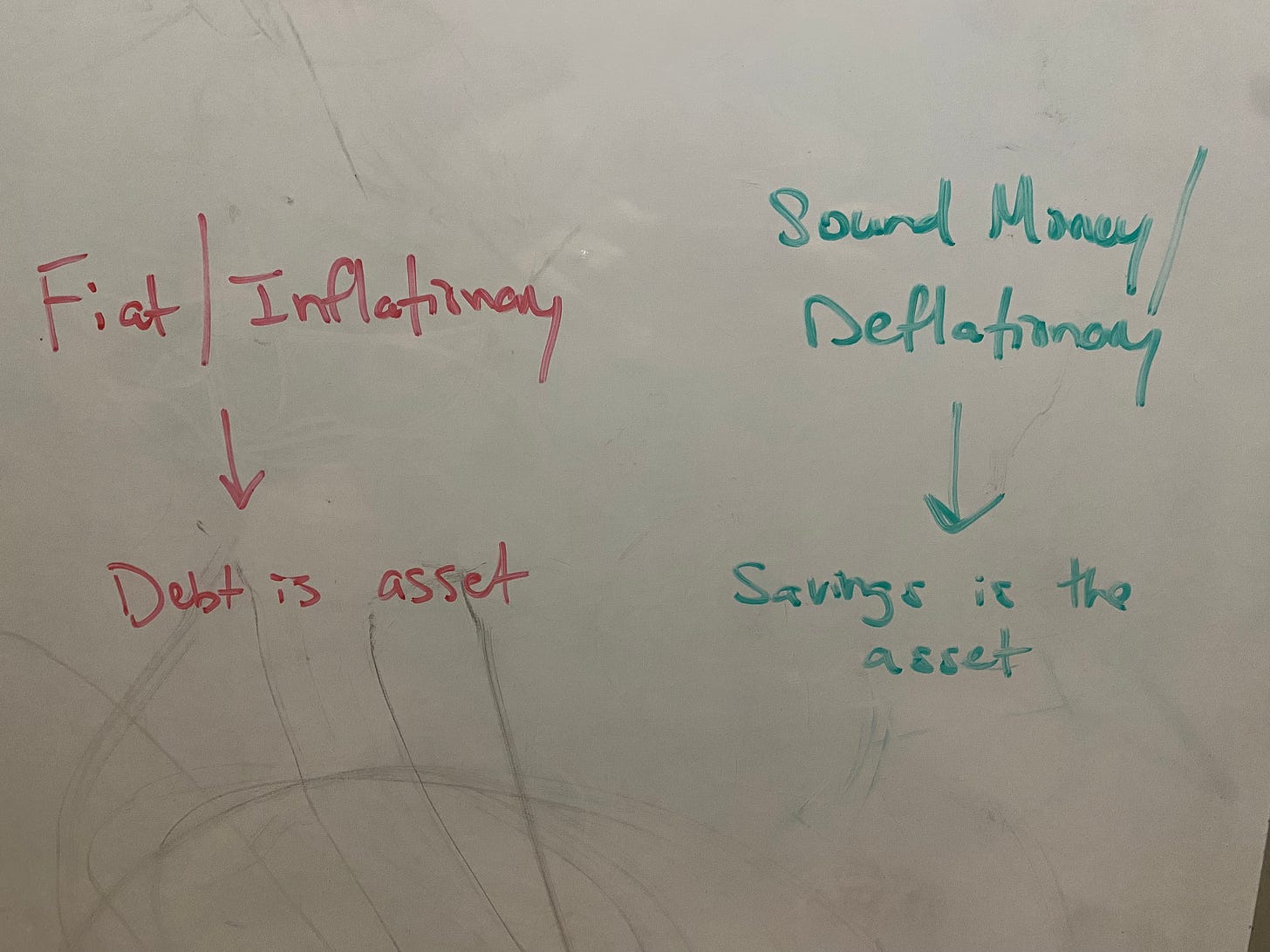

If you live in an inflationary world where fiat currencies rule then you must get in to good debt that produces cashflow to hedge.

Most people were never taught that you need assets to prosper in this world, hence why so few have the wealth they need at retirement.

Heck, you can even make the case that many people in bad debt will win because they are living large and then will have their neighbor pay off their student loans, give them PPP, welfare, Medicaid, medicare, etc..

