(Listen to audio version of me reading👆)

Dollar melting ice cubes

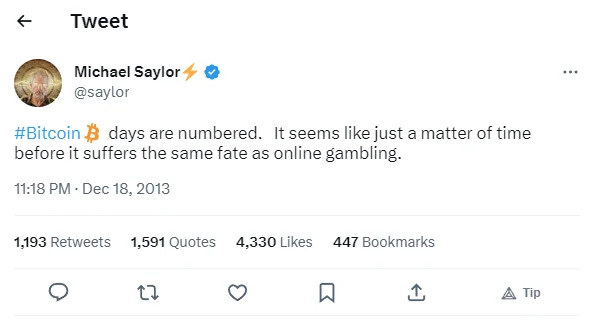

Billionaire Michael Saylor's infamous tweet a decade ago dismissing Bitcoin as worthless mirrors my initial skepticism. However, after witnessing the continual loss incurred by the US dollar through inflation, akin to an ice cube melting (dollar debasement), I, like Saylor, began recognizing Bitcoin's potential.

Matthew Kratter, a former Silicon Valley and Wall Street trader, once aligned with my initial view, shifted his perspective on Bitcoin in 2019, acknowledging that "the future is already here, just unevenly distributed."

Billionaires Tim Draper, Bill Miller, Ricardo Salinas, Stanley Druckenmiller, and Paul Tudor Jones also transitioned into fervent Bitcoin supporters over the past decade.

What do these billionaires know that I may not know?

Despite differing from these individuals greatly, my journey shares similarities with them. Observing Bitcoin's price fluctuations, exploring monetary history, and investing in gold, silver, and real estate led me to a gradual understanding of Bitcoin's essence the more I was broached with the subject.

Understanding Bitcoin and money itself didn't come overnight—it evolved through challenges, debunking the myth of Bitcoin's demise (declared dead nearly 500 times in 14 years) and going through my own sh*tcoin phase.

Bitcoin's resilience goes beyond fiat “gains,” promising a potential life-changing monetary system.

Currently, bitcoin has surged by nearly 200% from last year's low, consistently awakening interest in its 4-year halving cycles and reshaping perspectives.

This among its game theoretical and engineering properties suggest its enduring impact for centuries as a digital monetary fortress.

Can you say that about ANY country’s currency or ANY company?

