(Listen to audio version of me reading👆)

Quick little bounce in the market presumably because people are buying back in to the market after the TLH (tax-loss harvesting) end of the year.

Maybe it lasts but I wouldn’t hold my breath.

The likes of Dr. Jeff Ross, Lyn Alden, Mark Moss, and every other macro investor believes there will be a solid recession or worse, most likely end of first half or sometime in the 2nd half of 2023.

This is why we continually prepare for what is ahead here.

Trust, don’t verify.

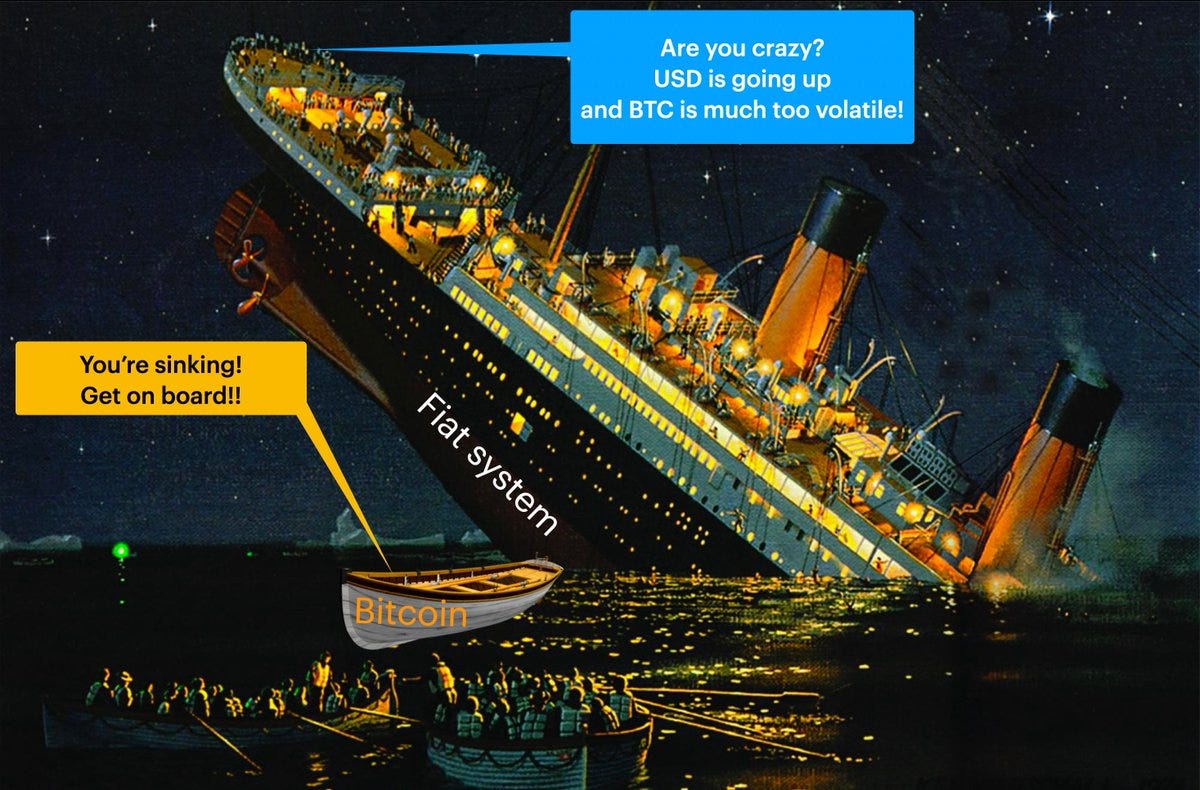

The charade cannot go forever.

Legacy finical system is slowly slipping under the waves.

Just because you don’t believe it doesn’t mean it is not happening.

Look on the street corners, the protests around the world, IRS coming after $600 in your account but has no budget and can’t even audit trillions from the Pentagon.

These are all the red flags for anyone paying attention.

Things are fine, until they aren’t.

We are so reliant on centralized structures and logistics that we will learn hard lessons if we aren’t prepared.

If we do heed the warnings then the chaos can be mitigated to a degree.

I am always a student. I am no expert. This is never financial advice, but only what I’m doing and what I see.

Bitcoin

Bitcoin, NOT crypto. Crypto is garbage. There is ONLY bitcoin.