And as I predicted will have their houses paid off they can’t afford by their neighbors because government will offer them a way out with a central bank digital currency that they won’t have the guts to turn down.

Those saving dollars are falling further behind because they are saving a liability they believe is an asset.

Wrong side of the balance sheet.

With a debt based system to get ahead you must get educated and get in to good debt.

In a sound money/deflationary world then saving capital would make sense and put you ahead.

This is why we advocate for bitcoin here.

Dollars don’t work because they lose value over time.

No one has to become a real estate expert or guru.

No one has to be a stock picker.

No one needs to gamble on crypto and NFTs.

All you need to do is save more than you spend (in bitcoin) and you will outrun all the governments and politician’s printing over the long term.

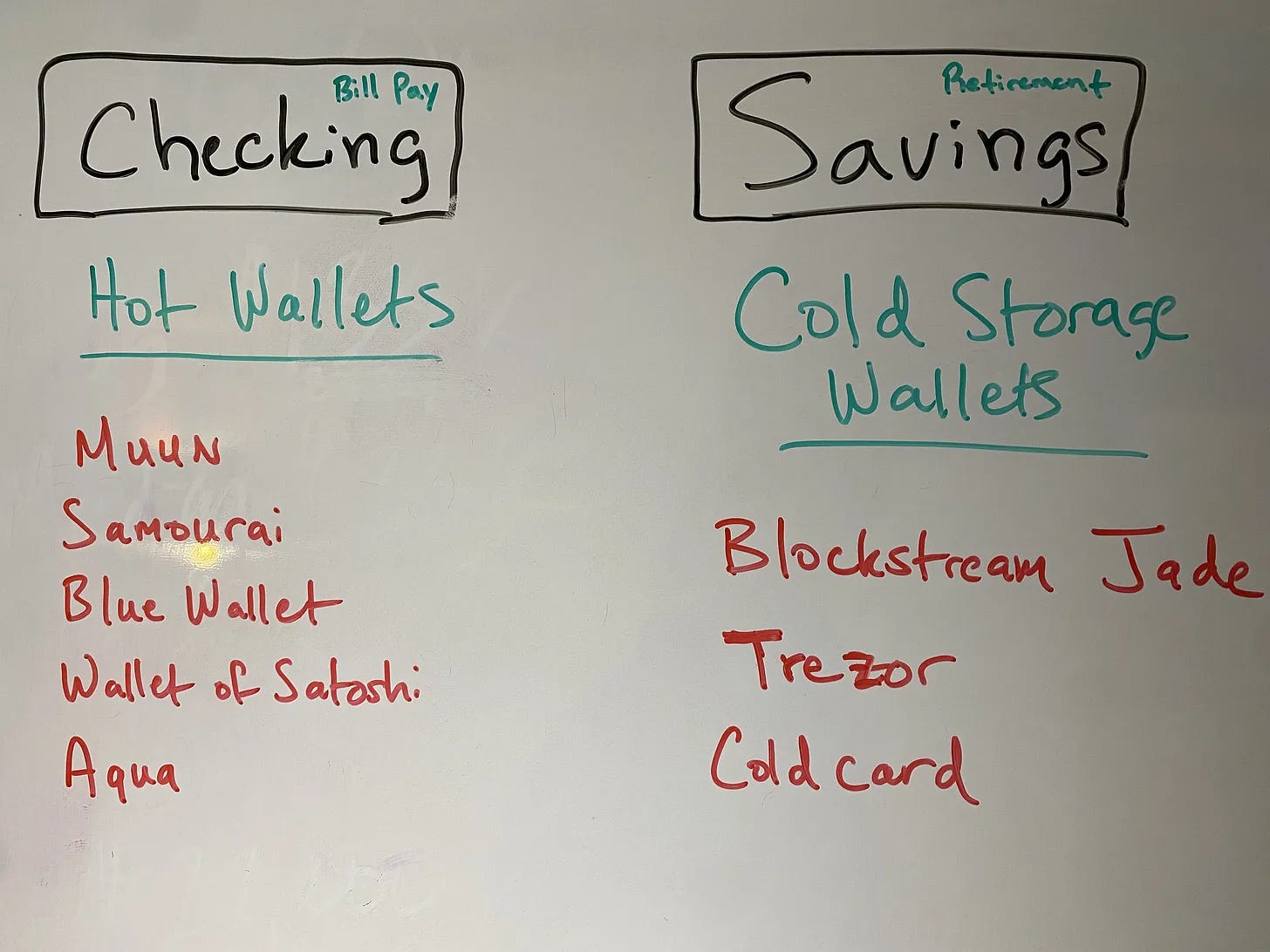

Bitcoin (NOT “crypto”)

The price of bitcoin holding firm in the wake of the banking crisis over the past 2 months.