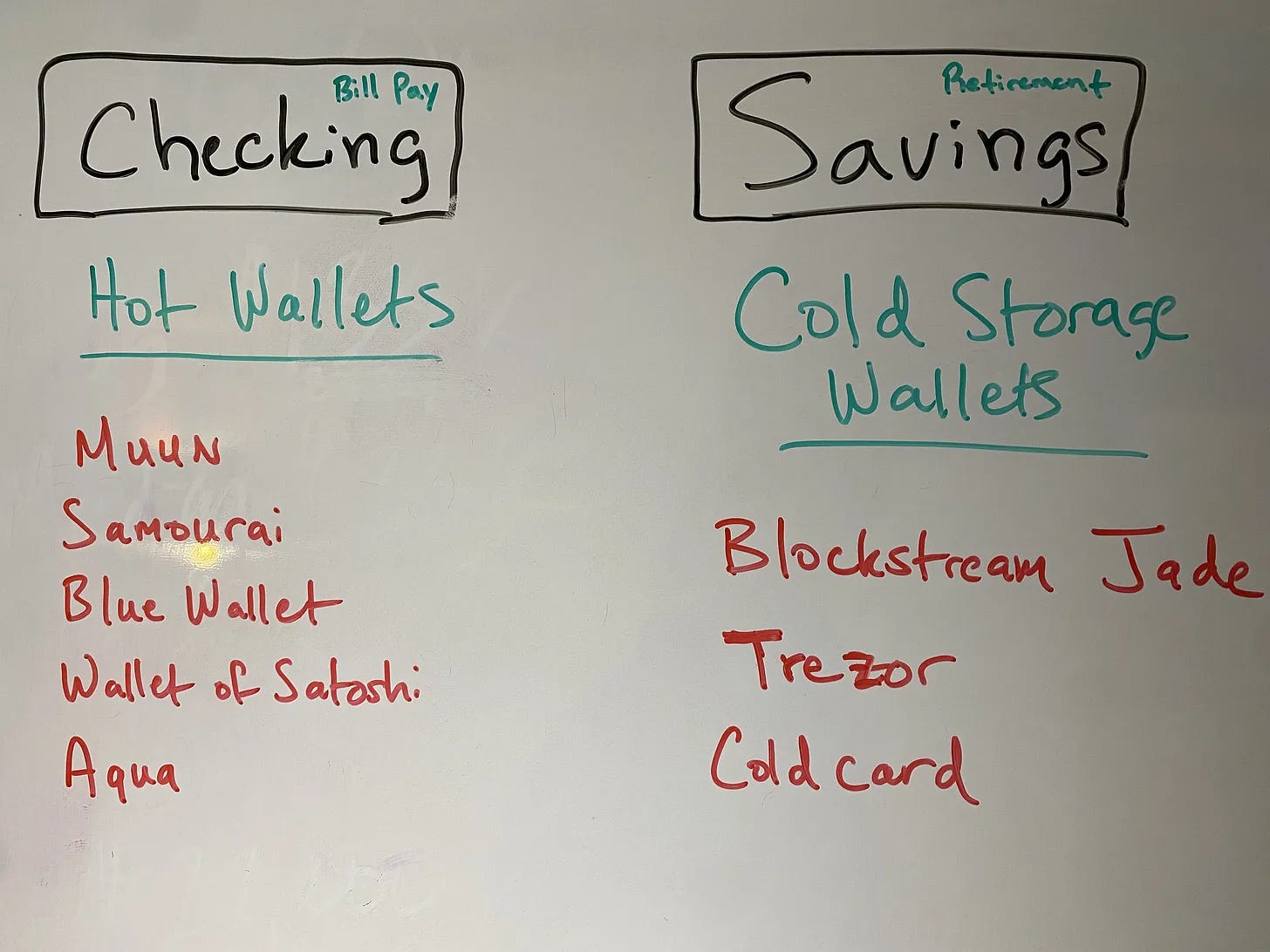

Here is my allocation:

Bitcoin (NOT “crypto”)

Over the past year, my Bitcoin portfolio has experienced significant growth, aligning with my earlier predictions.

We just hit over 50% of our portfolio saved in bitcoin for the first time ever. This will continue to grow and swallow up more of my balance sheet as the years pass.

A deeper comprehension of Bitcoin's trajectory leads to increased capital allocation and a firmer belief in its future potential.

I want to save true finite money for my finite time. I do NOT want to save dollar liabilities (or things denominated in dollars or US treasuries) long term because that makes your poorer over time.

We have about ~50% in bitcoin.

**I expect bitcoin to become majority of my portfolio again in the next few years as fiat decreases in value.**

Real estate (positive cash flowing rental real estate)

Recent challenges with all our rental properties, despite recent renovations, prompt more reflection on my real estate holdings.

Though inevitable, the recurring issues raise questions about maintaining real estate assets when Bitcoin, a digital monetary stronghold, exists.

I intend on resolving current problems and potentially retaining select properties for generational succession while considering a shift towards Bitcoin.

I don’t want the taxes I would be hit with and market is very unstable so time and energy may not be worth it currently.

We have about ~17% in rental real estate.

**Remember that the dollar is debt. Real estate like bonds over last 40 years has become more expensive and produces less yield if you don’t buy properly.**

Commodities (gold, silver, oil wells, uranium, copper, wheat, corn, etc..)

The recent significant surges in gold, reaching new all-time highs, and silver making substantial moves underscore the benefits of bearer assets.

My affinity for metals persists, although I'm contemplating potential adjustments while closely monitoring their performance for some strategic moves in the future to reallocate in to other classes depending on life events.

Will keep updated here.

We have about ~15% in commodities and physical gold/silver.

Paper (stocks/bonds/IRA/etc.)

My paper portfolio remains unchanged due to market overheating and unpredictability.

The bond performance has been huge the past month because yields have been falling like crazy. So much for risk free reward and “safe haven.”

You are paying with your life if that is the trade you are making. If you know you know.

The Federal Reserve's actions, coupled with impending elections, make me cautious.

I am adhering to the "invest in what you know" principle and have deliberately not touched this at all as you have seen in recent quarters.

We have about ~2% in paper.

***Special tip: watch the credit market (bonds) especially the 10 year treasury, to see where the markets are going to go. That tells us where the stock and rest of markets will go.

Cash/Businesses

Stagnancy characterizes cash holdings as I continue weekly Bitcoin investments via dollar-cost averaging.

Considering increased investments in Bitcoin trading cards due to my involvement in lead marketing role, witnessing remarkable growth in this market during a bearish phase.

The future is bright for personal brands and education companies that highlight the problems and help solve pain people are feeling.

Cash on hand is also good in case our long term view of inflation is wrong. If we experience massive deflation, and the dollar increasing in strength (DXY), then we will be able to use the dry powder (cash) to buy many more assets as well.

We have about ~16% in cash.

Remember

Heightened liquidity, diminishing yields, and a weakening dollar signal impending changes.

Expecting Federal Reserve interventions due to excessive debt lowering rates once something in the economy breaks.

Likely propelling Bitcoin, gold, and silver further than the current spikes from the past month.

These are early warning signals from the market.

The debt is too much to keep rates this high for years.

The USA is bankrupt and the debt markets will call the country’s bluff.

Get ready for all asset prices to rip.

Considering a departure from cash holdings due to anticipated market shifts and advising thorough research in to any asset you are going in to. This is paramount.

Election craziness, wars, and technological changes are coming.

Stay strong,

Brandon

I am always a student. I am no expert. Freedom advice, not financial advice.

Afterword

My newsletter is based off of 20+ years of historical, political, and monetary study plus my experiences in investing.

I spent the first 10 years studying politics and history.

The last 10 years I have studied monetary, fiscal history and policy, along with investing through what I call our “family office.”

In that time I have 15’xed our net worth through contrarian views and watching what people do, not what they say.

I believe you must know the financial and money games for ANY of the political side to make any sense.

If you like freedom and can’t stand politics and bridges to nowhere, racial polarization, division, hate, looting, and all the moral decay in society than you might just be a bitcoiner.

To fix all these problems we have a solution where you cannot be racketeered by governments anymore through inflation.

“Bitcoin fixes this.”

You don’t need a lot, just a couple percent is a vote for freedom and could change the world forever.

Study bitcoin. Invest in what you know.

I ONLY want to trade my finite time for finite assets, NOT trade my finite time for infinite pieces of paper/digits on a computer.

MAKE A FAIR TRADE FOR YOURSELF.