(Listen to audio version of me reading👆)

Band-Aids on bullet holes…

When I was a senior at Michigan State, our hockey team was not having a great year. We were two years removed from winning the national championship and yet we struggled to get to 10 wins for the entire season.

Now in our defense we had a lot of injuries and incoming freshman. We had many players on the club team up to help us out and one of my good friends, Kurt, literally played every position except goalie that year…

So you can see that it might cause for some adversity during that season.

One of the highlights of that year was we are in the upper peninsula playing at Lake Superior State and we had not played well and our coach called a team meeting and banned everyone from drinking alcohol the rest of the year. His heart was in the right place because he was a very experienced coach, and knew a thing or two. However, when you’re desperate, you sometimes do things that don’t always make the most sense. It was certainly a form of putting a Band-Aid on a bullet hole. Instead of getting to the root issues, we were slapping Band-Aids on the surface.

Much like the government we have today, focusing on the wrong issues and talking about canceling debts or printing more currency to bail out citizens or companies, instead of getting to the root core issue of why we have inflation and rising prices in the first place which is the very currency printing they keep speeding up.

As you can see, the problems will continue to faster and grow until the core issues are rooted out from within.

Things haven’t changed much from past month. Consistency and patience.

Bitcoin

Price has held very stable over the past month of turbulence in the bond market and another garbage crypto bank, Silvergate, failing.

Bitcoin is NOT crypto and crypto is NOT Bitcoin.

The least interesting aspect of bitcoin is price.

What are you going to do when the government comes to seize your money in your bank account or your other assets?

Remember this is the alternative and what they are prepared to do to you if you save in the dollar or any other fiat:

Between citadels being talked about in the presidential race already add small modular reactors in the nuclear world, which will be priced in bitcoin. There is a bright orange future ahead.

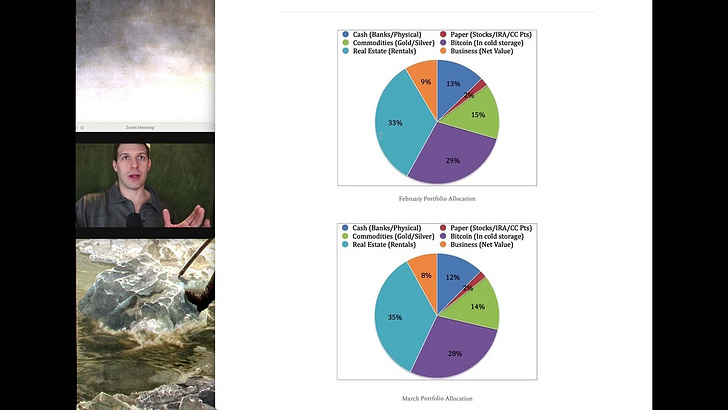

We have about ~28% in bitcoin.

**I expect bitcoin to become majority of my portfolio again in the next few years as it increases in value.**

Real estate (positive cash flowing rental real estate)

Last refinance still waiting on tenant situation and move out to get new rental rate as it was too low for market.

Still debating whether to get rid of them all and take my chips off table and get in to bitcoin with the real estate cash.

Real estate like bonds over last 40 years has become more expensive and produces less yield.

We bought these at good prices fortunately.

We have about ~35% in rental real estate.

**Remember that the dollar is debt. There’s nothing backing it so the further you can get into good debt and buy appreciating assets you will win long-term as government continues devaluing the dollar. (ie. Refinancing real estate and pulling cash out tax-free to invest in other assets will be the people who win long-term. Savers get crushed by inflation and minuscule interest savings rates.)**

Commodities (gold, silver, oil wells, uranium, copper, wheat, corn, etc..)

Primary assets and assets with no counter party are always a good option and safe bet.

This world we are entering with a transitioning global reserve currency, governments to hate their citizens and freedoms slipping away will lend kindly to those holding their own assets.

We have about ~14% in commodities and physical gold/silver

Paper (stocks/bonds/IRA/etc.)

I don’t have much in here and don’t plan to until “phase 2” kicks off once stocks are undervalued.

I like buying when there is blood in the streets an paper an real estate are bound to plunge or have an invisible crash against other assets (see chart below.)

Please see prior couple monthly investment letters to check more on what

”phase 2” means.

When the Fed pivots though, look out for those risk assets like tech stocks (nasdaq), they will go to the moon IMO.

We have about ~2% in paper

Cash/Businesses

Sitting on dry powder is SO important right now and I have been patiently building and waiting in the background and growing my education in the mean time.

Cash on hand is also good in case our long term view of inflation is wrong. If we experience massive deflation, and the dollar increasing in strength (DXY), then we will be able to use the dry powder (cash) to buy many more assets as well.

I expect this opportunity to sit in cash to last only another 6-12 months or so.

We have about ~20% is in cash

Conclusion

Fed Chair Powell just came out this week and spooked markets saying that inflation data was still hot and labor market was tight so expect even more rate hikes.

Markets did not like that.

Depending on your age will tell you where to invest but if you like freedom and can’t stand politics and bridges to nowhere, racial polarization, division, hate, looting, and all the moral decay in society than you might just be a bitcoiner.

To fix all these problems we have a solution where you cannot be racketeered by governments anymore through inflation.

“Bitcoin fixes this.”

You don’t need a lot, just a couple percent is a vote for freedom and could change the world forever.

I ONLY want to trade my finite time for finite assets.

Not trade my finite time for infinite pieces of paper/digits on a computer.

MAKE AN EQUAL TRADE FOR YOURSELF.

Stay strong,

Brandon

I am always a student. I am no expert. This is never financial advice, but only what I’m doing and what I see.

Freedom advice, not financial advice.

My newsletter is based off of 20+ years of historical, political, and monetary study plus my experiences in investing.

I spent the first 10 years studying politics and history.

The last 10 years I have studied monetary, fiscal history and policy, along with investing through what I call our “family office.”

I always mention to anyone that will listen: you must know the financial and money games for ANY of the political side to make any sense.

***Special tip: watch the credit market (bonds) especially the 10 year treasury, to see where the markets are going to go. That tells us where the stock and rest of markets will go.