The real timeframe you should look is 5-10 years minimum. Bitcoin is a savings technology that you can actually save and use what you have been taught your entire life.

Now we actually have the vehicle to do it with; an asset that becomes more valuable over time instead of a liability that gets printed in to oblivion and worth less over time.

Remember this is the alternative and what they are prepared to do to you if you save in the dollar at a bank:

We have about ~34% in bitcoin.

**I expect bitcoin to become majority of my portfolio again in the next few years as it increases in value.**

Real estate (positive cash flowing rental real estate)

Theme throughout our success over last 10 years is patience and more patience.

Moves investing should not be quick and punchy.

I may sell this property, refinance, or do some type of 1031 or seller finance to not trigger a taxable event.

Nothing changed here.

As you can see, this is why I am still debating whether to get rid of the SFR rentals and take my chips off table and get in to the hardest and most pristine collateral with the real estate cash.

I will mainly focus on multifamily apartments and storage in the future because of the economies of scale.

We have about ~32% in rental real estate.

Commodities (gold, silver, oil wells, uranium, copper, wheat, corn, etc..)

Primary assets with no counter party where you control your wealth is never a bad bet plus can provide a lot of cashflow and hedging to protect yourself.

Control is a MASSIVE characteristic smart investors look for in their investments.

Central banks went on gold buying spree last 10 years, which bodes well for holders.

We have about ~16% in commodities and physical gold/silver.

