(Listen to audio version of me reading👆)

There are many sayings that I learned as a kid growing up playing hockey from the coaches that I had.

One of my favorites that took me years to figure out was, “don’t think, it weakens the team.”

Another classic was, “it’s not the tools, it’s the carpenter.”

Both came from the same AAA coach I had at Little Caesars, Craig Roehl.

He brought me into AAA hockey and opened up a whole new world of opportunity for me and set the stage for my life as a professional hockey player.

It took me years to figure out that “thinking” instead of using your “intuition” would not only hold you back as an athlete, but as a human being.

And when he said, “it’s the tools, not the carpenter,” he meant that life’s not about what happens to you, but rather how you react to it that makes a difference.

Everything happens to everyone but not everyone responds the same way.

What are you going to do with your life that sets you apart?

I look at us the same way with investing and preparing ourselves for the unknown in the future.

Have hope for the best, but prepare for the worst, that way you have both sides covered.

This is precisely why I preach taking care of the bottom of Maslow’s hierarchy of needs, and when you have those first couple levels taken care of, you become more independent and more resilient and can take on anything.

Then investing becomes fun.

Our portfolio has gone up about 15x in the last decade because we take an approach that focuses on owning and controlling our assets so they are as much in our control as possible.

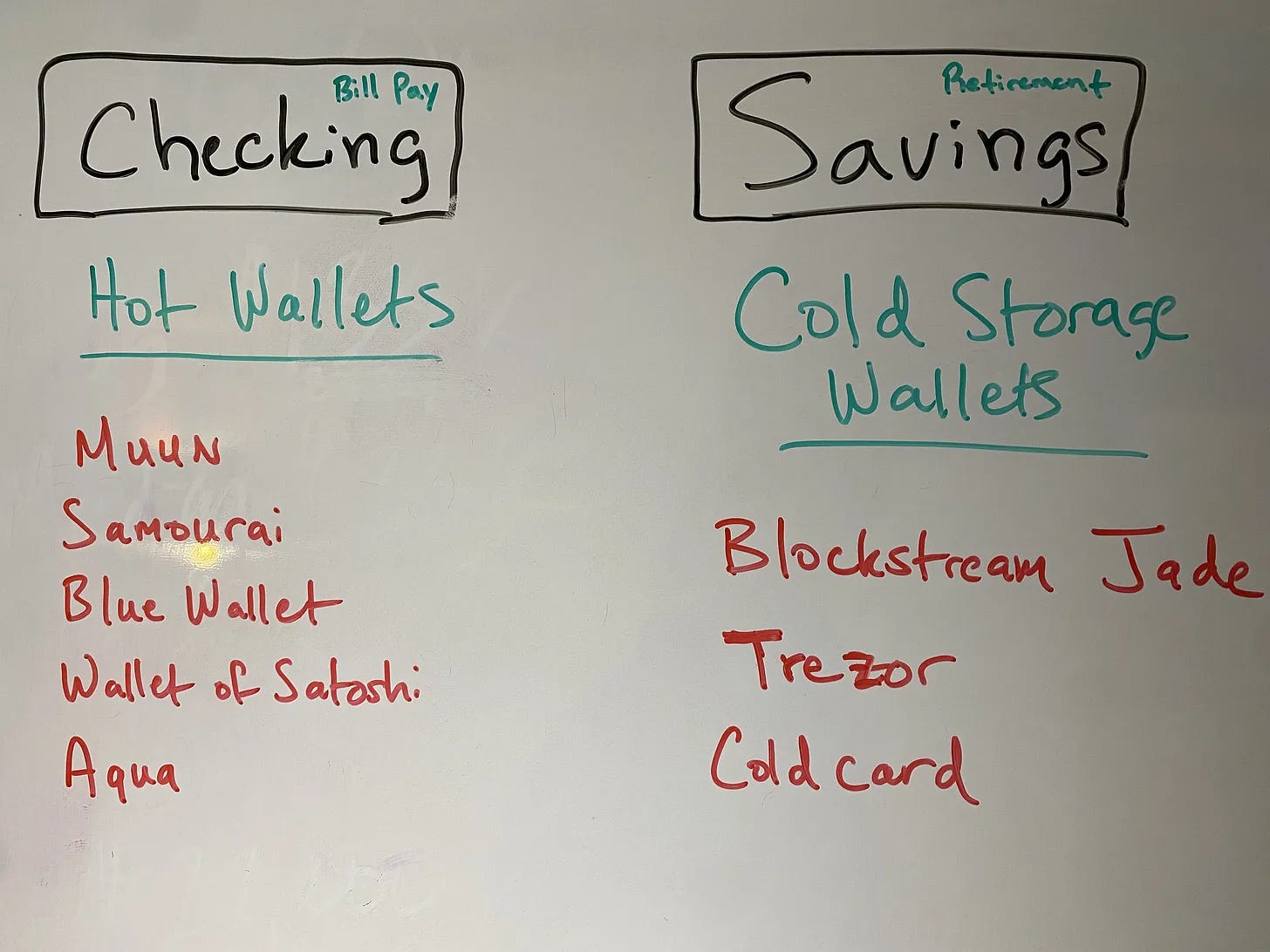

Bitcoin (NOT “crypto”)

Bitcoin holding up well right around 4,000 satoshis/dollar.

