(Listen to audio version of me reading👆)

Why I changed my whole life…

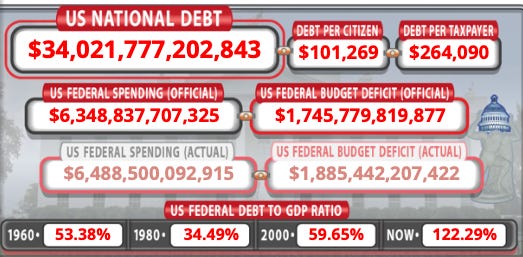

When the 2008-2009 crisis hit I was a senior in Michigan State, it puzzled me that the party that was supposed to be against the bailouts was the one initiating bailouts of “too big to fail companies.”

This decision created a moral hazard from the likes of which we will take decades to recover from. This gave the green-light for a companies and the banking system to do whatever they want and make any gamble they wish and produce less than superior products and services and get away with it because they knew they would be bailed out by the taxpayer.

The “fiscally conservative party” at that time initiated those bailouts, and the other party came in and sealed the deal and finalized it.

This is when I realized that there was no red versus blue, it is the state versus you. There is a party and one big club and you and I aren’t in it as George Carlin once famously said.

This blew my mind open, and the subsequent ramming of Obamacare down our throats, and then the architects of it admitting within the next year that they had to lie to the people and that Americans were too stupid to figure it out only cemented my prior suspicions.

You add in the fact that the Speaker of the House at the time said we needed to “pass the bills in order to see what was in them.” and as a young 20-something I couldn’t figure out why the majority of adults were totally fine with being completely lied to by their leaders?

This is why I started down the path of investing in my time, my skills and understanding of business, and what money truly was. What is the definition of money? What does it mean?

I’ve been blessed over the last 15 years to have found many great mentors, and forge my own path, which is allowed me to be very independent from mainstream thinking, and mainstream culture.

We have done quite well and positioned ourselves for the coming turmoil that will assuredly be on our doorstep soon, before it gets better.

Buckle up, because election season is just beginning and our job is to prepare the boat for the storms ahead.

Or maybe prepare the lifeboat for the storms ahead…

Here is my allocation last 4 months:

Bitcoin (NOT “crypto”)

Bitcoin continues to eat up more of our portfolio. The ETF approvals are all but imminent in the coming days. They will come at some point regardless.

