Could This Retire You AND Your 401k In 10 Years?

Achieving different results means taking different actions

(Listen to audio version of me reading👆)

So….what are we going to do to fix retirement and 401k?

We know from the previous blog what the government could do to fix social security and help people out, but will they?

What do you think those chances are?

From the Senators own mouths:

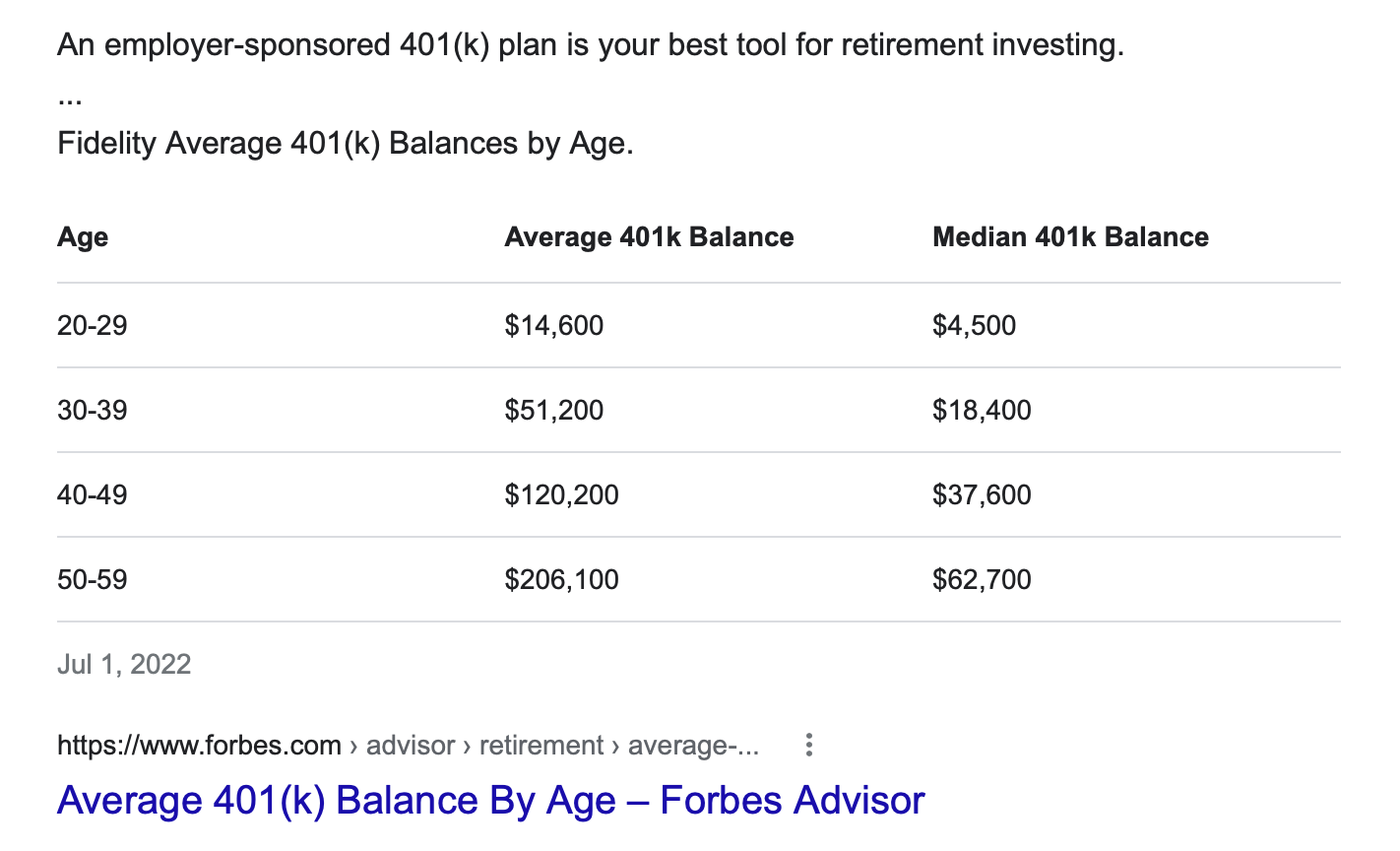

“As one of the largest 401(k) providers, Fidelity must be are aware of the precarious position of Americans’ retirement savings. While the average 401(k) balance is $129,157, the median balance for 401(k) accounts is just $33,472. With Americans living longer today than ever before, it is apparent that too many retirees are likely to outlast their balances during their golden years.

The irony of them not realizing their own policies have caused this destruction is off the charts.

We know the answer lies within ourselves and how we prepare ourselves and our family for what is coming.

Where could bitcoin take retirement?

Let’s just use a theoretical example for where many of the models say bitcoin will be priced at around 2030.

Using the problems of the current retirement issues and the senator’s own numbers of $133k for average 401(k) (and we know social security and Medicare are going to be insolvent in the same 10 year period as well) wouldn’t we want to think about doing something different to achieve a different result?

If you buy 0.1 bitcoin now, which would cost you $2,400 currently, out of your retirement account then that’s all you stand to lose.

But what do you have to gain?

Many models predict that bitcoin will be priced around $1 million per coin around 2030.

That would mean 0.1 bitcoin, if that’s all you ever bought, would be worth $100,000.

To recap, you invested (or risked) $2,400 and then by end of the decade and had the chance to make nearly the entirety of the average person’s current 401k balance.

Stunning.

Could be more?

What is the price of bitcoin was at $2-5 million per coin by 2032 like we used for our example in saving the Social Security fund in our last blog.

If you had 0.1 bitcoin and bitcoin was worth $2 million, you would have $200,000 or it could be up to $500,000 if bitcoin really pops like some think it will.

You would more than 2-5x the average 401(k) balance through just a 10% stake in bitcoin now, and just holding it over the next 10 years.

Do not be shaken out of position and sell, and you stand to benefit greatly.

Crazy part is, once you start going through these mental models you start increasing your bitcoin position size even more because your depth of knowledge and conviction increases.

In conclusion

Just to reiterate again, only a small stake now, could completely transform your retirement.

Even a $240 investment now which is .01 bitcoin could be $20,000, $40,000 or $50,000, ten years from now.

Asymmetric risk and position sizing.

You are risking a small amount of capital for a potentially massive gain.

We continually say that price is the least interesting aspect of bitcoin however we cannot be naïve to the fact that there is massive potential for wealth gain and that’s ultimately what drives many people into the asset/network initially before they realize the true power and freedom of the system.

We know that if we continue doing the same thing we will achieve the same result.

Achieving different results means taking different actions.

What are we going to do today to change results in our future?

Stay strong,

Brandon

Ps. We will have the audio of Fidelity’s BITCOIN: GET OFF ZERO article tomorrow and next week we will have why Elon Musk could be the most dangerous man on Earth or could be the most benign man on Earth…stay tuned!