(Listen to audio version of me reading👆)

Our little ones were in the pew the other day at mass and when we put some dollars in the offering basket the two oldest girls (almost 7 & 5) looked up and said, “those are fake dollars.”

I was like, “shhhhhh, you cannot say that out loud right now because most people don’t understand that or believe that.”

They have done this 3 weeks in a row.

Other than not listening to me…they asked why.

I told them that life is complicated and not everyone is taught the same way or has access to the same information.

They must trust but also verify what they are learning.

This blew my mind apart in 2010 after the financial crisis and seeing the uni-party unveiled to me.

A wake up call that I knew I needed to figure out the game of money and how we were all being played.

Simply put, the money is backed by nothing, making it currency, and making it easy to inflate away and slowly steal all your wealth (time and energy.)

This allows people in positions of power to control the masses with endless fear campaigns and propaganda while keeping most poor so they are helpless and subjected to this endless torture.

I have invested and educated myself on the ways around this.

My channels: video and blogs are based all around this simple fact.

Freedom isn’t easy to take or to keep. It requires citizens who are plugged in and care about their children’s future.

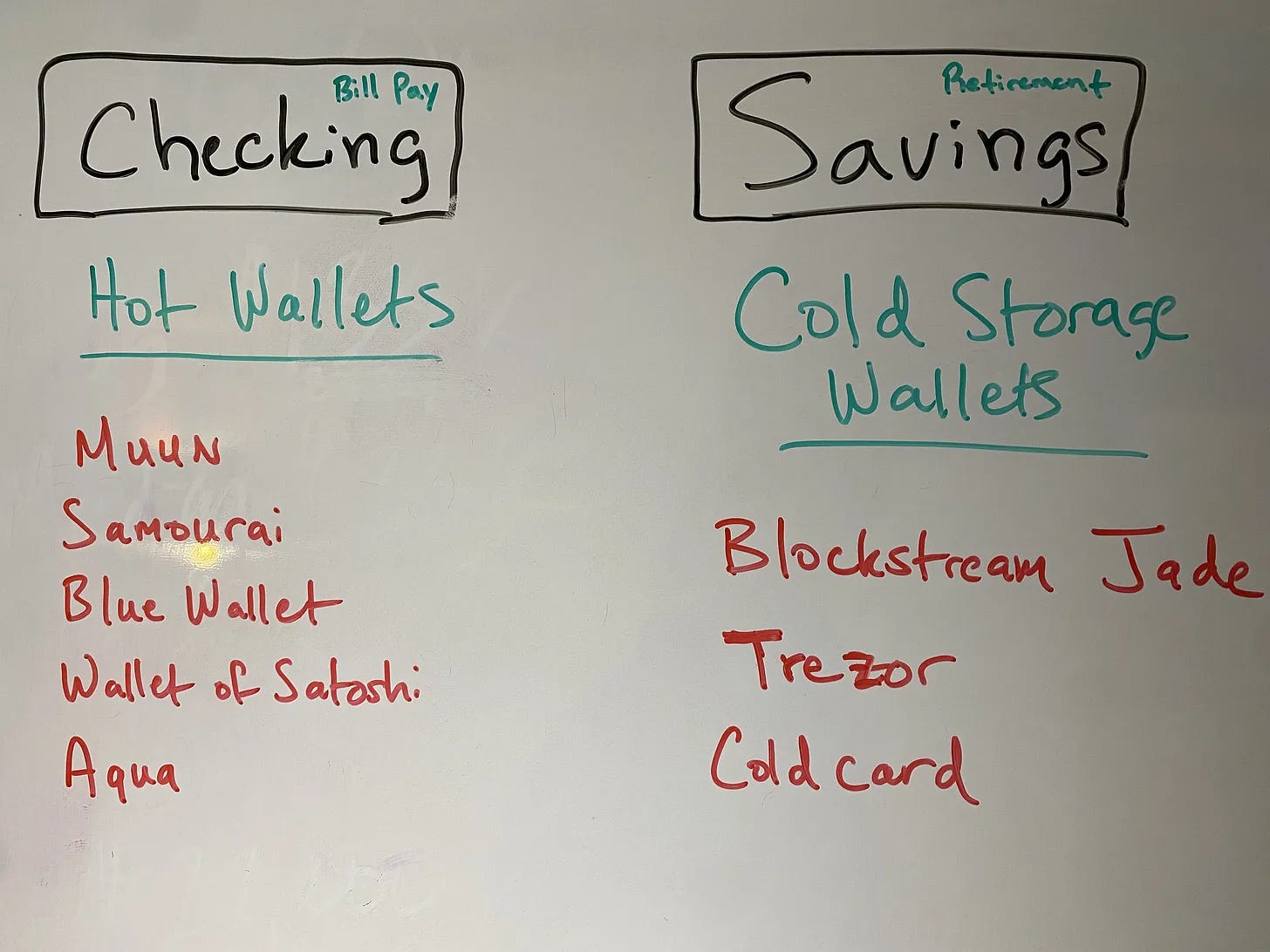

Here is how are “freedom portfolio” if currently looking.

