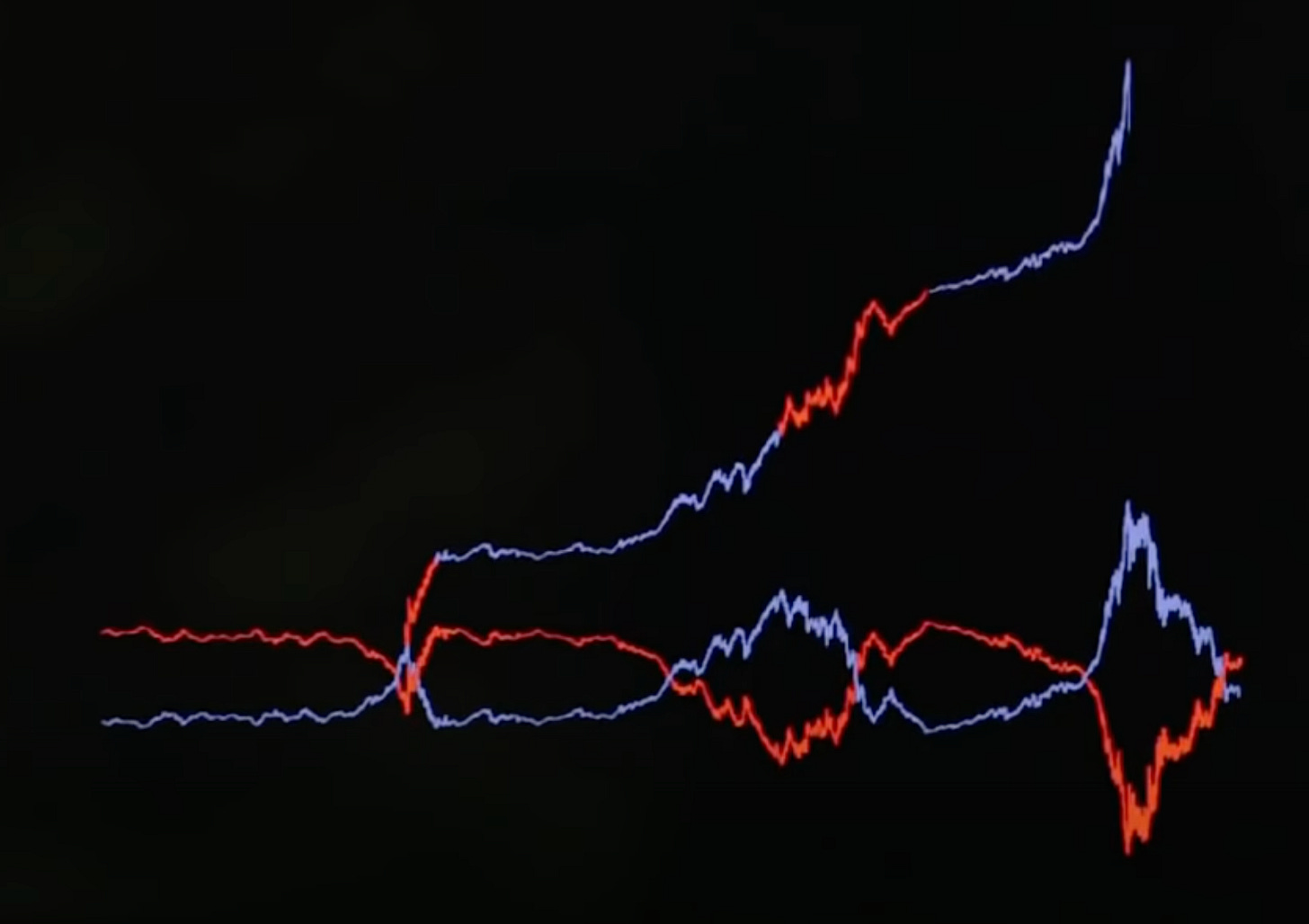

Wealth cycles are a phenomenon coined by Mike Maloney over the past 15 years. The video above is approx. 15 minutes.

He gives an incredible example of a family who started with a small house and sold it in to gold and turned it into tens of millions of dollars at the end of their life.

All because they continually invested at the bottom of a market cycle in one asset class, rode that asset up in value, and sold out and bought into the next asset class while it was low.

The old “buy low and sell high” plan.

They continually repeated the cycle multiple times throughout the course of their life.

By comparing and dividing the price of one asset against another asset, it gave their family a roadmap to generational wealth.

They paid attention to simple broad macro trends that gave them an easily distinguishable course to invest in and out of that anyone can do.

I did a 30-minute video on this almost 4 years ago walking through this on a whiteboard. How did I do compared to Mike, the professional?

You need not be a financial guru or genius to get ahead.

However, you are required to pay attention and NOT outsource your thinking and investing to “managers” who are looking over your wealth and never made a dollar investing in their lives and just suck fees from you.

“Who Stole My Pension?” is an incredible book by Robert Kiyosaki about the farce that is Americans pensions and 401k’s.

The incredible waste and corruption that have bankrupted the system and has put the country and peoples futures on tilt.

So much so, the government had to come in and stop pensions (DB - Defined Benefit) so companies could compete globally, and offloaded the retirement on to the employees (DC - Defined Contribution) and gambling in the markets taking all the risk while the fund managers take none and soak up fees each year!

The 55-65+ year old demo has around ~$80k in their 401k saved for retirement! This is catastrophic and means higher taxes and inflation coming our way to pay our way out through currency printing.

These mistakes don’t have to continue, they CAN be changed.

Many are set up to fail because they have failed to plan.

As Jim Rohn says “if you rely in the government for your retirement you can divide by 5 at the end of your life. If you invest yourself you can multiply by 5.”

No one will care more about your retirement than you will.

It takes diligence and discipline, but ANYONE can do it.

By using this simple “price to value” formula you can put yourself in the driver’s seat for your wealth building and retirement with confidence!

Stay strong,

Brandon

————

Ps. I receive a lot of questions about what I expect to happen or what people should do with their cash etc..

I will be continuing my daily write ups for free and I’ll eventually add a paid monthly version that’s going to be about $50-100/year. May even have a Voxer channel to ask questions directly, too. This will walk through my portfolio each month and what I am doing in the current environment.

I am not a registered financial advisor nor have any financial licenses. I am just documenting my investing journey and my experiences and what has worked for me and not worked through all the different asset classes.