(Listen to audio version of me reading👆)

"Slow and steady wins the race. Good things come to those who wait. Patience is a virtue." These are all sayings that you've likely encountered throughout your life. While not all sayings are universally true, many enduring ones are rooted in fundamental truths.

Similarly, the best comedy often originates from first principles or some aspect of truth. If it were entirely fabricated, it wouldn't stand the test of time, nor would it be humorous.

Our current economic environment demands a high degree of patience. Investing is a plan more than it is crazy high-flying fun. The pervasive influence of social media and the relentless 24-hour news cycle create the illusion that we must undertake extraordinary measures to secure our financial well-being.

FOMO is created on a grand scale.

This notion is not entirely baseless, as the fiat system, characterized by unchecked currency printing, erodes our purchasing power and drives up the cost of living. Consequently, we find ourselves compelled to engage in high-stakes trading and risk-taking with our hard-earned resources, which represent our time and energy. Must we really resort to gambling to stay afloat and avoid financial instability?

I maintain that there's a more sound alternative. We need a more robust form of currency that can safeguard our purchasing power over time, benefitting all 8 billion people on this planet.

This vision is undoubtedly ambitious, but what other choice do we have? It's why I've restructured my life and mission, leveraging two decades of experience in politics, investing, business, and money. This is the reality I perceive, and it's why I've planted my flag with such confidence.

Here is my allocation which hasn’t changed much from the past month, slow and steady:

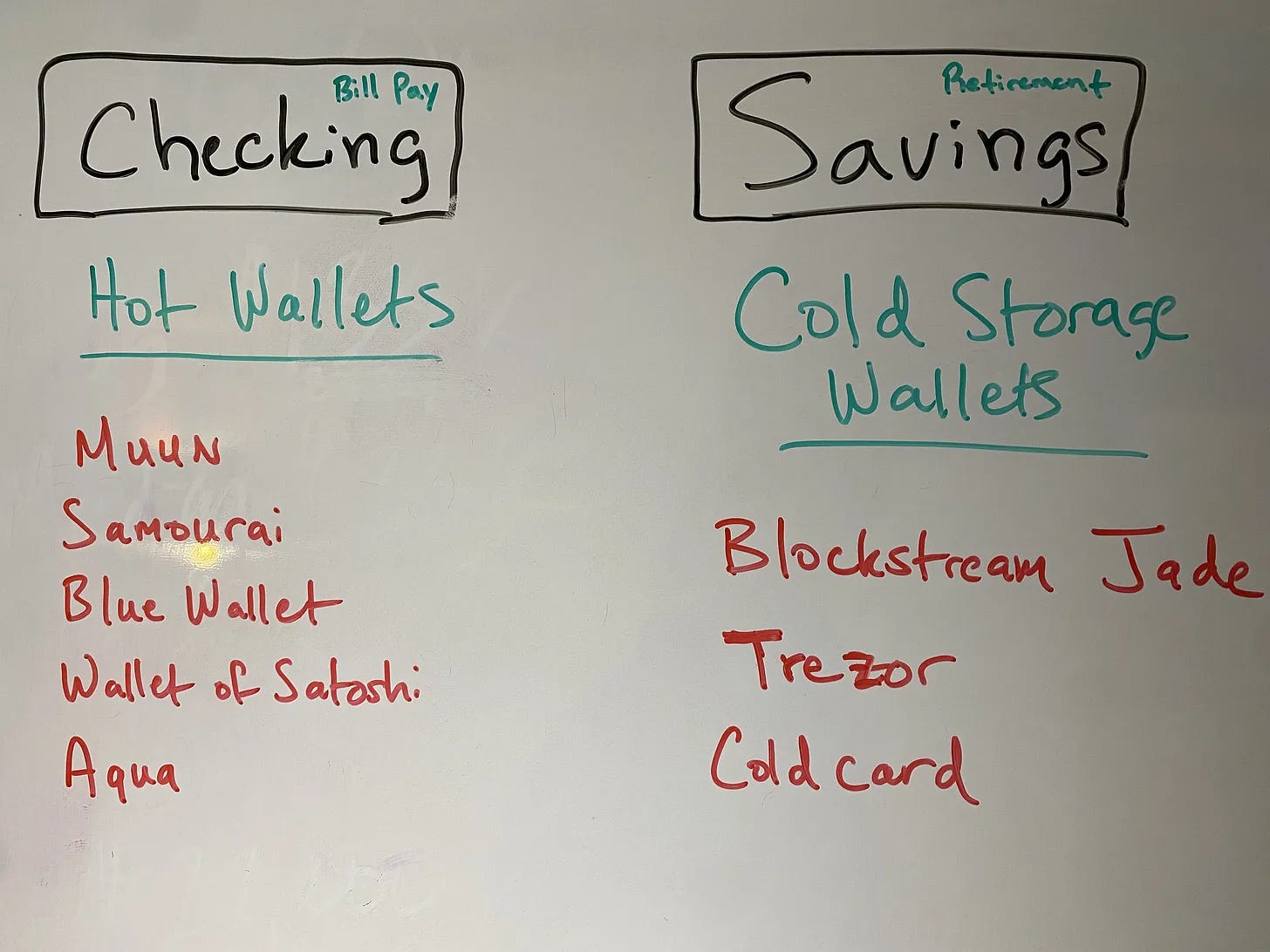

Bitcoin (NOT “crypto”)

I continue to dollar cost average (save weekly in bitcoin) which is opposite of trying to “time” the market.