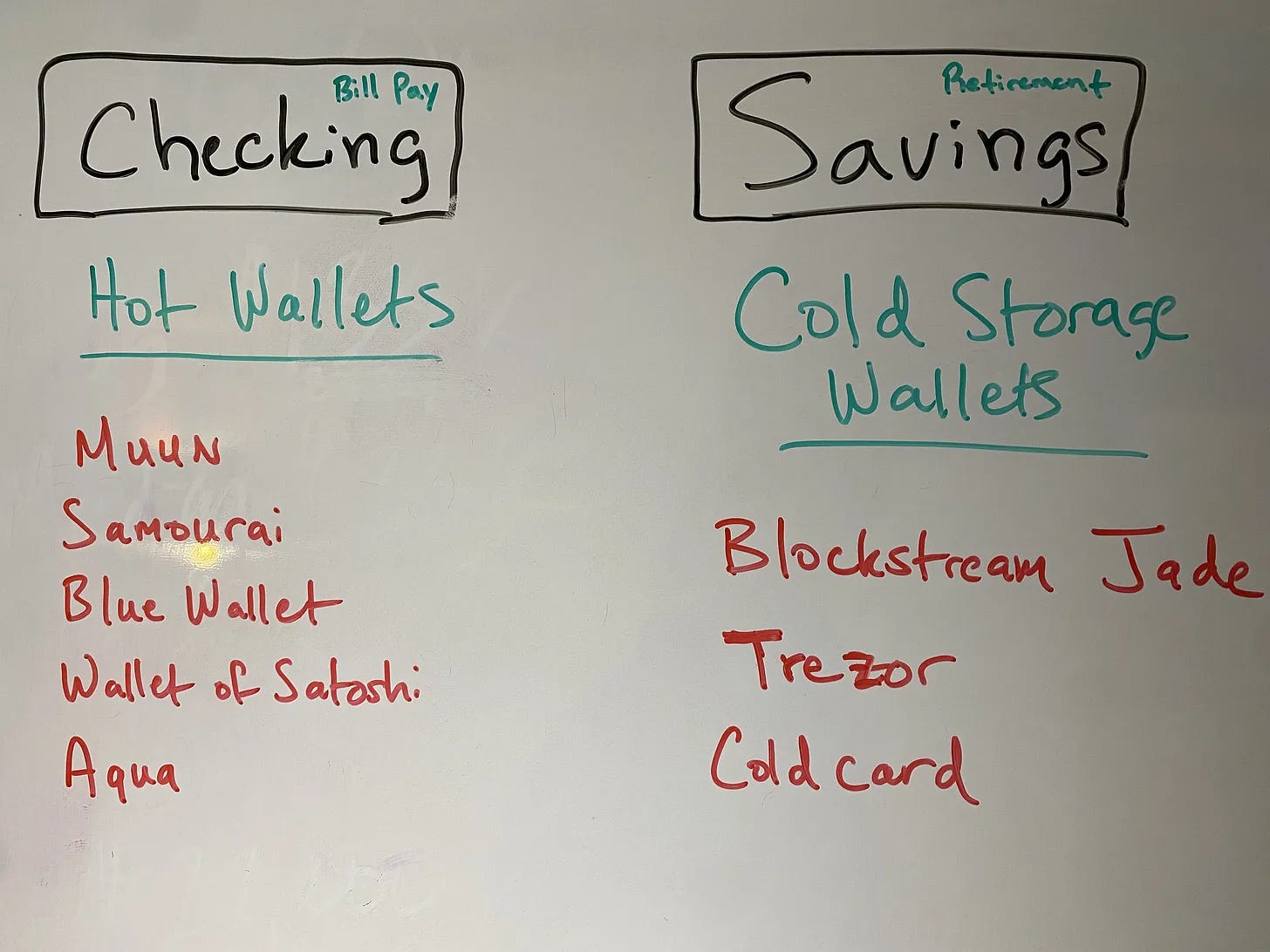

Remember that ETFs are paper bitcoin, and the real bitcoin that gives you sovereignty is the bitcoin that you store in your cold storage wallet.

See here for the easy steps, and how to do this.

Bitcoin removes power from the state in places it back in the hands the people hence why I have moved over the years from the dollar, to gold/silver, and then to bitcoin as my education increased.

We have about ~51% in bitcoin.

**I expect bitcoin to become majority of my portfolio again in the next few years as fiat decreases in value.**

Real estate (positive cash flowing rental real estate)

Still dealing with some tenant issues here and there on our rental properties and renewing leases etc..

Still trying to rent one of them out after we renovated the property after it was damaged by a tenant.

Also fixing roofing issues on another one.

We will see if the income that the rentals provide exceeded the rate at which property taxes and maintenance increase in the coming years.

Will be keeping a close eye on this.

We have about ~16% in rental real estate.

**Remember that the dollar is debt. Real estate like bonds over last 40 years has become more expensive and produces less yield if you don’t buy properly.**

Commodities (gold, silver, oil wells, uranium, copper, wheat, corn, etc..)

Nothing has changed here and still thinking about what to do with this asset class as time moves forward.

Will keep you updated here if I decide to do anything explicitly.

We are most likely coming in to a commodity super-cycle where real tangible assets will do well over the coming decades. However these markets can be manipulated very easily because of the legacy families that own much of this.

We have about ~13% in commodities and physical gold/silver.

Paper (stocks/bonds/IRA/etc.)

Bonds have fallen steadily over the last couple months, which is pure insanity for the “safe haven asset” that is supposed to be stable. Bonds have climbed back up slightly in the past fe days, and we have seen upticks in the price of bitcoin once again and other hard assets because of another flight out of bonds.

I hold NO bonds as I believe they are immoral as I have outlined before

I have almost tripled my wife’s IRA over last two years after starting to actively manage it. I don’t want to pull it out early obviously because I don’t want to be penalized and taxed. Made bitcoin bets in the portfolio that have done very well.

I am adhering to the "invest in what you know" principle and have deliberately not touched this at all as you have seen in recent quarters.

We have about ~3% in paper.

***Special tip: watch the credit market (bonds) especially the 10 year treasury, to see where the markets are going to go. That tells us where the stock and rest of markets will go.

Cash/Businesses

Might be investing in the coming months year into Bitcoin Trading Cards as I take more of an active role in the head of marketing. I love that side of the business and the art and education is truly one of my passions and the children’s books that I have written will be another product offering we will provide through this company moving forward. We have massive goals in 2024 and some huge collaborations with people you may know as well!

Still have a decent chunk in cash to be nimble in case disaster in the markets strike or just locally so we can survive a few months.

Cash on hand is also good in case our long term view of inflation is wrong. If we experience massive deflation, and the dollar increasing in strength (DXY), then we will be able to use the dry powder (cash) to buy many more assets as well.

We have about ~17% in cash.

Remember

At the end of the day with all the turmoil and all the job losses over the last year and a half with assuredly more to come the most important thing you can do is to build community.

Build a group of people in real life around you like friends and family and your local rancher farmer and sheriff as they are great tools we have in our belt in order to weather any storm ahead.

Other than that, I have spent years accumulating different hard assets like weapons and security and food storage and other monetary assets that are outside the system and only under my control.

I do not want to be left at the behest of a system that has broken the social contract with me, my family and society.

I will not put my life and my family’s safety in the hands of a government hellbent on using every last bit of my freedom and wealth, to uphold its own power.

Fool me once, shame on you. Fool me twice, shame on me.

Stay strong,

Brandon

I am always a student. I am no expert. Freedom advice, not financial advice.

Afterword

My newsletter is based off of 20+ years of historical, political, and monetary study plus my experiences in investing.

I spent the first 10 years studying politics and history.

The last 10 years I have studied monetary, fiscal history and policy, along with investing through what I call our “family office.”

In that time I have 15’xed our net worth through contrarian views and watching what people do, not what they say.

I believe you must know the financial and money games for ANY of the political side to make any sense.

If you like freedom and can’t stand politics and bridges to nowhere, racial polarization, division, hate, looting, and all the moral decay in society than you might just be a bitcoiner.

To fix all these problems we have a solution where you cannot be racketeered by governments anymore through inflation.

“Bitcoin fixes this.”

You don’t need a lot, just a couple percent is a vote for freedom and could change the world forever.

Study bitcoin. Invest in what you know.

I ONLY want to trade my finite time for finite assets, NOT trade my finite time for infinite pieces of paper/digits on a computer.

MAKE A FAIR TRADE FOR YOURSELF.