The banking collapses, the rate hikes, plus the SEC suing and going after scam coins and exchanges bodes well for clearing up the confusion that crypto is trash and there is only bitcoin.

BlackRock is getting in to bitcoin among other massive entities all the while the governments attack the crypto, exchanges, and stable coins. It is a beautiful thing to see.

The peaceful revolution of people sick of governments destroying their wealth, their time, their vote, their voice is here and the war is being waged.

Every person educating and fighting for freedom and bitcoin is on the side of peace and liberty and speeding up the change of our system.

Remember this is the alternative and what they are prepared to do to you if you save in the dollar at a bank:

We have about ~31% in bitcoin.

**I expect bitcoin to become majority of my portfolio again in the next few years as it increases in value.**

Real estate (positive cash flowing rental real estate)

Finally got our Redford single family rental cleaned and its been a challenge because of all the life challenges going on so things haven’t progressed as fast as I would have liked.

Looking forward to selling here and placing this capital in bitcoin.

https://twitter.com/alphaazeta/status/1668643899097636864?s=20

Great twitter thread from someone much smarter than me on why bitcoin is better than physical real estate.

I will mainly focus on investing in multifamily apartments and storage in the future because of the economies of scale and hopefully I will be able to collect bitcoin from those residents.

We have about ~34% in rental real estate.

Commodities (gold, silver, oil wells, uranium, copper, wheat, corn, etc..)

Primary assets with no counter party where you control your wealth is never a bad bet plus can provide a lot of cashflow and hedging to protect yourself.

Control is a MASSIVE characteristic smart investors look for in their investments.

Central banks still on gold buying spree which started 10 years ago, which bodes well for holders of the metals.

We have about ~16% in commodities and physical gold/silver.

Paper (stocks/bonds/IRA/etc.)

Same as last month…I don’t have much in here and don’t plan to until “phase 2” kicks off once stocks are undervalued.

I like buying when there is blood in the streets. Then you can pick up great rental real estate and dividend value stocks at great prices that throw off great cash flow.

Remember, we make money when we buy.

I also like to buy things I know a lot about (Bitcoin, real estate, gold/silver). I am still studying and learning and taking courses on stocks and selling options etc.. Not ready yet.

Paper and real estate are bound to plunge or have an invisible crash against other assets (see chart below.)

Please see prior couple monthly investment letters to check more on what

”phase 2” means.

We have about ~2% in paper.

***Special tip: watch the credit market (bonds) especially the 10 year treasury, to see where the markets are going to go. That tells us where the stock and rest of markets will go.

Cash/Businesses

Patiently building and growing your education while stacking cash and sats waiting to see what will play out.

I will only be in cash for another 6-9 months or so. I keep buying more bitcoin and dollar cost averaging and may buy a little gold. I want to stay liquid and those assets are perfect as they increase in purchasing power I could trade out for cashflowing assets.

Cash on hand is also good in case our long term view of inflation is wrong. If we experience massive deflation, and the dollar increasing in strength (DXY), then we will be able to use the dry powder (cash) to buy many more assets as well.

Crashes take usually 2-3 years to play out and fully bottom but don’t plan on things working out like you think they will.

We have about ~17% in cash.

Remember…

I want us all to remember that if we can become independent and resilient, the less we need our overlords and the easier we sleep at night.

This means more prosperity, more liberty, higher standard of living and lower costs.

The Fed is going to continue to be behind the curve and struggle to do either of their mandates, which is keeping a steady employment and inflation low/stable prices.

This is the “publicly stated” goal, their real goal is enriching the owners of their bank.

The “Creature From Jekyll Island,” written by G. Edward Griffin lays this out in complete and fascinating detail.

Once you understand this, the whole world opens up to you and you can make better decisions for you and your family and become a wealthier and more free human being.

Stay strong,

Brandon

I am always a student. I am no expert. This is never financial advice, but only what I’m doing and what I see.

Afterword

Freedom advice, not financial advice.

My newsletter is based off of 20+ years of historical, political, and monetary study plus my experiences in investing.

I spent the first 10 years studying politics and history.

The last 10 years I have studied monetary, fiscal history and policy, along with investing through what I call our “family office.”

In that time I have 15’xed our net worth through contrarian views and watching what people do, not what they say.

I always mention to anyone that will listen: you must know the financial and money games for ANY of the political side to make any sense.

**Remember that the dollar is debt. Real estate like bonds over last 40 years has become more expensive and produces less yield if you don’t buy properly.**

If you like freedom and can’t stand politics and bridges to nowhere, racial polarization, division, hate, looting, and all the moral decay in society than you might just be a bitcoiner.

To fix all these problems we have a solution where you cannot be racketeered by governments anymore through inflation.

“Bitcoin fixes this.”

You don’t need a lot, just a couple percent is a vote for freedom and could change the world forever.

I ONLY want to trade my finite time for finite assets, NOT trade my finite time for infinite pieces of paper/digits on a compute.

MAKE AN EQUAL TRADE FOR YOURSELF.