(Listen to audio version of me reading👆)

The beauty of a debit card but greater security than a credit card.

Imagine traveling all over the world or even going from country to country in Europe and being able to pull out your phone and pay instantaneously, final settlement, faster than credit cards, and paying no fees for a customer or merchant…

Imagine being able to use a global currency that you can use ANYWHERE in the world with an internet connection.

It wasn’t too long ago that the “New World Order” was trying to usher in its global “one world currency.”

They are still trying to do that with central bank digital currencies but Satoshi Nakamoto had something up his/her sleeves that shook the world’s power structure to its core.

Something they could not envision and did not see coming that would change all of this forever.

Turning the power structure forever from the few global families to the average individual.

What is in a bitcoin?

A Satoshi is the divisible unit of bitcoin.

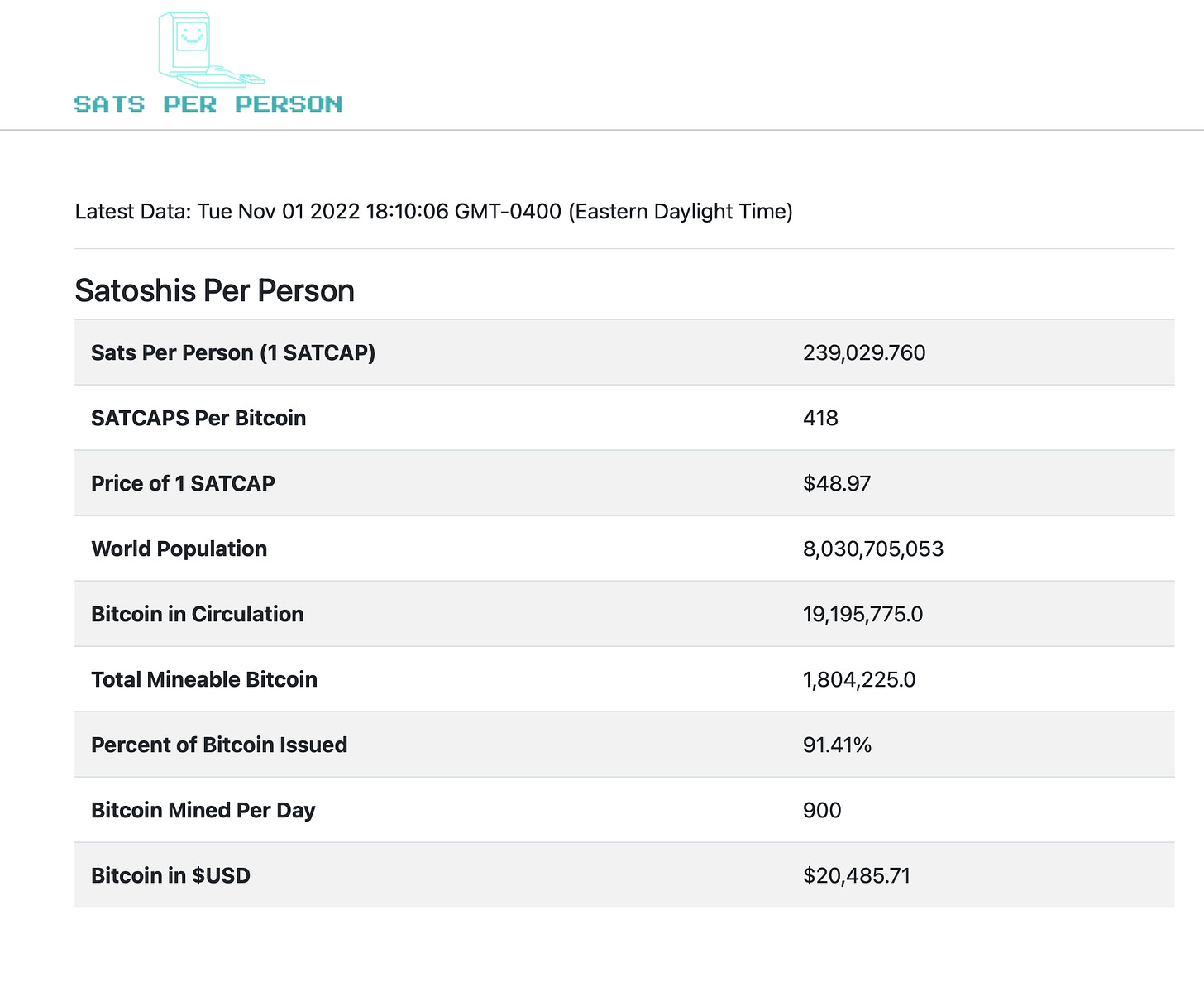

There are 100 million Satoshi‘s in every single bitcoin.