(In the future I will be adding in a section regarding the art, guns, ammo and other assets I own to give you a better sense of what is actually happening.)

Bitcoin (NOT “crypto”)

Bitcoin up 80%+ this year.

I cannot stand talking about price of bitcoin but most people do and I get a lot of heat from people when price goes down.

So I have to mention when it is ripping higher.

Governments of the world are planning on you not being aware and being unprepared for the monetary transition coming.

Prepare early and often. Dollar cost averaging your savings just like you would normally save.

Except this time in the hardest asset known to man, not depreciating dollars.

DCA or dollar cost averaging just means buying a certain preset amount each week regardless of what is going on.

We have about ~36% in bitcoin.

**I expect bitcoin to become majority of my portfolio again in the next few years as it increases in value.**

Real estate (positive cash flowing rental real estate)

We had a few offers coming in our Redford property. Accepted one and still continuing to show it because it is an investor so we will see what happens here.

Much of these funds will be put in to digital real estate: bitcoin.

The other handful of properties have been pretty reliable but there are still things to come up from time to time. Certainly a LONG term play in real estate.

Look forward to when we can provide apartment housing that is beautiful and get paid in bitcoin.

We have about ~31% in rental real estate.

Commodities (gold, silver, oil wells, uranium, copper, wheat, corn, etc..)

No change here. Primary assets with no counter party where you control your wealth is never a bad bet plus can provide a lot of cashflow and hedging to protect yourself.

Control is a MASSIVE characteristic smart investors look for in their investments.

Central banks still on gold buying spree which started 10 years ago, which bodes well for holders of the metals.

We have about ~15% in commodities and physical gold/silver.

Paper (stocks/bonds/IRA/etc.)

Same as last month…I don’t have much in here and don’t plan to until “phase 2” kicks off once stocks are undervalued.

I like buying when there is blood in the streets. Then you can pick up great rental real estate and dividend value stocks at great prices that throw off great cash flow.

Remember, we make money when we buy. This goes for ALL asset classes.

I also like to buy things I know a lot about (Bitcoin, real estate, gold/silver). I am still studying and learning and taking courses on stocks and selling options etc.. Not ready yet.

Paper and real estate are bound to plunge or have an invisible crash against other assets (see chart below.)

Please see prior couple monthly investment letters to check more on what

”phase 2” means.

We have about ~3% in paper.

***Special tip: watch the credit market (bonds) especially the 10 year treasury, to see where the markets are going to go. That tells us where the stock and rest of markets will go.

Cash/Businesses

Will sit on portion of cash from house Redford house sale, put most in bitcoin after securing more art/bitcoin trading cards as well.

More on this strategy and what is going on here in the future.

Might interest you as to my thoughts here and what is happening…

Diversify in assets that will span time.

Remember bitcoin holders get wealthier over time, so they will be able to purchase things and transfer from the rest of society.

Cash on hand is also good in case our long term view of inflation is wrong. If we experience massive deflation, and the dollar increasing in strength (DXY), then we will be able to use the dry powder (cash) to buy many more assets as well.

Crashes take usually 2-3 years to play out and fully bottom but don’t plan on things working out like you think they will.

We have about ~15% in cash.

Remember…

We have spent much of our time the past decade + talking about preparation and getting ourselves ready for the time that is coming where governments have their hands in every facet of your life.

The government is rolling out the FedNow which is the digital infrastructure for the CBDC (central bank digital currency) we have been warning about for years.

Nothing in the system will shield you from this like bitcoin and a little bit of gold/silver.

Anything paper or denominated in paper can be shut off if someone in government doesn’t like what you are doing or saying.

30 years ago did you think America would look like what it does today?

Imagine what it will look like in 10 more years…

Prepare accordingly.

Stay strong,

Brandon

I am always a student. I am no expert. This is never financial advice, but only what I’m doing and what I see.

Afterword

Freedom advice, not financial advice.

My newsletter is based off of 20+ years of historical, political, and monetary study plus my experiences in investing.

I spent the first 10 years studying politics and history.

The last 10 years I have studied monetary, fiscal history and policy, along with investing through what I call our “family office.”

In that time I have 15’xed our net worth through contrarian views and watching what people do, not what they say.

I always mention to anyone that will listen: you must know the financial and money games for ANY of the political side to make any sense.

**Remember that the dollar is debt. Real estate like bonds over last 40 years has become more expensive and produces less yield if you don’t buy properly.**

If you like freedom and can’t stand politics and bridges to nowhere, racial polarization, division, hate, looting, and all the moral decay in society than you might just be a bitcoiner.

To fix all these problems we have a solution where you cannot be racketeered by governments anymore through inflation.

“Bitcoin fixes this.”

You don’t need a lot, just a couple percent is a vote for freedom and could change the world forever.

I ONLY want to trade my finite time for finite assets, NOT trade my finite time for infinite pieces of paper/digits on a compute.

MAKE AN EQUAL TRADE FOR YOURSELF.