(Listen to audio version of me reading👆)

Elon Musk is dropping the Twitter files, confirming the things that any half-away person knew already.

We are still fighting proxy wars with nuclear powers.

We cannot seem to figure out how to use cheap energy to fill the needs of people around the world.

Legacy media is being disrupted by alternative media.

Legacy financial system is slowly being overtaken by the bitcoin network.

We cannot seem to figure out how to run elections, secure them, or count votes in America.

All the while, the bond market is still telling us there is going to be a recession in 2023.

Not sure how prepared the average person is for this.

Many people had a rough time in 2022.

But there were also many living their best life.

I guess it is truly the story you are telling yourself in your mind, right?

Oh and FTX blew up and uncovered even more scams and corruption inside DC and crypto land.

You couldn’t have scripted this clown world we live in any better if you tried.

I am always a student. I am no expert. This is never financial advice, but only what I’m doing and what I see.

Bitcoin

Bitcoin, NOT crypto. Crypto is garbage. There is ONLY bitcoin.

If FTX didn’t prove this to you then I don’t know what would.

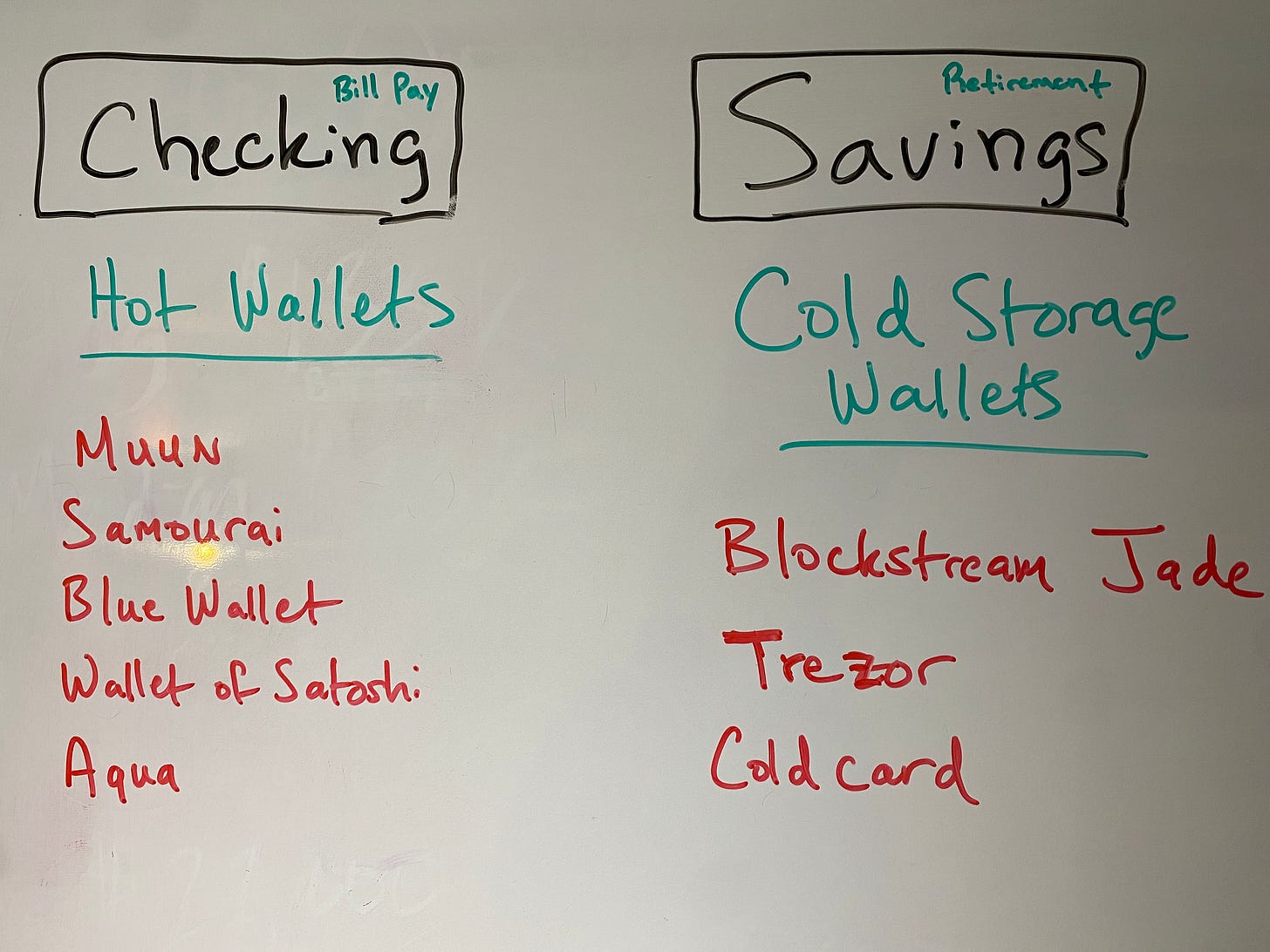

The REAL power lies in the fact that when you own and custody bitcoin in your own cold storage hardware wallet, you have become your own sovereign bank.