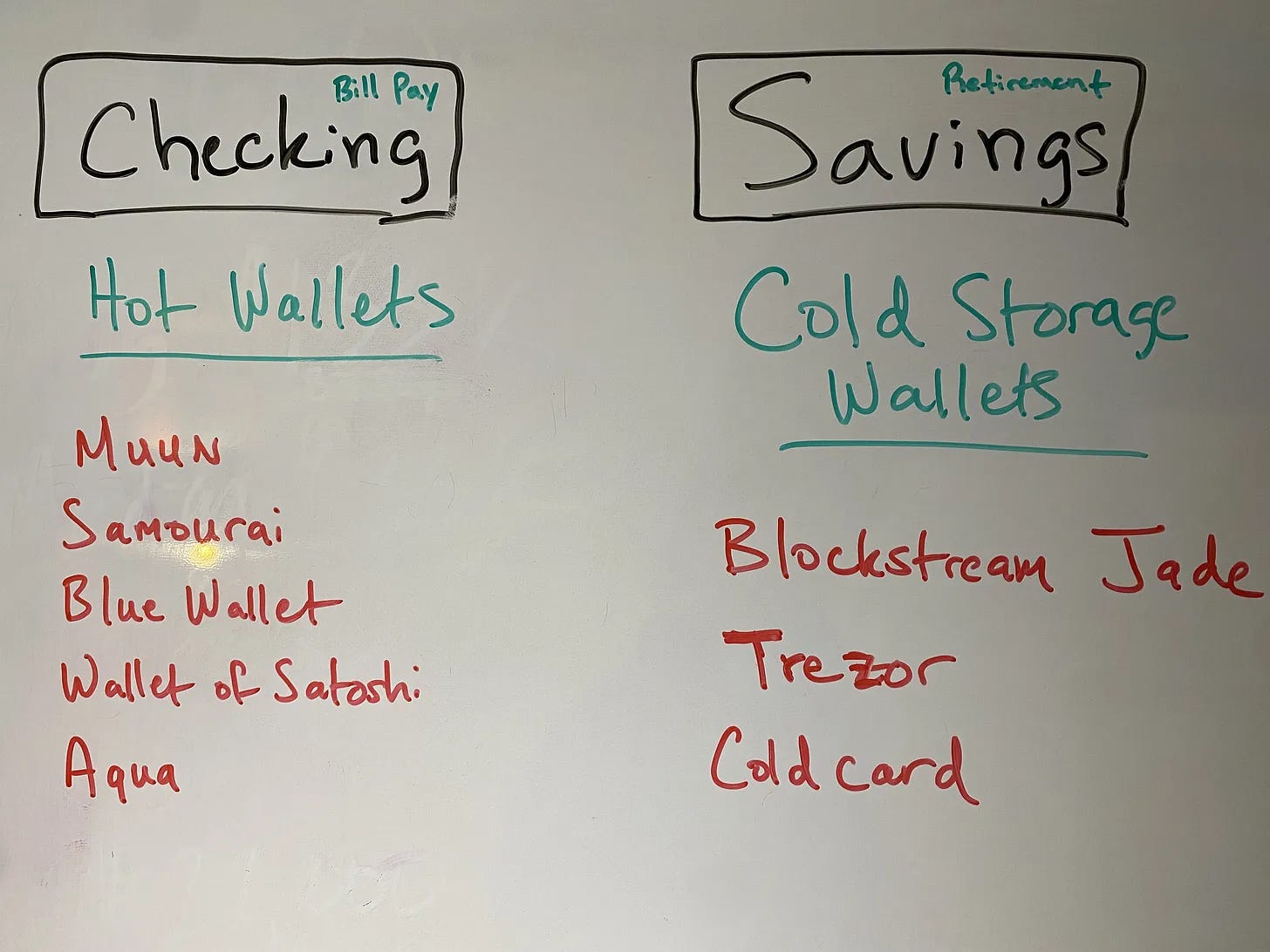

The REAL power lies in the fact that when you own and custody bitcoin in your own cold storage hardware wallet, you have become your own sovereign bank.

No one can freeze you out of the system or steal or dilute your wealth.

Bitcoin fixes so many of the monetary problems the central banks have brought on us, like inflation.

If you leave your bitcoin on exchanges you will eventually get REKT/rug-pulled/have your wealth stolen.

“Not your keys, not your coins.”

Not to mention even the FDIC came out and said you WILL get bailed-in if you stick in the legacy system long enough.