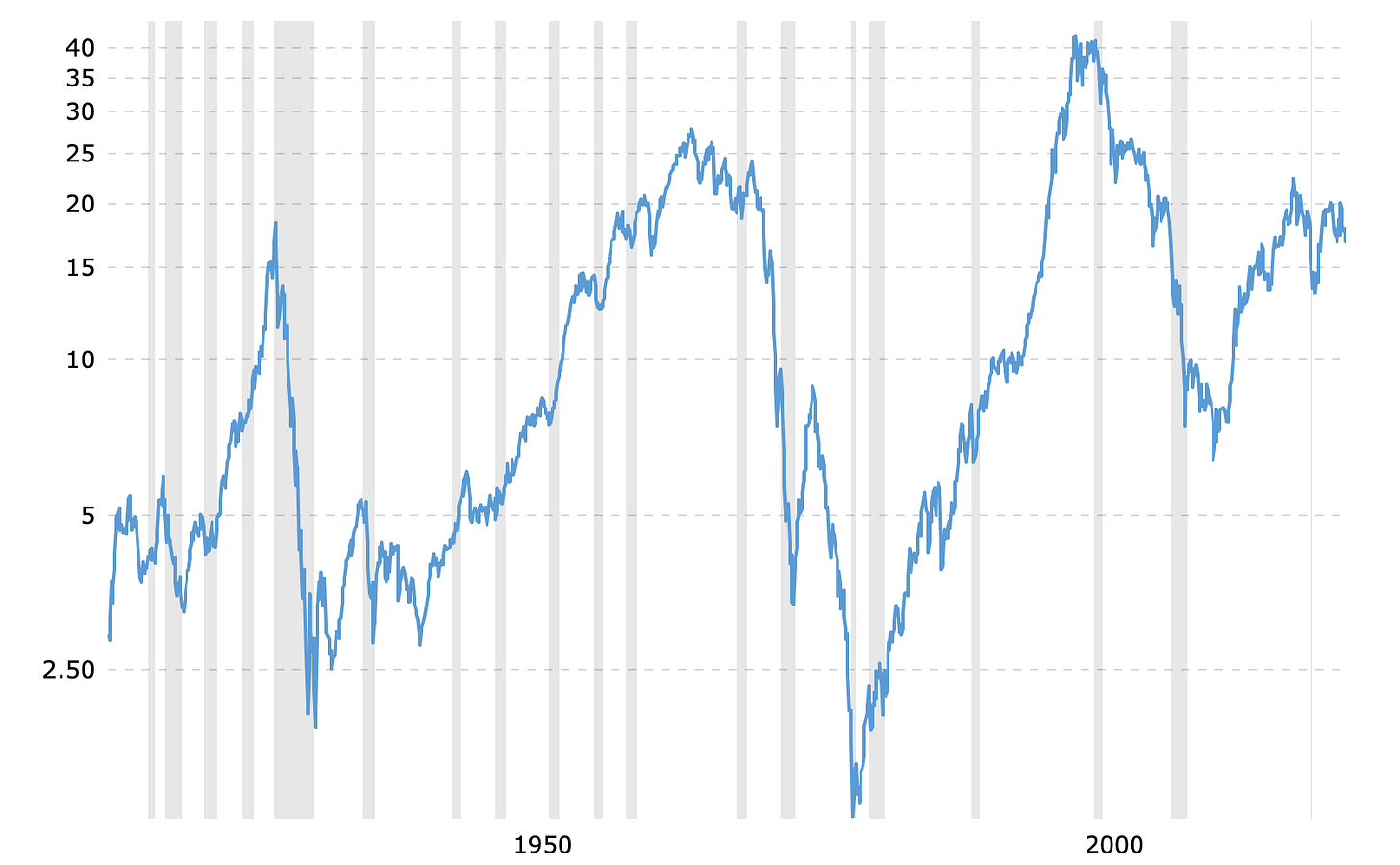

Paper (stocks/bonds/IRA/etc.)

Same as last month…I don’t have much in here and don’t plan to until “phase 2” kicks off once stocks are undervalued.

I like buying when there is blood in the streets. Then you can pick up great rental real estate and dividend value stocks at great prices that throw off great cash flow.

Remember, we make money when we buy.

I also like to buy things I know a lot about (Bitcoin, real estate, gold/silver). I am still studying and learning and taking courses on stocks and selling options etc.. Not ready yet.

Paper and real estate are bound to plunge or have an invisible crash against other assets (see chart below.)

Please see prior couple monthly investment letters to check more on what

”phase 2” means.

We have about ~2% in paper.

***Special tip: watch the credit market (bonds) especially the 10 year treasury, to see where the markets are going to go. That tells us where the stock and rest of markets will go.

Cash/Businesses

Patiently building and growing your education while stacking cash and sats waiting to see what will play out.

I will only be in cash for another 6-9 months or so. I keep buying more bitcoin and dollar cost averaging and may buy a little gold. I want to stay liquid and those assets are perfect as they increase in purchasing power I could trade out for cashflowing assets.

Cash on hand is also good in case our long term view of inflation is wrong. If we experience massive deflation, and the dollar increasing in strength (DXY), then we will be able to use the dry powder (cash) to buy many more assets as well.

Crashes take usually 2-3 years to play out and fully bottom.

We have about ~15% in cash.

Conclusion

What is the point of life if you are not free?

Are you really free?

Can you do what you want when you want?

Do you have the time or money to do it?

Will government let you?

Most people live the illusion they are free.

Step back and assess your situation.

Get prepared and have assets outside the control of another party.

Reliance on government and 3rd parties is killing the individual and freedom.

Bitcoin, gold, silver, guns, ammo, security, water, purification, seeds, skills, food storage, land, and most important building a community of like-minded people.

Stay strong,

Brandon

I am always a student. I am no expert. This is never financial advice, but only what I’m doing and what I see.

Afterword

Freedom advice, not financial advice.

My newsletter is based off of 20+ years of historical, political, and monetary study plus my experiences in investing.

I spent the first 10 years studying politics and history.

The last 10 years I have studied monetary, fiscal history and policy, along with investing through what I call our “family office.”

In that time I have 15’xed our net worth through contrarian views and watching what people do, not what they say.

I always mention to anyone that will listen: you must know the financial and money games for ANY of the political side to make any sense.

**Remember that the dollar is debt. Real estate like bonds over last 40 years has become more expensive and produces less yield if you don’t buy properly.**

If you like freedom and can’t stand politics and bridges to nowhere, racial polarization, division, hate, looting, and all the moral decay in society than you might just be a bitcoiner.

To fix all these problems we have a solution where you cannot be racketeered by governments anymore through inflation.

“Bitcoin fixes this.”

You don’t need a lot, just a couple percent is a vote for freedom and could change the world forever.

I ONLY want to trade my finite time for finite assets, NOT trade my finite time for infinite pieces of paper/digits on a compute.

MAKE AN EQUAL TRADE FOR YOURSELF.