No one can freeze you out of the system or steal or dilute your wealth.

Bitcoin fixes so many of the monetary problems the central banks have brought on us, like inflation.

If you leave your bitcoin on exchanges you will eventually get REKT/rug-pulled/have your wealth stolen.

“Not your keys, not your coins.”

About ~20% in bitcoin.

**I expect bitcoin to become majority of my portfolio again in the next few years as it increases in value.**

Real estate (positive cash flowing rental real estate)

Still looking to refinance one more rental property to pull out cash and get more dry powder ready for what may become a very crazy next year or two.

Rates rising still and Fed may slow but it may be a great time in about 6-12 months to pick up some great deals.

I would rather hold cash short term next 12 months and have long term debts at low-ish rates paid off by our residents.

We have about ~36% in rental real estate.

**Remember that the dollar is debt. There’s nothing backing it so the further you can get into good debt and buy appreciating assets you will win long-term as government continues devaluing the dollar. (ie. Refinancing real estate and pulling cash out tax-free to invest in other assets will be the people who win long-term. Savers get crushed by inflation and minuscule interest savings rates.)**

Commodities (gold, silver, oil wells, uranium, copper, wheat, corn, etc..)

I haven’t bought much in this area but I know hard assets will be sought after and will take over this next decade or two.

Primary assets are always a safe bet. Not the paper derivatives but buying the actual thing like an oil well or physical gold/silver.

Commodities, I believe, will be in bull market over the next decade or two as derivatives crash and primary assets come front and center.

Again, I would rather diversify in the analog world spread around different vaults and geographic locations that we can access in emergency.

We have ~16% in gold/silver

Paper (stocks/bonds/IRA/etc.)

Stopped buying our eXp Realty company stock.

Really battening down the hatches.

Fed is committed to crushing things.

Would rather put it in assets I control.

When they pivot though, look out for those risk assets like tech stocks (nasdaq), they will go to the moon IMO.

Again, there will be a time for stocks in “phase 2” once the defensive positions and hedges (insurance) pay out, like I explained at the beginning of this month’s letter.

We have ~2% in stocks

Cash/Businesses

Looking to invest in private companies like multifamily and self storage or mining operations for bitcoin if proposals make sense. Good cash flowing positions where I know the management, etc..

As you can see we are trying to raise a lot more cash for the next 12 months or so because I do feel like they are going to be some great buying opportunities.

Cash is going to be up toward 20-30% of portfolio soon but Bitcoin keeps that down because we keep swapping fiat for bitcoin.

Cash on hand is also good in case our long term view of inflation is wrong. If we experience massive deflation, and the dollar increasing in strength, then we will be able to use the dry powder (cash) to buy many more assets.

~27% is in cash.

Conclusion

Fed may be slowing rates. A good portions of my letter hasn’t changed much in months because patience is the BIGGEST ingredient to successful investing.

Investing is kind of like driving; the people who change lanes the most, get in the most accidents.

DXY (relative dollar strehtng) and 10 year yields have come down which has eased pressure a bit globally.

Let us see how long the central banks can keep the tsunami from crashing ashore.

Remember, the beginning of the article we talked about how the yield curve inversion (bonds) are forecasting recession for 2023, still.

This is not the time to get fancy and be trying to shoot the moon and “make a killing.”

Be defensive and learn as much as you can.

Great wealth is being transferred now and in the coming years from those who did not understand the global landscape to the ones who studied and were diligent.

“Wealth is never destroyed is merely transferred,” as Mike Maloney always says.

This is why I have been a big proponent over the past few months of sitting on more dry powder (cash.)

This education process is what we have been going through for 12 years here and will continue to share what we find and what we are doing…

Riding the fine line of staying very liquid and but also don’t want a ton of cash on the balance sheet for more than about 12-18 more months because you are paying an option premium of REAL inflation which is around to 15-20% each year.

Keep in mind when making an investment it has to be beating 20-24% each year, as Warren Buffett says.

Precisely why I love saving IN bitcoin instead of US dollars, because it historically grows CAGR (compound annual growth rate) at 100-150%/year.

I ONLY want to trade my finite time for finite assets. Not trade my finite time for infinite pieces of paper/digits on a computer.

MAKE AN EQUAL TRADE FOR YOURSELF.

Stay strong,

Brandon

My newsletter is based off of 20+ years of historical, political, and monetary study plus my experiences in investing.

I spent the first 10 years studying politics and history.

The last 10 years I have studied monetary, fiscal history and policy, along with investing through what I call our “family office.”

I always mention to anyone that will listen: you must know the financial and money games for ANY of the political side to make any sense.

***Special tip: watch the credit market (bonds) especially the 10 year treasury, to see where the markets are going to go. That tells us where the stock and rest of markets will go.