(Listen to audio version of me reading👆)

Life is all about incentives.

Take health insurance, the system is so messed up, and fiat currencies are so broken that the prices continue running away, because companies have been capped by the government the profit they can make on your premiums.

Sounds great right?

Instead this incentivizes companies to increase prices and give you more medicine instead of proactive care to keep you out.

This way they can make more off of you.

We got rid of blue cross blue shield a few years ago because the premiums were sky high and the deductibles were outrageous

I was better off have no insurance and just paying out of pocket or raising money if something huge came up.

I was getting nothing for the $12,000+ I paid in each year.

Then I started looking in to crowdfunding for health issues and to my surprise there were companies already starting with that similar mindset.

We are in a crowd sharing platform now (Zion/Planstin) and actually changing again soon to a bitcoin focused company called Crowdhealth.

I’m going to try and get the founder on the podcast soon.

They are enabling peer to peer consumer to doctor payments soon through bitcoin and the lightning network.

The new world is starting to unveil themselves where costs are a fraction of the price and privacy is immeasurably higher.

Wealth and health go right along with each other.

You cannot have one without the other.

(In the future I will be adding in a section regarding the art, guns, ammo, food and other assets I own to give you a better sense of what is actually happening.)

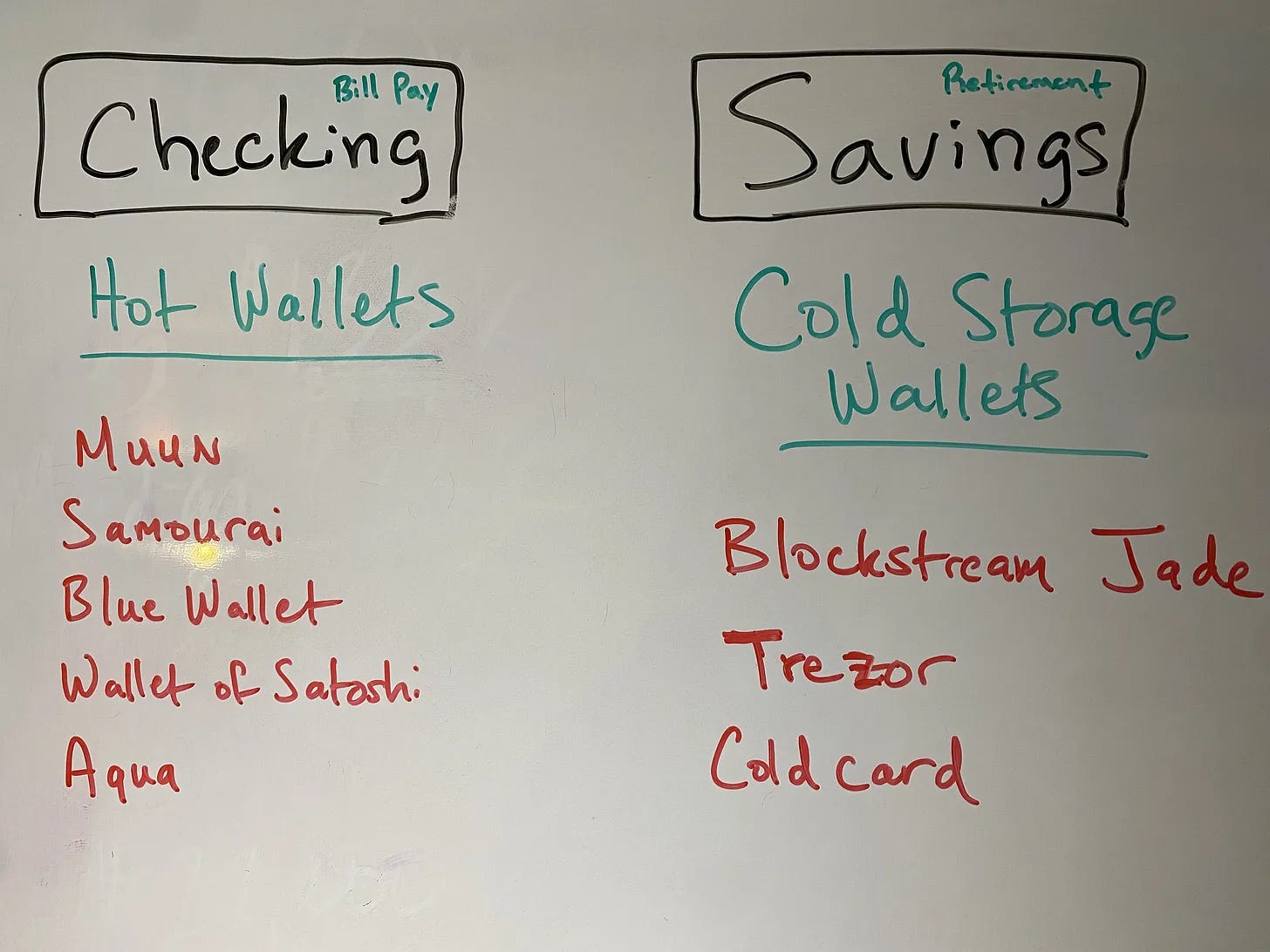

Bitcoin (NOT “crypto”)