Leaving all assets in a bank is just as dangerous as leaving them in a “crypto” exchange.

We are in a new era of personal responsibility and accountability that will sweep over the country in the next decade.

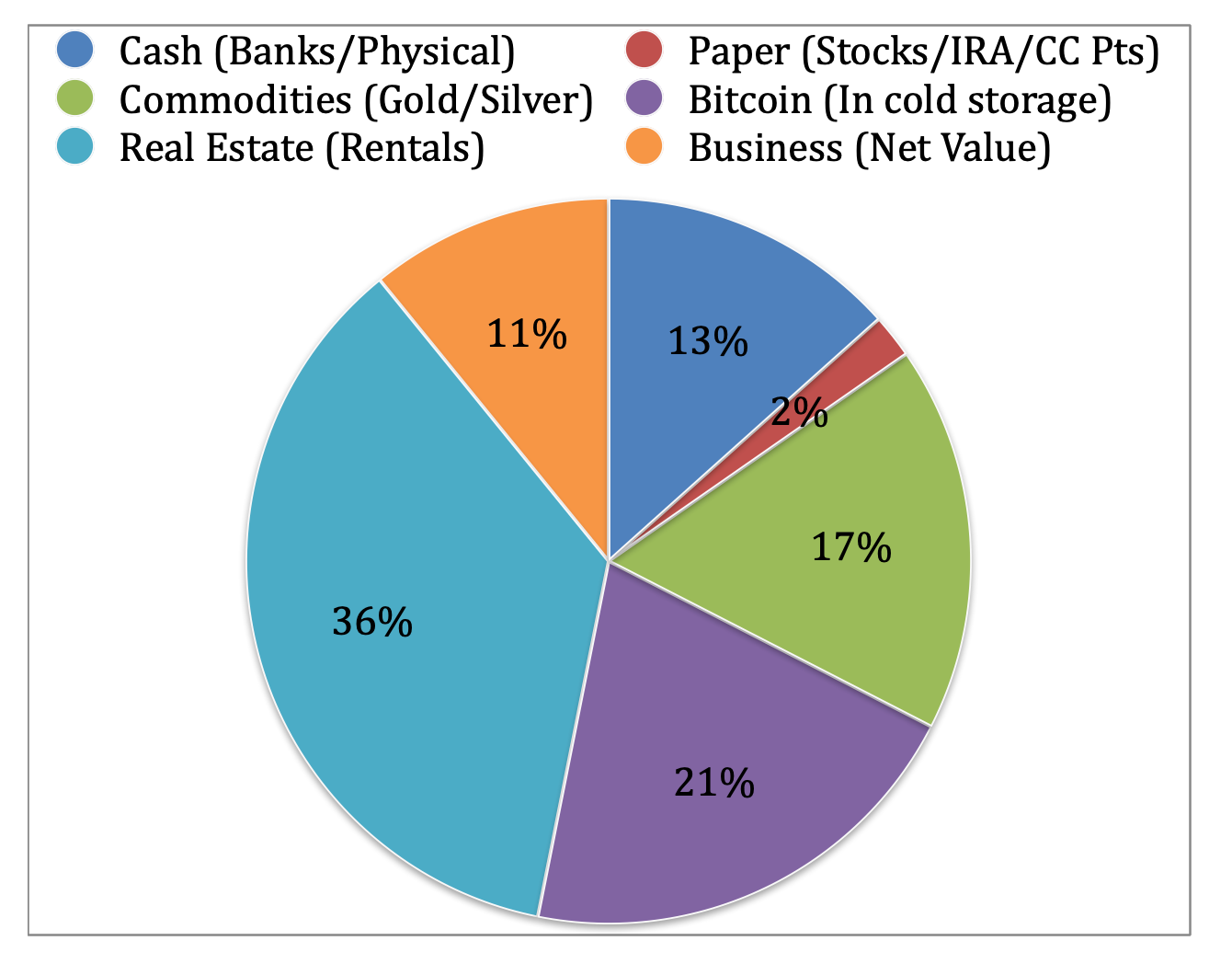

About ~21% in bitcoin.

**I expect bitcoin to become majority of my portfolio again in the next few years as it increases in value.**

Real estate (positive cash flowing rental real estate)

Last refinance is taking forever because of all the hoops we have to jump through on commercial loan.

Rates rising still and Fed may slow but it may be a great time in about 6-12 months to pick up some great deals.