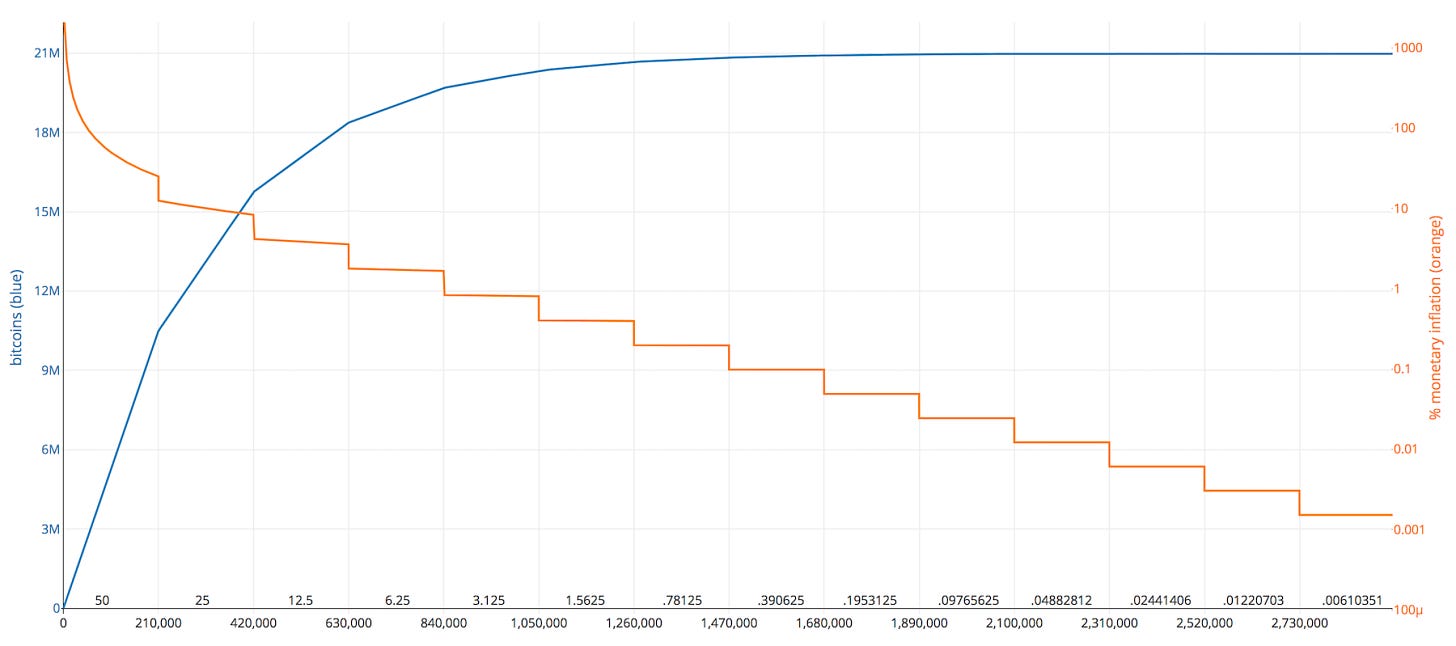

There will only ever be 21 million bitcoin mined, which mining of new coins ends around the year 2140.

It is said that there are already 3-4,000,000 bitcoin lost forever because many people in the early days lost their coins or threw away the hard drives (with their keys) and they are gone forever.

For math purposes, among others, it makes sense to still use the 21 million supply cap.

This is the control in the experiment.

The important thing to note is that there will never be more.

There can only be less, which means your asset only gets more valuable.

Bitcoin is the control and all pricing in the world is being anchored by a constant, no variables of interest rates, currency printing, etc..

So, there will only ever be 2.1 quadrillion Satoshi‘s that exist.

It is said that it will be rare for you to know someone who owns an entire bitcoin someday.

This is for two reasons, one because the more valuable bitcoin becomes the harder it will be for the average person to obtain one bitcoin.

Number two; as the economy slowly becomes hyper-bitcoinized people will be spending their Sats into the economy which will dilute their supply but also decentralize the supply hardening the network even more.

The only way to get sats back will be to provide value for others.

Now that we know how the math looks let’s talk about how things will be priced in Satoshi someday.

Just like everything has a price of a US Dollar on it since the Dollar is the world reserve currency, someday everything will have a price of bitcoin or Satoshi‘s on it.

The free market generally (when central banks aren’t moving goalposts with interest rates and golden parachutes) determines prices, as money is just a piece of information that relays value to people throughout society.

Money is a store of your economic time and energy.

For example, Laszlo 12 years ago decided since there was no fiat price of a bitcoin to sell 10,000 bitcoins for a price of pizza. The pizza store owner agreed. And there we have a sale of two willing market participants agreeing on value.

This then established a value for bitcoin in the open market.

In theory if you take the US dollar value away you could say that the pizza owner was willing to take 10,000 bitcoin or 1 trillion Satoshi‘s for a pizza.

This is how the free market will (and is already) re-pricing everything in Satoshi‘s.

You will go to a vendor and buy a notebook but instead of saying $5 on it (or maybe it will still have a fiat price), instead it will say this cost 1,000 Satoshi’s.

Bingo.

You have just entered into hyper-bitcoinization on the bitcoin standard.

You are now exponentially freer as you hold bitcoin and you’re purchasing power continues to go up as governments have to continually print and devalue their fiat currencies.

Welcome to the bitcoin standard.

Check the book out by Saifedean Ammous for a deeper dive on the standard and what life will look like.

Please check out our other blogs on and videos on the subject for a deeper looks.

Fix the money, fix the world.

Separation of money and state.

Stay strong,