The best savings tool we have, Bitcoin, is up 80%+ this year.

The BRICS countries are meeting in a couple weeks to discuss moving away from the dollar.

This means even more inflation as dollars come back to America in the coming years.

If you are holding dollars, this means you will have to continually find more and more dollars to pay for normal every day things.

You will also have to find more dollars just to pay for the same bitcoin.

Bitcoin is 180° opposite from the dollar and fiat currencies.

If you denominate everything in your life in bitcoin, your life gets cheaper and things become much clearer.

Go to www.pricedinbitcoin21.com and you’ll see exactly what I’m talking about in visual form.

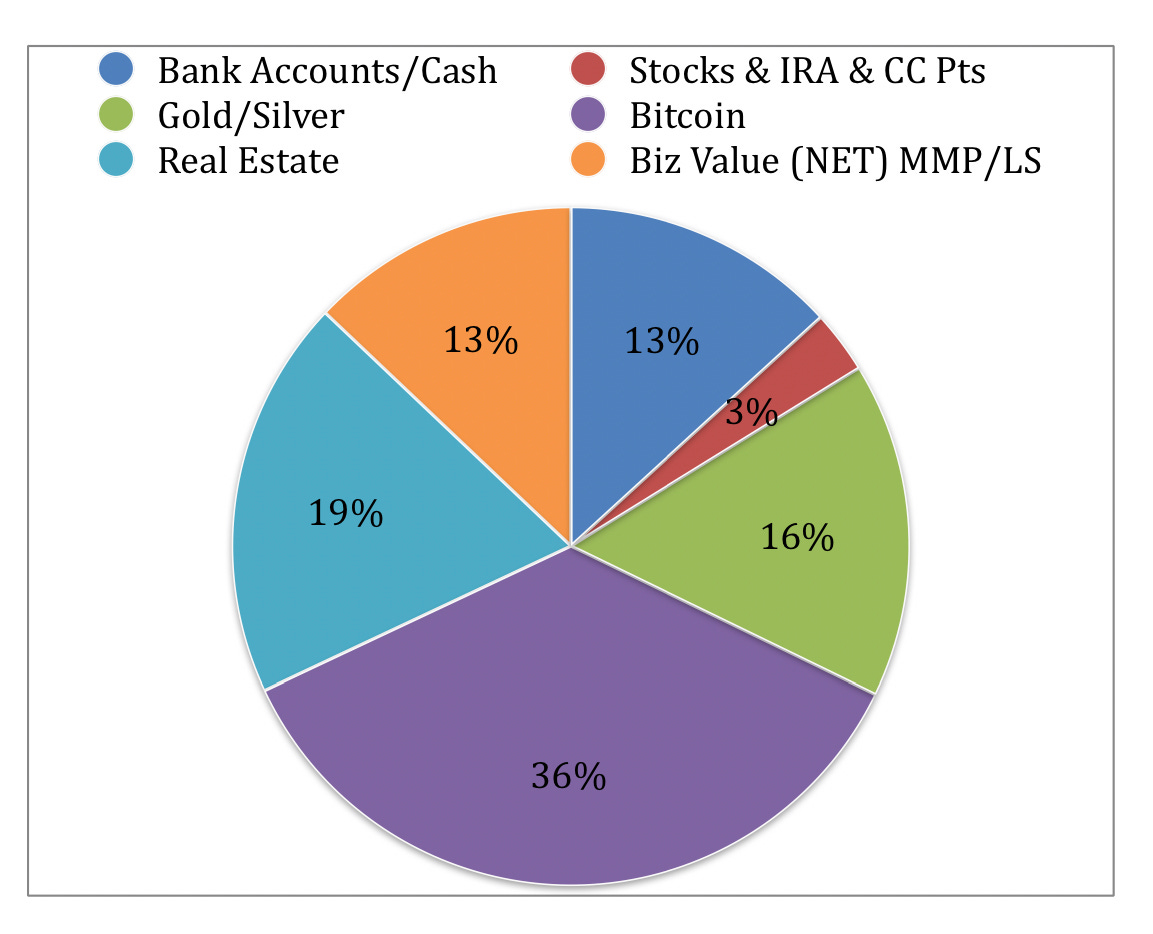

We have about ~36% in bitcoin.