I would rather hold cash short term next 12 months and have long term debts at low-ish rates paid off by our residents.

Real estate getting crushed overall, and I am not touching it yet.

I want the market to flush itself out the next 12 months.

We have about ~36% in rental real estate.

**Remember that the dollar is debt. There’s nothing backing it so the further you can get into good debt and buy appreciating assets you will win long-term as government continues devaluing the dollar. (ie. Refinancing real estate and pulling cash out tax-free to invest in other assets will be the people who win long-term. Savers get crushed by inflation and minuscule interest savings rates.)**

Commodities (gold, silver, oil wells, uranium, copper, wheat, corn, etc..)

I haven’t bought much in this area but I know hard assets will be sought after and will take over this next decade or two.

Primary assets are always a safe bet. Not the paper derivatives but buying the actual thing like an oil well or physical gold/silver.

Commodities, I believe, will be in bull market over the next decade or two as derivatives crash and primary assets come front and center.

Again, I would rather diversify in the analog world spread around different vaults and geographic locations that we can access in emergency.

We have ~17% in gold/silver

Paper (stocks/bonds/IRA/etc.)

Stopped buying our eXp Realty company stock.

Really battening down the hatches.

Fed is committed to crushing things.

Would rather put it in assets I control.

When they pivot though, look out for those risk assets like tech stocks (nasdaq), they will go to the moon IMO.

We have ~2% in stocks

**There will be a time for stocks in “phase 2” once the defensive positions and hedges (insurance) pay out, like I explained at the beginning of this month’s letter. Obviously depends on your time horizon, mine is around 10 years minimum on any investment on average or more.

Cash/Businesses

Looking to invest in private companies like multifamily and self storage or mining operations for bitcoin if proposals make sense. Good cash flowing positions where I know the management, etc..

As you can see we are trying to raise a lot more cash for the next 12 months or so because I do feel like they are going to be some great buying opportunities.

Cash is going to be up toward 20-30% of portfolio soon but Bitcoin keeps that down because we keep swapping fiat for bitcoin.

Cash on hand is also good in case our long term view of inflation is wrong. If we experience massive deflation, and the dollar increasing in strength, then we will be able to use the dry powder (cash) to buy many more assets.

~24% is in cash.

Conclusion

Fed did start slowing rates like we predicted last month.

May keep slowing or pause rates in coming months depending on how CPI numbers come in.

A good portion of my letter hasn’t changed much in months because patience is the BIGGEST ingredient to successful investing.

Investing is kind of like driving; the people who change lanes the most, get in the most accidents.

DXY (relative dollar strength) and 10 year yields have come down which has eased pressure a bit globally after going up towards end of December.

This is not the time to get fancy and be trying to shoot the moon and “make a killing.”

Be defensive and learn as much as you can.

Great wealth is being transferred now and in the coming years from those who did not understand the global landscape to the ones who studied and were diligent.

Video I made here on how bitcoin is re-pricing EVERY asset and how to find true value in assets regardless of “price.”

“Wealth is never destroyed is merely transferred,” as Mike Maloney always says.

https://www.pricedinbitcoin21.com/landing

Everything priced in bitcoin (link above) great way to see the re-pricing of all assets in the hardest money to ever exist. Opposite of what’s happening in fiat and hard to see from that angle.

We are riding the fine line of staying very liquid and but also don’t want a ton of cash on the balance sheet for more than about 12-18 more months because you are paying an option premium of REAL inflation which is around to 15-20% each year.

Keep in mind when making an investment it has to be beating 20-24% each year, as Warren Buffett says.

Precisely why I love saving IN bitcoin instead of US dollars, because it historically grows CAGR (compound annual growth rate) at 100-150%/year. Zoom out.

I ONLY want to trade my finite time for finite assets. Not trade my finite time for infinite pieces of paper/digits on a computer.

MAKE AN EQUAL TRADE FOR YOURSELF.

Stay strong,

Brandon

Freedom advice, not financial advice.

My newsletter is based off of 20+ years of historical, political, and monetary study plus my experiences in investing.

I spent the first 10 years studying politics and history.

The last 10 years I have studied monetary, fiscal history and policy, along with investing through what I call our “family office.”

I always mention to anyone that will listen: you must know the financial and money games for ANY of the political side to make any sense.

***Special tip: watch the credit market (bonds) especially the 10 year treasury, to see where the markets are going to go. That tells us where the stock and rest of markets will go.