(Listen to audio version of me reading👆)

The Trifecta

The three things to watch for in the market are:

Oil prices

10 year treasury yield

DXY, which is the relative strength of the dollar

That trifecta is the bellwether for the economy.

You can know exactly what’s going on if you watch those indicators.

The stock market is derived from this, not the other way around.

Most people watch the stock market and don’t realize that the credit market is the biggest market in the world and drives the train.

The legacy financial system continues to slip under the waves…

Bond yields have continued dropping over the last few months however, the last week or so they have bounced back up again, up to 3.8% on 10-yr treasuries.

When bond yields approach 4% and above its warning lights going up.

We will keep a close eye on this with our daily market updates on YouTube.

We have our fifth generation stealth aircraft shooting down water balloons in the sky while Epstein‘s client list and NORDStream pipeline evidence is mounting that the U.S. aided in the destruction.

You are being distracted from the real games being played just as we were 2,000 years ago in the Roman Colosseum.

It’s the money stupid.

Hence, why we continually prepare here at the “Reset.”

We know that things are coming unglued, the law of polarity tells us that it also equals the greatest opportunity possible for those that are prepared.

Bitcoin

Pop back since beginning of year over 40%.

If you’re worried about the “government crack down,” then you are admitting that you have no vote and you can’t change who is representing you. Game theory will play itself out, why would I let my enemy get the benefits of hardest asset and most powerful computer network to ever exist?

Remember this is the alternative and what they are prepared to do to you if you save in the dollar or any other fiat:

Now becoming evident that bitcoin stabilizes grades, and actually cleans up the environment while using renewable energy more than any other source according to some sources.

These are just a few of the reasons that I believe in saving deflationary bitcoin over inflationary fiat currencies.

Fiat currencies lose value and purchasing power daily.

Why hold a liability that people call an asset?

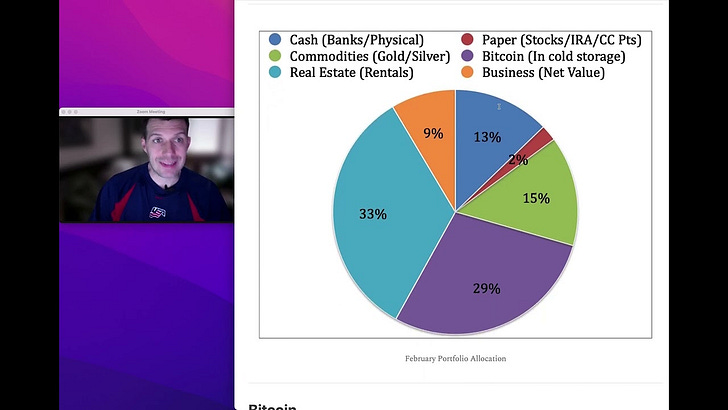

About ~29% in bitcoin.

**I expect bitcoin to become majority of my portfolio again in the next few years as it increases in value.**

Real estate (positive cash flowing rental real estate)

Last refinance still taking forever because of all the hoops we have to jump through on commercial loan.

We have our rental properties and just trying to stabilize them.

Little issues coming up here and there that makes me think about selling them all putting it all into bitcoin.

Can’t lie to you.

We have about ~33% in rental real estate.

**Remember that the dollar is debt. There’s nothing backing it so the further you can get into good debt and buy appreciating assets you will win long-term as government continues devaluing the dollar. (ie. Refinancing real estate and pulling cash out tax-free to invest in other assets will be the people who win long-term. Savers get crushed by inflation and minuscule interest savings rates.)**

Commodities (gold, silver, oil wells, uranium, copper, wheat, corn, etc..)

Primary assets are always a safe bet. Not the paper derivatives but buying the actual thing like an oil well or physical gold/silver.

Commodities, I believe, will be in bull market over the next decade or two as derivatives crash and primary assets come front and center.

Again, I would rather diversify in the analog world spread around different vaults and geographic locations that we can access in emergency.

We have ~15% in gold/silver

Paper (stocks/bonds/IRA/etc.)

I don’t have much in here and don’t plan to until “phase 2” kicks off once stocks are undervalued.

I like buying when there is blood in the streets.

Please see prior couple monthly investment letters to check more on what

”phase 2” means.

Would rather put it in assets I control for now, in times of hostile governments.

When the Fed pivots though, look out for those risk assets like tech stocks (nasdaq), they will go to the moon IMO.

We have ~2% in stocks

Cash/Businesses

Sitting on dry powder and trying to raise more in other areas.

This is SO important right now.

I am still cautiously looking to invest in private companies like multifamily and self storage or mining operations for bitcoin if proposals make sense. Good cash flowing positions where I know the management, etc..

Cash on hand is also good in case our long term view of inflation is wrong. If we experience massive deflation, and the dollar increasing in strength (DXY), then we will be able to use the dry powder (cash) to buy many more assets.

~22% is in cash

Conclusion

Fed continued slowing rates, and markets don’t know what to make of it.

Markets are jumping all over the place and the Fed is coming out with contradictory reports compared to the jobs actually being laid off and jobs being added.

Inflation is same but raging all over the world like in Argentina, at 99%!

Bond yields keep wanting to jump.

Something doesn’t smell right so prepare accordingly.

This is NOT the time to get fancy and shoot the moon.

Stay in cash for deflation and picking up deals.

Stay in bitcoin for inflation/debasement protection.

I ONLY want to trade my finite time for finite assets. Not trade my finite time for infinite pieces of paper/digits on a computer.

MAKE AN EQUAL TRADE FOR YOURSELF.

Stay strong,

Brandon

I am always a student. I am no expert. This is never financial advice, but only what I’m doing and what I see.

Freedom advice, not financial advice.

My newsletter is based off of 20+ years of historical, political, and monetary study plus my experiences in investing.

I spent the first 10 years studying politics and history.

The last 10 years I have studied monetary, fiscal history and policy, along with investing through what I call our “family office.”

I always mention to anyone that will listen: you must know the financial and money games for ANY of the political side to make any sense.

***Special tip: watch the credit market (bonds) especially the 10 year treasury, to see where the markets are going to go. That tells us where the stock and rest of markets will go.