**I expect bitcoin to become majority of my portfolio again in the next few years as it increases in value.**

Real estate (positive cash flowing rental real estate)

We sold our Redford property finally!

Have the proceeds sitting in cash as we just closed two weeks ago.

Some of already invested in the bitcoin trading cards company I’m helping to build and the art that we have made there.

More on this soon but our other properties are stable for now.

Look forward to when we can provide apartment housing that is beautiful and get paid in bitcoin by our residents.

We have about ~19% in rental real estate.

Commodities (gold, silver, oil wells, uranium, copper, wheat, corn, etc..)

A legit historical hedge to chaos.

No counter parties.

Bearer instruments that you control.

No change here.

Primary assets with no counter party where you control your wealth is never a bad bet.

Control is a MASSIVE characteristic smart investors look for in their investments.

Central banks still on gold buying spree which started 10 years ago, which bodes well for holders of the metals.

Until they start buying bitcoin…

We have about ~16% in commodities and physical gold/silver.

Paper (stocks/bonds/IRA/etc.)

Stocks we own are up a bunch over last month or two but it’s minimal part of portfolio.

I don’t have much in here and don’t plan to until “phase 2” kicks off once stocks are undervalued.

I like buying when there is blood in the streets.

Then you can pick up great rental real estate and dividend value stocks at great prices that throw off great cash flow.

Remember, we make money when we buy. This goes for ALL asset classes.

I also like to buy things I know a lot about (Bitcoin, real estate, gold/silver). I am still studying and learning and taking courses on stocks and selling options etc..

Not ready yet.

Paper and real estate are bound to plunge or have an invisible crash against other assets (see chart below.)

Please see prior couple monthly investment letters to check more on what

”phase 2” means.

We have about ~3% in paper.

***Special tip: watch the credit market (bonds) especially the 10 year treasury, to see where the markets are going to go. That tells us where the stock and rest of markets will go.

Cash/Businesses

Will sit on portion of cash from Redford house sale and invest more in to art/bitcoin trading cards as well.

More on this strategy and what is going on here in the future.

Might interest you as to my thoughts here and what is happening…

Diversify in assets that will hedge currency printing.

Cash on hand is also good in case our long term view of inflation is wrong. If we experience massive deflation, and the dollar increasing in strength (DXY), then we will be able to use the dry powder (cash) to buy many more assets as well.

We have about ~26% in cash.

Remember…

When you align incentives the world starts to heal.

Fiat is the disease.

Simply put, the dollar is backed by nothing, making it currency, and making it easy to inflate away and slowly steal all your wealth (time and energy.)

This allows people in positions of power to control the masses with endless fear campaigns and propaganda while keeping most poor so they are helpless and subjected to this endless torture.

Broken currencies permeate all areas of life.

Bitcoin is a neutral money that captures deflation and spreads the higher standard of living and lower costs back to all people inside that system.

Fiat currencies are designed to lower standards of living and raise costs for the 99%.

The stealth tax that governments and bankers use to siphon away your wealth without having to tell you.

Stay strong,

Brandon

I am always a student. I am no expert. This is never financial advice, but only what I’m doing and what I see.

Afterword

Freedom advice, not financial advice.

My newsletter is based off of 20+ years of historical, political, and monetary study plus my experiences in investing.

I spent the first 10 years studying politics and history.

The last 10 years I have studied monetary, fiscal history and policy, along with investing through what I call our “family office.”

In that time I have 15’xed our net worth through contrarian views and watching what people do, not what they say.

I always mention to anyone that will listen: you must know the financial and money games for ANY of the political side to make any sense.

**Remember that the dollar is debt. Real estate like bonds over last 40 years has become more expensive and produces less yield if you don’t buy properly.**

If you like freedom and can’t stand politics and bridges to nowhere, racial polarization, division, hate, looting, and all the moral decay in society than you might just be a bitcoiner.

To fix all these problems we have a solution where you cannot be racketeered by governments anymore through inflation.

“Bitcoin fixes this.”

You don’t need a lot, just a couple percent is a vote for freedom and could change the world forever.

I ONLY want to trade my finite time for finite assets, NOT trade my finite time for infinite pieces of paper/digits on a compute.

MAKE AN EQUAL TRADE FOR YOURSELF.