No one can accurately time things and if you miss the couple biggest days of the year then you are statistically behind the curve.

It is better to not think about it once you have realized what bitcoin is and just put it on autopilot.

I want to save true finite money for my finite time. I do NOT want to save dollar liabilities (or things denominated in dollars or US treasuries) long term because that makes your poorer over time.

We have about ~44% in bitcoin.

**I expect bitcoin to become majority of my portfolio again in the next few years as fiat decreases in value.**

Real estate (positive cash flowing rental real estate)

Still getting the property from last month cleaned up currently as the resident left the place a mess.

Dealing with a couple minor issues with incompetent local governments which is fun as well.

The economic situation moving forward and governments becoming crazier especially here in Michigan where the rentals are based makes me really want to take my cash out and put them in to bitcoin which helps build the new system and the city can deal with landlords again they deserve…

The houses I have were all destroyed when I bought them and I redid them top to bottom. You can see what happens when government treats the good business owners like garbage, they attract worse owners and the good ones leave their jurisdiction.

We have about ~19% in rental real estate.

**Remember that the dollar is debt. Real estate like bonds over last 40 years has become more expensive and produces less yield if you don’t buy properly.**

Commodities (gold, silver, oil wells, uranium, copper, wheat, corn, etc..)

Commodity investments remain unchanged, but I'm still contemplating selling some assets to diversify further, but I haven’t pulled the trigger yet.

This still will be a great asset class in the coming years as the industry is being choked from every angle.

When there is low supply and much demand, prices will rise.

We have about ~16% in commodities and physical gold/silver.

Paper (stocks/bonds/IRA/etc.)

Still not moving on this yet either.

The paper asset class of stocks and bonds has been decimated the past 2 years. The 60/40 portfolio has been one of the worst performing trades and these dollar denominated assets will most likely not beat inflation the next decade, especially bonds.

Bonds are citizens paying the government to spend on whatever they want, then the government owes you back principal and interest, mind you they don’t produce profit because they don’t provide good or services, so they take it from students (student loan interest on debt) and tax receipts, which guarantees you and your family will be taxed in the future to pay off previous bond agreements.

Most pensions, endowments, and retirement plans like 401k and 529, and insurance plans are based off of bond purchases.

We have about ~2% in paper.

***Special tip: watch the credit market (bonds) especially the 10 year treasury, to see where the markets are going to go. That tells us where the stock and rest of markets will go.

Cash/Businesses

Cash is lower with some bitcoin purchases and trading my worthless US trash tokens for bitcoin. Huge wins.

Bitcoin Trading Cards I will be investing in the coming months.

I will also be investing in my own education/media company that will be putting out children’s books and courses on financial literacy and frameworks for life that I have used and am teaching my children with.

Cash on hand is also good in case our long term view of inflation is wrong. If we experience massive deflation, and the dollar increasing in strength (DXY), then we will be able to use the dry powder (cash) to buy many more assets as well.

We have about ~19% in cash.

Remember…

Clearly, there has been a significant increase in my Bitcoin holdings. This trend arises from the ongoing debasement of fiat currency, which continues to drive the price of Bitcoin upward. Consequently, it is gradually taking up a larger share of my portfolio, as I have noted in previous monthly letters.

We've all been instructed to save money, but the key difference lies in ensuring that our savings are allocated wisely – in the right assets.

Money, not currency.

Many individuals experience diminishing wealth daily because they save their hard-earned time and energy in a liability that is constantly devalued through excessive printing, rather than investing in an asset that possesses scarcity comparative to their finite time on this Earth.

We aren’t out of the woods by any means. I think the next 6-12 months could be an absolutely painstaking ride. Though it is hard to predict timing on these cataclysmic events we do know they will happen.

Take a look at the US debt clock and the daily job cuts sites to get a better picture of where we are and make the decision for yourself where you think this is headed…

Stay strong,

Brandon

I am always a student. I am no expert. Freedom advice, not financial advice.

Afterword

My newsletter is based off of 20+ years of historical, political, and monetary study plus my experiences in investing.

I spent the first 10 years studying politics and history.

The last 10 years I have studied monetary, fiscal history and policy, along with investing through what I call our “family office.”

In that time I have 15’xed our net worth through contrarian views and watching what people do, not what they say.

I believe you must know the financial and money games for ANY of the political side to make any sense.

If you like freedom and can’t stand politics and bridges to nowhere, racial polarization, division, hate, looting, and all the moral decay in society than you might just be a bitcoiner.

To fix all these problems we have a solution where you cannot be racketeered by governments anymore through inflation.

“Bitcoin fixes this.”

You don’t need a lot, just a couple percent is a vote for freedom and could change the world forever.

I ONLY want to trade my finite time for finite assets, NOT trade my finite time for infinite pieces of paper/digits on a computer.

MAKE A FAIR TRADE FOR YOURSELF.

Study bitcoin. Invest in what you know.